NVIDIA 2004 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2004 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

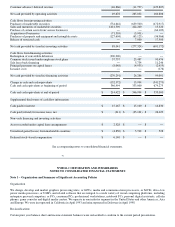

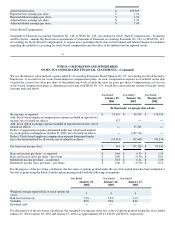

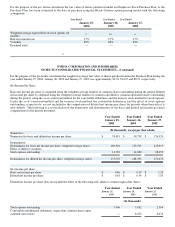

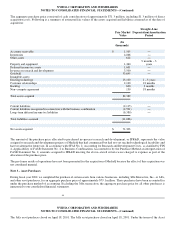

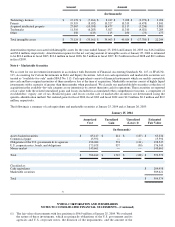

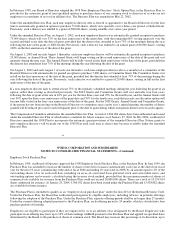

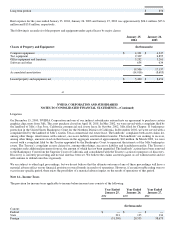

The aggregate purchase price consisted of cash consideration of approximately $71.3 million, including $1.3 million of direct

acquisition costs. Following is a summary of estimated fair values of the assets acquired and liabilities assumed as of the date of

acquisition:

Fair Market

Value

Straight−Line

Depreciation/Amortization

Period

(In

thousands)

Accounts receivable $ 1,505 −−

Inventories 4,066 −−

Other assets 612 −−

Property and equipment 1,460 9 months – 3

years

Deferred income tax assets 1,601 −−

In−process research and development 3,500 −−

Goodwill 53,695 −−

Intangible assets:

Existing technology 13,100 1 – 3 years

Customer relationships 2,100 18 months

Backlog 600 3 months

Non−compete agreement 150 18 months

Total assets acquired 82,389

Current liabilities (2,115) −−

Current liabilities recognized in connection with the business combination (2,591) −−

Long−term deferred income tax liabilities (6,380) −−

Total liabilities assumed (11,086)

Net assets acquired $ 71,303

The amount of the purchase price allocated to purchased in−process research and development, or IPR&D, represents the value

assigned to research and development projects of MediaQ that had commenced but had not yet reached technological feasibility and

have no alternative future use. In accordance with SFAS No. 2, Accounting for Research and Development Costs , as clarified by FIN

4, Applicability of FASB Statement No. 2 to Business Combinations Accounted for by the Purchase Method an interpretation of

FASB Statement No. 2, amounts assigned to IPR&D meeting the above−stated criteria were charged to expense as part of the

allocation of the purchase price.

The pro forma results of operations have not been presented for the acquisition of MediaQ because the effect of this acquisition was

not considered material.

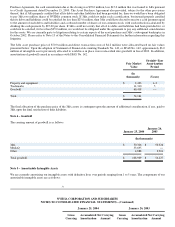

Note 3 – Asset Purchases

During fiscal year 2002, we completed the purchase of certain assets from various businesses, including 3dfx Interactive, Inc., or 3dfx,

and other asset purchases, for an aggregate purchase price of approximately $79.1 million. These purchases have been accounted for

under the purchase method of accounting. Excluding the 3dfx transaction, the aggregate purchase price for all other purchases is

immaterial to our consolidated financial statements.

50

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

The 3dfx asset purchase closed on April 18, 2001. The 3dfx asset purchase closed on April 18, 2001. Under the terms of the Asset