NVIDIA 2004 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2004 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

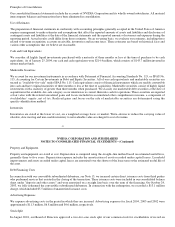

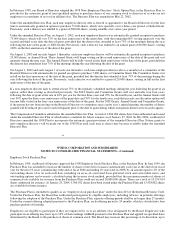

Obligations , which addresses financial accounting and reporting for obligations associated with the retirement of tangible long−lived

assets and the associated asset retirement costs. The standard applies to legal obligations associated with the retirement of long−lived

assets that result from the acquisition, construction, development and/or normal use of the assets. SFAS No. 143 requires that the fair

value of a liability for an asset retirement obligation be recognized in the period in which it is incurred if a reasonable estimate of fair

value can be made. The fair value of the liability is added to the carrying amount of the associated asset and this additional carrying

amount is depreciated over the life of the asset. Under our current operating lease agreements for our headquarters facility, we may be

obligated to return a minimal amount of property to its original condition upon lease termination based on the landlord’s discretion at

that time. We believe this obligation, if any, is immaterial.

Income Taxes

We record income taxes using the asset and liability method. Deferred tax assets and liabilities are recognized for the estimated future

tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and

their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates in effect for the year in which those

temporary differences are expected to be recorded or settled. The effect on deferred tax assets and liabilities of a change in tax rates is

recognized in income in the period that includes the enactment date. We also account for income tax contingencies in accordance with

Statement of Financial Accounting Standards No. 5, Accounting for Contingencies.

45

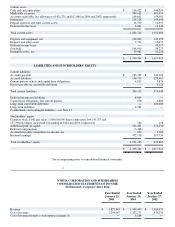

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

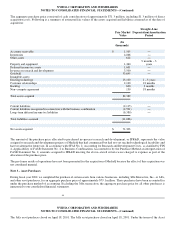

Fair Value of Financial Instruments

The carrying value of cash, cash equivalents, accounts receivable, accounts payable and accrued liabilities approximate their fair

values due to their relatively short maturities as of January 25, 2004 and January 26, 2003. Marketable securities are comprised of

available−for−sale securities that are reported at fair value with the related unrealized gains and losses included in accumulated other

comprehensive income, a component of stockholders’ equity, net of tax.

Foreign Currency Translation

We use the U.S. dollar as our functional currency. Foreign currency assets and liabilities are remeasured into U.S. dollars at

end−of−period exchange rates, except for inventories, prepaid expenses and other current assets, property, plant and equipment,

deposits and other assets and equity, which are remeasured at historical exchange rates. Revenue and expenses are remeasured at

average exchange rates in effect during each period, except for those expenses related to the previously noted balance sheet amounts,

which are remeasured at historical exchange rates. Gains or losses from foreign currency remeasurement are included in "Other

income (expense), net" and to date have not been significant.

Comprehensive Income

Comprehensive income consists of net earnings and unrealized gains and losses on available−for−sale securities, recorded net of tax.

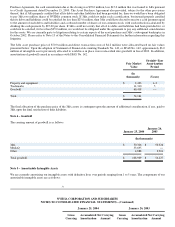

Goodwill and Intangible Assets

Effective fiscal 2003, we completed the adoption of Statement of Financial Accounting Standards No. 142, or SFAS No. 142,

Goodwill and Other Intangible Assets . As required by SFAS No. 142, we discontinued amortizing the remaining balances of goodwill

as of the beginning of fiscal 2003. All remaining and future acquired goodwill will be subject to impairment tests annually, or earlier if

indicators of potential impairment exist, using a fair−value−based approach. All other intangible assets will continue to be amortized

over their estimated useful lives and assessed for impairment under SFAS No. 144, Accounting for the Impairment or Disposal of

Long−Lived Assets.

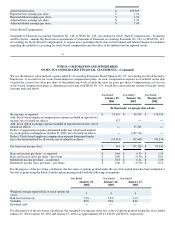

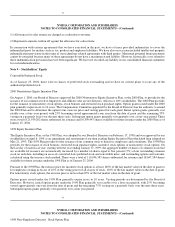

In accordance with SFAS No. 142, we have elected to perform our annual impairment review during the fourth quarter. We have

completed our annual goodwill impairment test and concluded that there was no impairment. Had SFAS No. 142 been adopted in

fiscal 2002, our results would have been as follows:

Year Ended

January 27,

2002

(In thousands, except

per share data)

Net income $ 176,924

Goodwill and workforce amortization, tax effected $ 7,065