NVIDIA 2004 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2004 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

delays in the introduction of digital media processors using our next generation technology during the first half of fiscal 2004 and any

such delays in the future or failure of these or other processors to meet or exceed specifications of competitive products could

materially harm our business.

Our failure to identify new product opportunities or develop new products could harm our business.

As our digital media processors develop and competition increases, we anticipate that product life cycles at the high end will remain

short and average selling prices will continue to decline. In particular, we expect average selling prices and gross margins for our

digital media processors to decline as each product matures and as unit volume increases. As a result, we will need to introduce new

products and enhancements to existing products to maintain overall average selling prices and gross margins. In order for our digital

media processors to achieve high volumes, leading PC OEMs, ODMs, and add−in board and motherboard manufacturers must select

our digital media processor for design into their products, and then successfully complete the designs of their products and sell them.

We may be unable to successfully identify new product opportunities or to develop and bring to market in a timely fashion new

products. In addition, we cannot guarantee that new products we develop will be selected for design into PC OEMs’, ODMs’, and

add−in board and motherboard manufacturers’ products, that any new designs will be successfully completed or that any new products

will be sold. As the complexity of our products and the manufacturing process for products increases, there is an increasing risk that

we will experience problems with the performance of products and that there will be delays in the development, introduction or

volume shipment of our products. We may experience difficulties related to the production of current or future products or other

factors may delay the introduction or volume sale of new products we developed. In addition, we may be unable to successfully

manage the production transition risks with respect to future products. Failure to achieve any of the foregoing with respect to future

products or product enhancements could result in rapidly declining average selling prices, reduced margins and reduced demand for

products or loss of market share. In addition, technologies developed by others may render our digital media processors

non−competitive or obsolete or result in our holding excess inventory, any of which would harm our business.

27

We could suffer a loss of market share if our products contain significant defects.

Products as complex as those offered by us may contain defects or failures when introduced or when new versions or enhancements to

existing products are released. We have in the past discovered defects and incompatibilities with customers’ hardware in certain of our

products and may experience delays or loss of revenue to correct any new defects in the future. Errors in new products or releases after

commencement of commercial shipments could result in loss of market share or failure to achieve market acceptance. Our products

typically go through only one verification cycle prior to beginning volume production and distribution. As a result, our products may

contain defects or flaws that are undetected prior to volume production and distribution. If these defects or flaws exist and are not

detected prior to volume production and distribution, we may be required to reimburse customers for costs to repair or replace the

affected products in the field. These costs could be significant and could adversely affect our business and operating results.

Risks Related to Our Partners

We sell our products to a small number of customers and our business could suffer by the loss of these customers.

We have only a limited number of customers and our sales are highly concentrated. Our sales process involves achieving key design

wins with leading PC OEMs and major system builders and supporting the product design into high volume production with key

CEMs, ODMs, motherboard and add−in board manufacturers. These design wins in turn influence the retail and system builder

channel that is serviced by CEMs, ODMs, motherboard and add−in board manufacturers. Our distribution strategy is to work with a

small number of leading independent CEMs, ODMs, motherboard manufacturers, add−in board manufacturers and stocking

representatives, each of which has relationships with a broad range of system builders and leading PC OEMs. Currently, we sell a

significant majority of our digital media processors directly to stocking representatives, CEMs, ODMs, motherboard and add−in board

manufacturers, which then sell boards with our graphics processor to leading PC OEMs, retail outlets and to a large number of system

builders. As a result, our business could be harmed by the loss of business from PC OEMs, CEMs, ODMs, motherboard and add−in

board manufacturers. In addition, revenue from PC OEMs, CEMs, ODMs, motherboard and add−in board manufacturers that have

directly or indirectly accounted for significant revenue in past periods, individually or as a group, may not continue, or may not reach

or exceed historical levels in any future period.

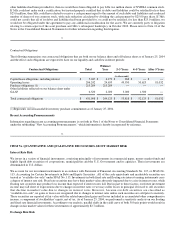

Difficulties in collecting accounts receivable could result in significant charges against income, which could harm our business.

Our accounts receivable are highly concentrated and make us vulnerable to adverse changes in our customers' businesses and to

downturns in the economy and the industry. We maintain an allowance for doubtful accounts for estimated losses resulting from the

inability of our customers to make required payments. This allowance consists of an amount identified for specific customers and an

amount based on overall estimated exposure. As of the of fiscal 2004, fiscal 2003 and fiscal 2002 our allowance for doubtful accounts

represented 0.1%, 0.2% and 0.2% of revenue for each fiscal year, respectively. If the financial condition of our customers were to

deteriorate, resulting in an impairment of their ability to make payments, additional allowances may be required which could

adversely affect our operating results. We may have to record additional reserves or write−offs in the future, which could harm our

business.