Lululemon 2011 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2011 Lululemon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

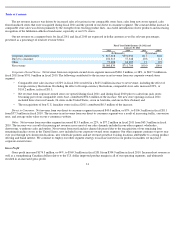

and as such, franchise sales, which included inventory sales and royalties, will no longer be a part of our other net revenue in future fiscal years.

Warehouse sales are typically held one or more times a year to sell slow moving inventory or inventory from prior seasons to retail customers at

discounted prices. Our showrooms are typically small locations that we open from time to time when we enter new markets and feature a limited

selection of our product offering during select hours. Other net revenue accounted for 7% of total revenue in fiscal 2011, 9% of total net revenue

in fiscal 2010 and 9% of total net revenue in fiscal 2009.

We believe that our athletic apparel has and will continue to appeal to consumers outside of North America who value its technical

attributes as well as its function and style. In 2004, we opened our first store in Australia which was operated under a franchise license. In fiscal

2009 we made a 13% equity investment in lululemon athletica australia Pty, our franchise operator. During fiscal 2010 we increased our

investment to 80% which has provided us control over lululemon athletica australia Pty. In fiscal 2008, we opened a company-operated

showroom in Hong Kong.

In the past, we have entered into franchise agreements to distribute lululemon athletica branded products to more quickly disseminate our

brand name and increase our net revenue and net income. In exchange for the use of our brand name and the ability to operate lululemon

athletica stores in certain regions, our franchisees generally pay us a one-time franchise fee and ongoing royalties based on their gross revenue.

Additionally, unless otherwise approved by us, our franchisees are required to sell only lululemon athletica branded products, which are

purchased from us at a discount to the suggested retail price. Pursuing new franchise partnerships or opening new franchise stores is not part of

our near-term store growth strategy, and we reacquired our four remaining franchise stores in fiscal 2011.

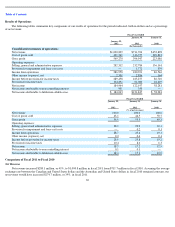

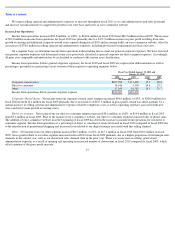

Basis of Presentation

Net revenue is comprised of:

in each case, net of an estimated allowance for sales returns and discounts.

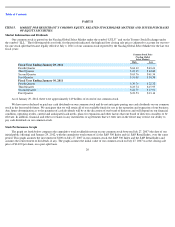

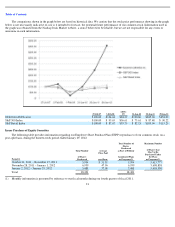

In addition, we separately track comparable store sales, which reflect net revenue at corporate-

owned stores that have been open for at least

12 months. Therefore, net revenue from a store is included in comparable store sales beginning with the first month for which the store has a full

month of comparable prior year sales. Non-comparable store sales include sales from new stores that have not been open or otherwise not

operated by us for 12 months or from stores which have been significantly remodeled or relocated. Also included in non-comparable stores sales

are sales from direct to consumer sales, wholesale, franchises, warehouse sales and showrooms, and sales from corporate-

owned stores which we

have closed.

By measuring the change in year-over-

year net revenue in stores that have been open for 12 months or more, comparable store sales allows

us to evaluate how our core store base is performing. Various factors affect comparable store sales, including:

27

•

corporate

-

owned store net revenue, which includes sales to customers through corporate

-

owned stores in North America and

Australia;

•

direct to consumer revenue, which includes sales from our e

-

commerce website; and

•

other net revenue, which includes wholesale accounts, franchises net revenue, which consists of royalties as well as sales of our

products to franchises, warehouse sales, outlets and sales from company

-

operated showrooms.

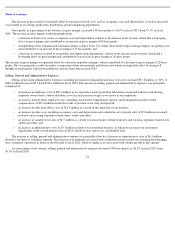

•

the location of new stores relative to existing stores;

•

consumer preferences, buying trends and overall economic trends;

•

our ability to anticipate and respond effectively to customer preferences for technical athletic apparel;