Lululemon 2011 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2011 Lululemon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

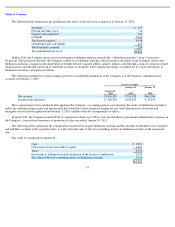

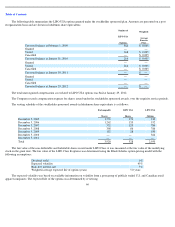

As of January 29, 2012, the unrecognized compensation cost related to these options was $10,387, which is expected to be recognized over

a weighted-average period of 2.4 years; and the total aggregate intrinsic value for stock options outstanding and exercisable was $36,572. The

intrinsic value of stock options exercised during the years ended January 29, 2012, January 30, 2011, and January 31, 2010 was $42,783,

$28,463, and $8,093. The weighted-average grant date fair value of options granted during the years ended January 31, 2011, January 30, 2011,

and January 31, 2010 was $22.51, $25.66, and $8.07, respectively.

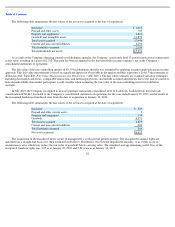

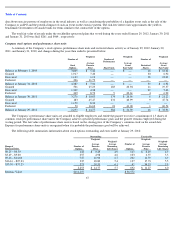

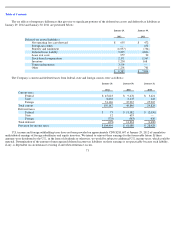

The fair value of options with service conditions was determined at the date of grant using the Black-Scholes model. Expected volatilities

are based on a review of a peer group of publicly traded apparel retailers. The expected term of options with service conditions is the simple

average of the term and the requisite service period as stated in the respective option contracts. The risk-free interest rate is the Federal Reserve

federal funds rate. The following assumptions were used in calculating the fair value of stock options issued in fiscal 2011:

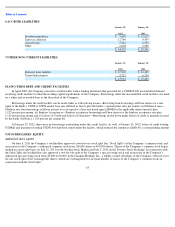

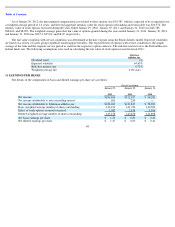

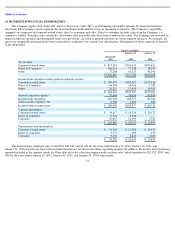

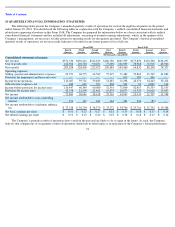

11 EARNINGS PER SHARE

The details of the computation of basic and diluted earnings per share are as follows:

68

lululemon

athletica inc.

Dividend yield

0

%

Expected volatility

64.65

%

Risk

-

free interest rate

0.72

%

Weighted

-

average life

4.06 years

Fiscal Year Ended

January 29,

2012

January 30,

2011

January 31,

2010

Net income

$

184,964

$

122,197

$

58,281

Net income attributable to non

-

controlling interest

901

350

—

Net income attributable to lululemon athletica inc

$

184,063

$

121,847

$

58,281

Basic weighted

-

average number of shares outstanding

143,196

141,720

140,502

Effect of stock options assumed exercised

2,082

2,138

1,396

Diluted weighted

-

average number of shares outstanding

145,278

143,858

141,898

Net basic earnings per share

$

1.29

$

0.86

$

0.41

Net diluted earnings per share

$

1.27

$

0.85

$

0.41