NVIDIA 2004 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2004 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

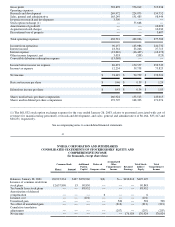

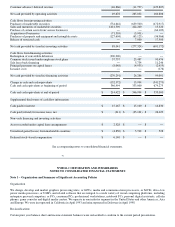

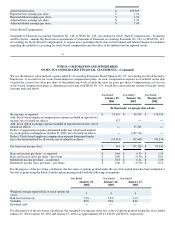

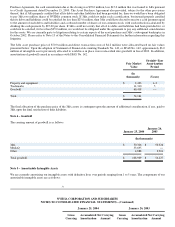

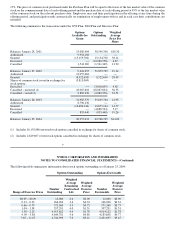

7,906 12,364 8,976

The weighted−average price of stock options excluded from the computation of diluted earnings per share was $29.63, $32.45 and

$54.62 for the years ended January 25, 2004, January 26, 2003 and January 27, 2002, respectively. The convertible subordinated

debentures were convertible into shares of common stock at a conversion price of $46.36 per share and were anti−dilutive for the

years ended January 26, 2003 and January 27, 2002. The convertible subordinated debentures were no longer outstanding as of

January 25, 2004 due to the redemption on October 24, 2003.

48

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

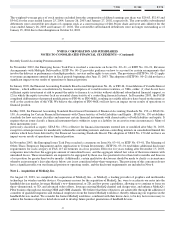

Recently Issued Accounting Pronouncements

In November 2002, the Emerging Issues Task Force reached a consensus on Issue No. 00−21, or EITF No. 00−21, Revenue

Arrangements with Multiple Deliverables. EITF No. 00−21 provides guidance on how to account for certain arrangements that

involve the delivery or performance of multiple products, services and/or rights to use assets. The provisions of EITF No. 00−21 apply

to revenue arrangements entered into in fiscal periods beginning after June 15, 2003. The adoption of EITF No. 00−21 did not have a

significant impact on our results of operations or financial position.

In January 2003, the Financial Accounting Standards Board issued Interpretation No. 46, or FIN 46, Consolidation of Variable Interest

Entities , which addresses consolidation by business enterprises of variable interest entities, or VIEs, either: (1) that do not have

sufficient equity investment at risk to permit the entity to finance its activities without additional subordinated financial support, or

(2) in which the equity investors lack an essential characteristic of a controlling financial interest. In December 2003, the FASB

completed deliberations of proposed modifications to FIN 46, or FIN 46(R), resulting in variable effective dates based on the nature as

well as the creation date of the VIE. We believe the adoption of FIN 46(R) will not have an impact on our results of operations or

financial position.

In May 2003, the Financial Accounting Standards Board issued Statement of Financial Accounting Standards No. 150, or SFAS No.

150, Accounting for Certain Financial Instruments with Characteristics of both Liabilities and Equity . SFAS No. 150 establishes

standards for how an issuer classifies and measures certain financial instruments with characteristics of both liabilities and equity. It

requires that an issuer classify a financial instrument that is within its scope as a liability (or an asset in some circumstances). Many of

those instruments were

previously classified as equity. SFAS No. 150 is effective for financial instruments entered into or modified after May 31, 2003,

except for certain provisions for mandatorily redeemable controlling interests and non−controlling interests in consolidated limited life

entities which have been deferred by the Financial Accounting Standards Board. The adoption of SFAS No. 150 did not have an

impact on our results of operations or financial position.

In November 2003, the Emerging Issues Task Force reached a consensus on Issue No. 03−01, or EITF No. 03−01, The Meaning of

Other−Than−Temporary Impairment and its Application to Certain Investments . EITF No. 03−01 establishes additional disclosure

requirements for each category of FAS 115 investments in a loss position. Effective for years ending after December 15, 2003,

companies must disclose the aggregate amount of unrealized losses, and the aggregate related fair value of their investments with

unrealized losses. Those investments are required to be segregated by those in a loss position for less than twelve months and those in

a loss position for greater than twelve months. Additionally, certain qualitative disclosures should be made to clarify a circumstance

whereby an investment’s fair value that is below cost is not considered other−than−temporary. The provisions of this consensus do not

have a significant effect on our financial position or operating results, and the disclosure requirements are included in Note 6.

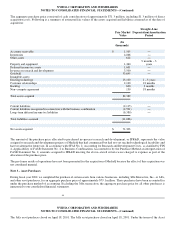

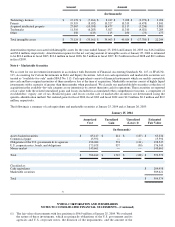

Note 2 – Acquisition of MediaQ, Inc.

On August 19, 2003, we completed the acquisition of MediaQ, Inc., or MediaQ, a leading provider of graphics and multimedia

technology for wireless mobile devices. Our primary reasons for the acquisition of MediaQ, Inc. were to accelerate our entry into the

handheld devices market, leverage MediaQ’s two−dimensional, or 2D, and low power capabilities, allowing us to continue to focus on

three−dimensional, or 3D, and advanced video efforts, leverage existing MediaQ channel and design wins, and enhance MediaQ’s

PDA business through our existing OEM and ODM channels. We believe that these objectives are achievable through the addition of

a number of qualified engineers and technical employees from the former MediaQ workforce, thereby enhancing our expertise in the

handheld devices market. We consider the former MediaQ workforce, combined with their know−how, to be key factors necessary to

achieve the business objectives listed above and to develop future product generations of handheld devices.

49