Lululemon 2011 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2011 Lululemon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

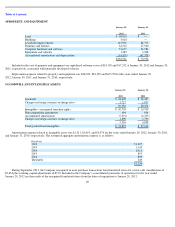

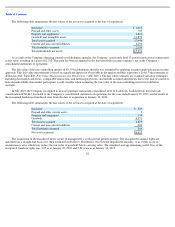

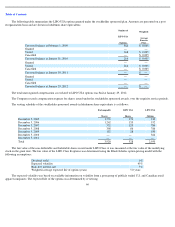

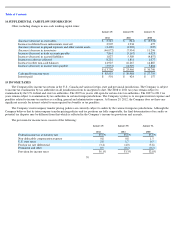

4 PROPERTY AND EQUIPMENT

Included in the cost of property and equipment are capitalized software costs of $14,150 and $17,252 at January 29, 2012 and January 30,

2011, respectively, associated with internally developed software.

Depreciation expense related to property and equipment was $28,709, $23,549 and $19,758 for the years ended January 29,

2012, January 30, 2011, and January 31, 2010, respectively.

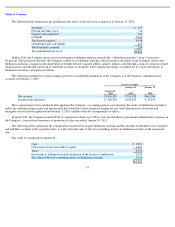

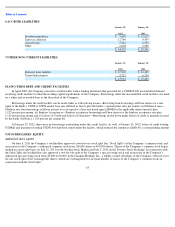

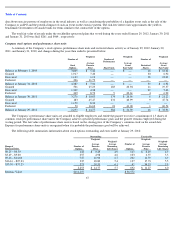

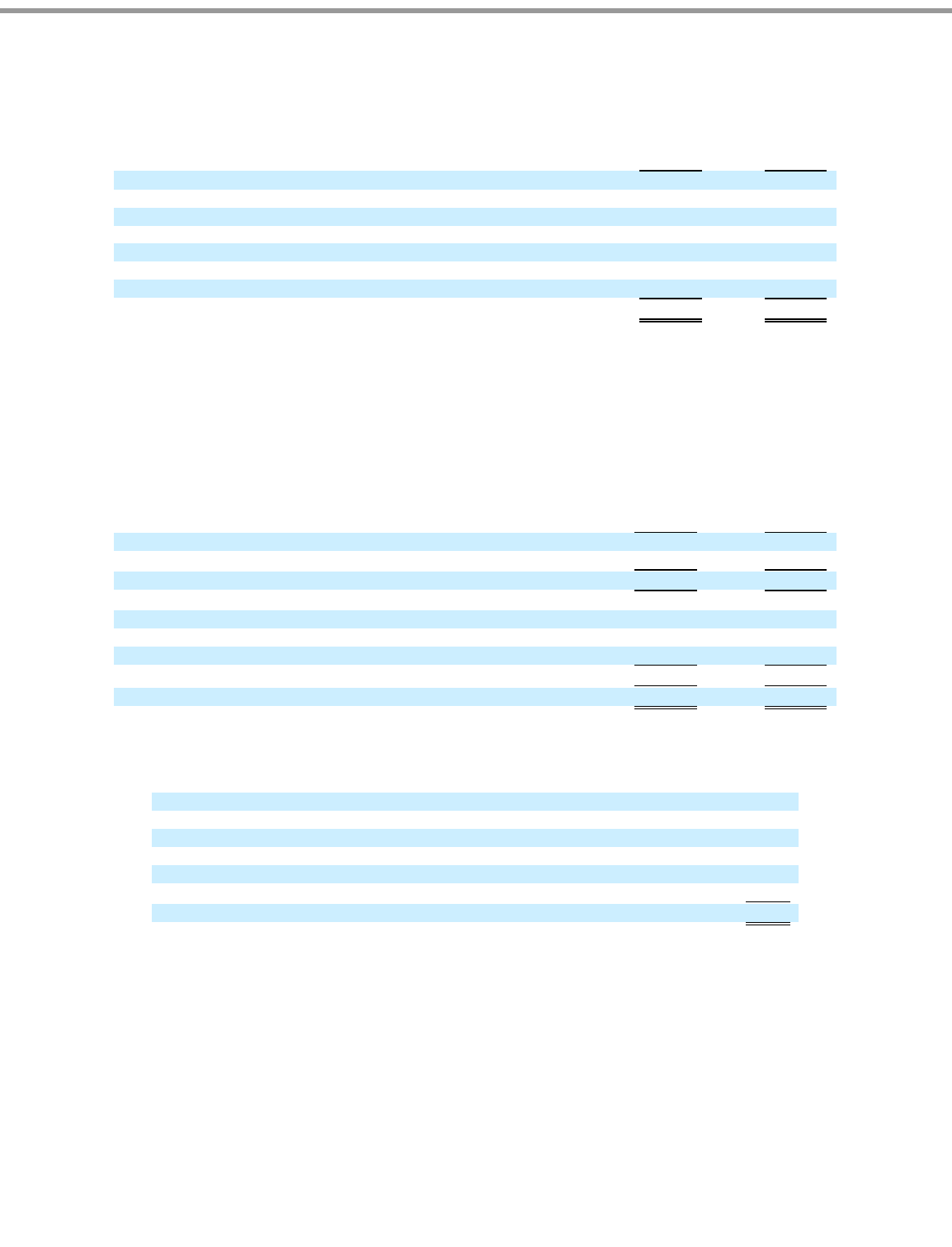

5 GOODWILL AND INTANGIBLE ASSETS

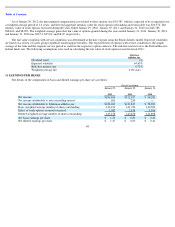

Amortization expense related to intangible assets was $1,311, $1,065, and $1,074 for the years ended January 29, 2012, January 30, 2011,

and January 31, 2010, respectively. The estimated aggregate amortization expense is as follows:

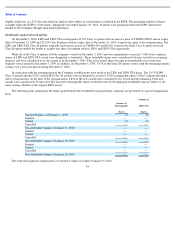

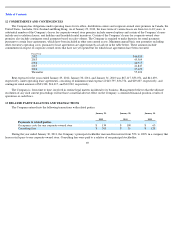

During September 2011, the Company reacquired in asset purchase transactions four franchised stores for a total cash consideration of

$5,654 plus working capital adjustments of $170. Included in the Company’s consolidated statements of operations for the year ended

January 29, 2012 are the results of the reacquired franchised stores from the dates of acquisition to January 29, 2012.

60

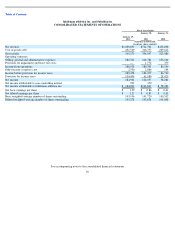

January 29,

2012

January 30,

2011

Land

$

60,014

$

—

Buildings

5,018

—

Leasehold improvements

113,931

84,773

Furniture and fixtures

22,512

17,940

Computer hardware and software

51,657

34,581

Equipment and vehicles

1,285

1,038

Accumulated amortization and depreciation

(91,476

)

(67,378

)

$

162,941

$

70,954

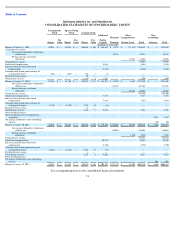

January 29,

2012

January 30,

2011

Goodwill

$

23,609

$

18,437

Changes in foreign currency exchange rates

2,727

1,837

26,336

20,274

Intangibles

—

reacquired franchise rights

$

10,709

$

10,709

Non

-

competition agreements

694

694

Accumulated amortization

(7,676

)

(6,355

)

Changes in foreign currency exchange rates

1,809

1,790

5,536

6,838

Total goodwill and intangibles

$

31,872

$

27,112

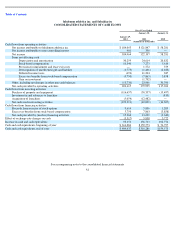

Fiscal Year

2012

$

1,327

2013

1,145

2014

1,011

2015

895

2016

809

Thereafter

349

$

5,536