Lululemon 2011 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2011 Lululemon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

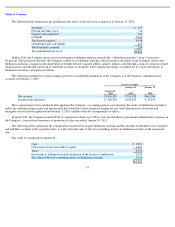

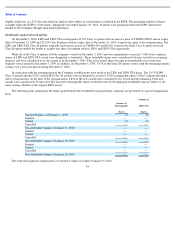

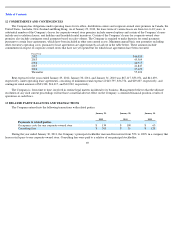

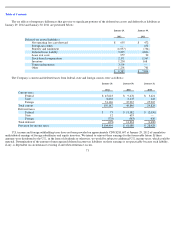

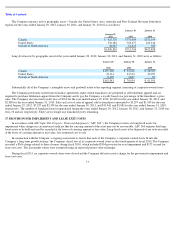

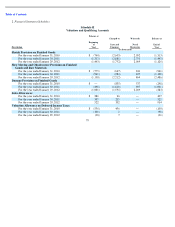

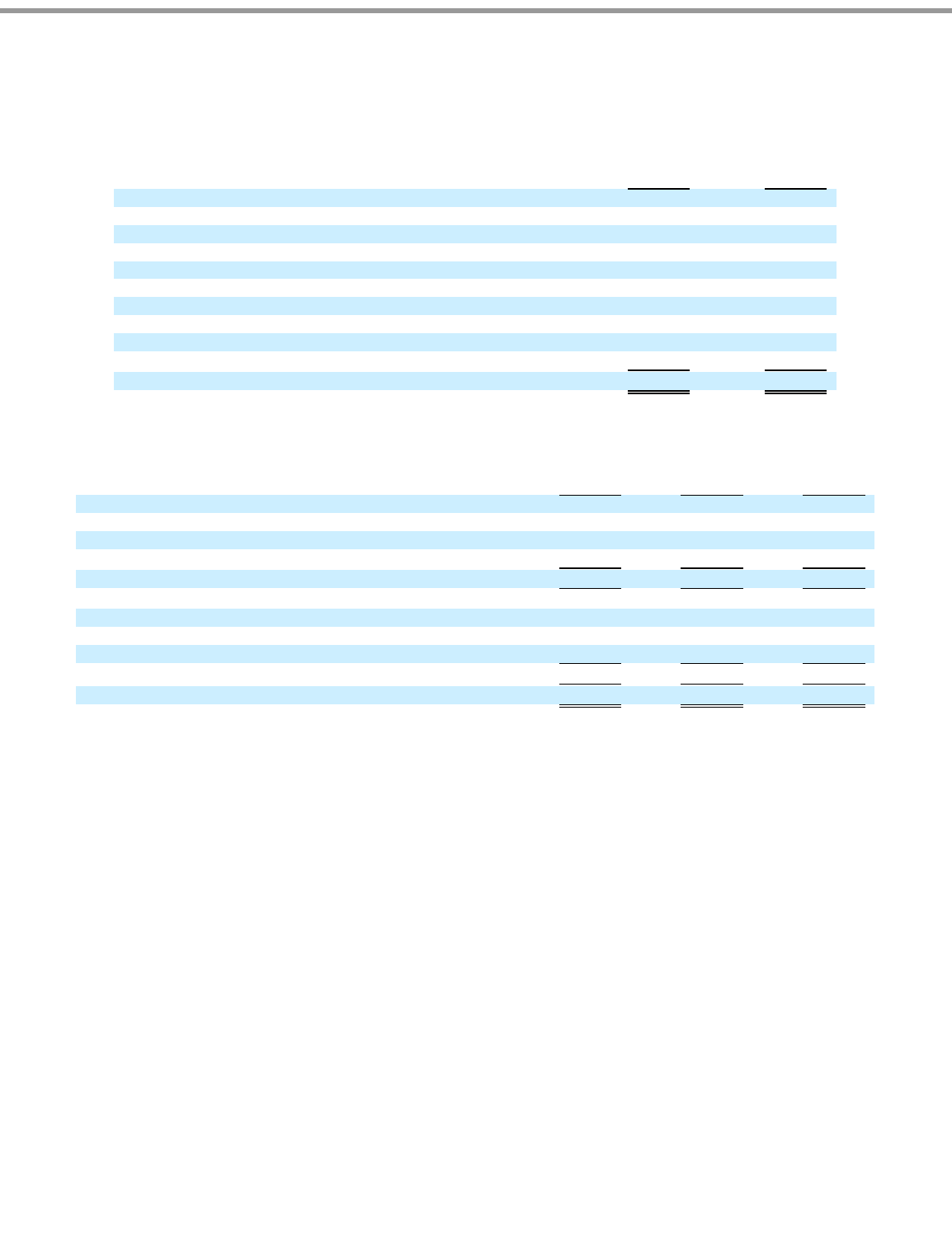

The tax effects of temporary differences that give rise to significant portions of the deferred tax assets and deferred tax liabilities at

January 29, 2012 and January 30, 2011 are presented below:

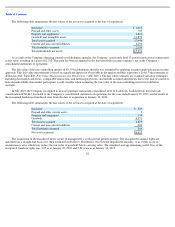

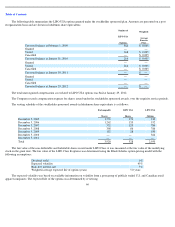

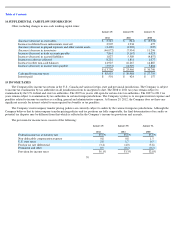

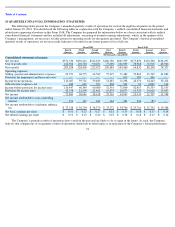

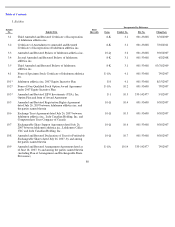

The Company’s current and deferred taxes from federal, state and foreign sources were as follows:

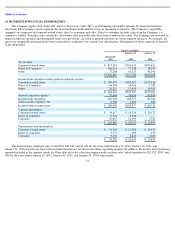

U.S. income and foreign withholding taxes have not been provided on approximately CDN $283,607 at January 29, 2012 of cumulative

undistributed earnings of foreign subsidiaries and equity investees. We intend to reinvest these earnings for the foreseeable future. If these

amounts were distributed to the U.S., in the form of dividends or otherwise, we would be subject to additional U.S. income taxes, which could be

material. Determination of the amount of unrecognized deferred income tax liabilities on these earnings is not practicable because such liability,

if any, is dependent on circumstances existing if and when remittance occurs.

71

January 29,

2012

January 30,

2011

Deferred tax assets/(liabilities)

Net operating loss carryforward

$

655

$

472

Foreign tax credits

—

672

Property and equipment

(6,957

)

(734

)

Deferred lease liability

5,825

4,896

Lease exit costs

957

92

Stock

-

based compensation

2,171

1,567

Inventory

1,230

168

Tenant inducements

3,505

—

Other

1,201

761

$

8,587

$

7,894

January 29,

2012

January 30,

2011

January 31,

2010

Current taxes

Federal

$

45,623

$

9,476

$

3,621

State

8,438

2,435

243

Foreign

51,126

37,935

25,965

Total current

105,187

49,846

29,829

Deferred taxes

Federal

$

73

$

11,182

$

(2,030

)

State

12

635

—

Foreign

(778

)

(583

)

630

Total deferred

(693

)

11,234

(1,400

)

Provision for income taxes

$

104,494

$

61,080

$

28,429