Lululemon 2011 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2011 Lululemon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

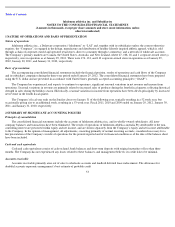

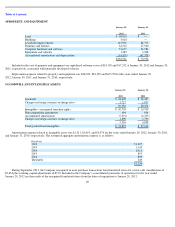

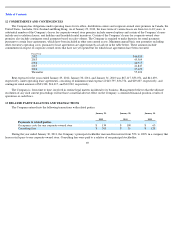

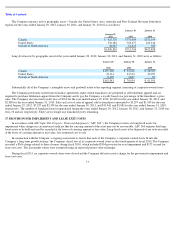

6 ACCRUED LIABILITIES

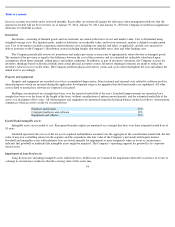

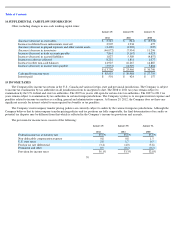

7 OTHER NON-CURRENT LIABILITIES

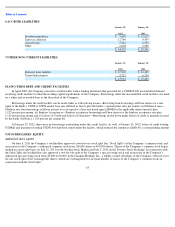

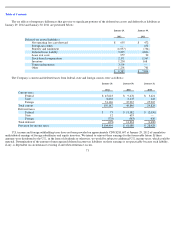

8 LONG-TERM DEBT AND CREDIT FACILITIES

In April 2007, the Company executed a credit facility with a lending institution that provided for a CDN$20,000 uncommitted demand

revolving credit facilities to fund the working capital requirements of the Company. Borrowings under the uncommitted credit facilities are made

on a when-and-as-needed basis at the discretion of the Company.

Borrowings under the credit facility can be made either as i) Revolving Loans—Revolving loan borrowings will bear interest at a rate

equal to the Bank’s CDN$ or USD$ annual base rate (defined as zero% plus the lender’s annual prime rate) per annum, ii) Offshore Loans—

Offshore rate loan borrowings will bear interest at a rate equal to a base rate based upon LIBOR for the applicable interest period, plus

1.125 percent per annum, iii) Bankers Acceptances—Bankers acceptance borrowings will bear interest at the bankers acceptance rate plus

1.125 percent per annum and iv) Letters of Credit and Letters of Guarantee—Borrowings drawn down under letters of credit or guarantee issued

by the banks will bear a 1.125 percent per annum fee.

At January 29, 2012, there were no borrowings outstanding under this credit facility. As well, at January 29, 2012, letters of credit totaling

USD$nil and guarantees totaling USD$1,466 had been issued under the facility, which reduced the amount available by a corresponding amount.

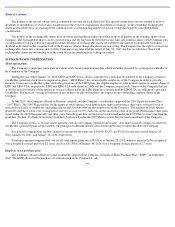

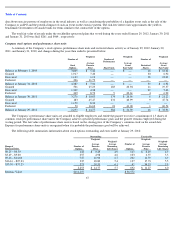

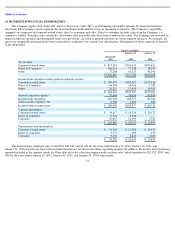

9 STOCKHOLDERS’ EQUITY

Authorized share capital

On June 8, 2011 the Company’s stockholders approved a two-for-one stock split (the “Stock Split”) of the Company’s common stock and

an increase in the Company’s authorized common stock from 200,000 shares to 400,000 shares. Shares of the Company’s common stock began

trading on a post-split basis on July 12, 2011 on the Nasdaq Stock Market and July 6, 2011 on the Toronto Stock Exchange. In connection with

the Stock Split, the stockholders also approved a two-for-one split of the Company’s special voting stock and an increase in the Company’s

authorized special voting stock from 30,000 to 60,000. Lulu Canadian Holding, Inc., a wholly-owned subsidiary of the Company, effected a two-

for-one stock split of the exchangeable shares (which are exchangeable for an equal number of shares of the Company’s common stock) in

connection with the Stock Split.

63

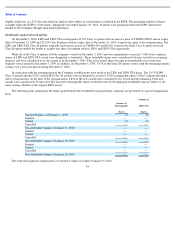

January 29,

2012

January 30,

2011

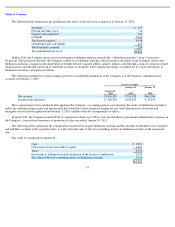

Inventory purchases

$

9,648

$

11,925

Sales tax collected

12,740

4,505

Accrued rent

5,343

2,750

Other

6,804

6,086

$

34,535

$

25,266

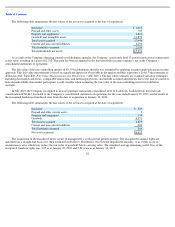

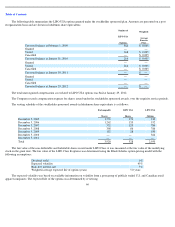

January 29,

2012

January 30,

2011

Deferred lease liability

$

15,302

$

13,129

Tenant Inducements

9,712

6,516

$

25,014

$

19,645