Lululemon 2011 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2011 Lululemon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

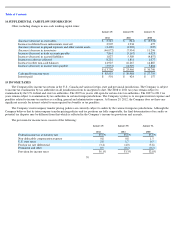

Table of Contents

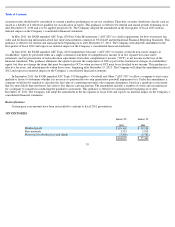

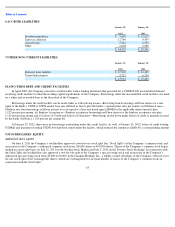

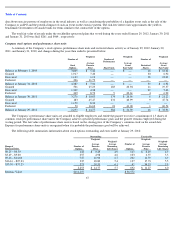

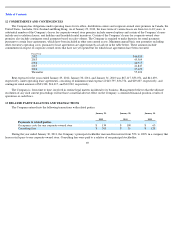

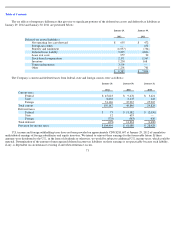

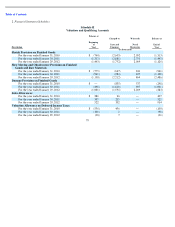

12 COMMITMENTS AND CONTINGENCIES

The Company has obligations under operating leases for its office, distribution centers and corporate-owned store premises in Canada, the

United States, Australia, New Zealand and Hong Kong. As of January 29, 2012, the lease terms of various leases are from two to 10 years. A

substantial number of the Company’s leases for corporate-owned store premises include renewal options and certain of the Company’s leases

include rent escalation clauses, rent holidays and leasehold rental incentives. Certain of the Company’s leases for corporate-owned store

premises also include contingent rental payments based on sales volume. The Company is required to make deposits for rental payments

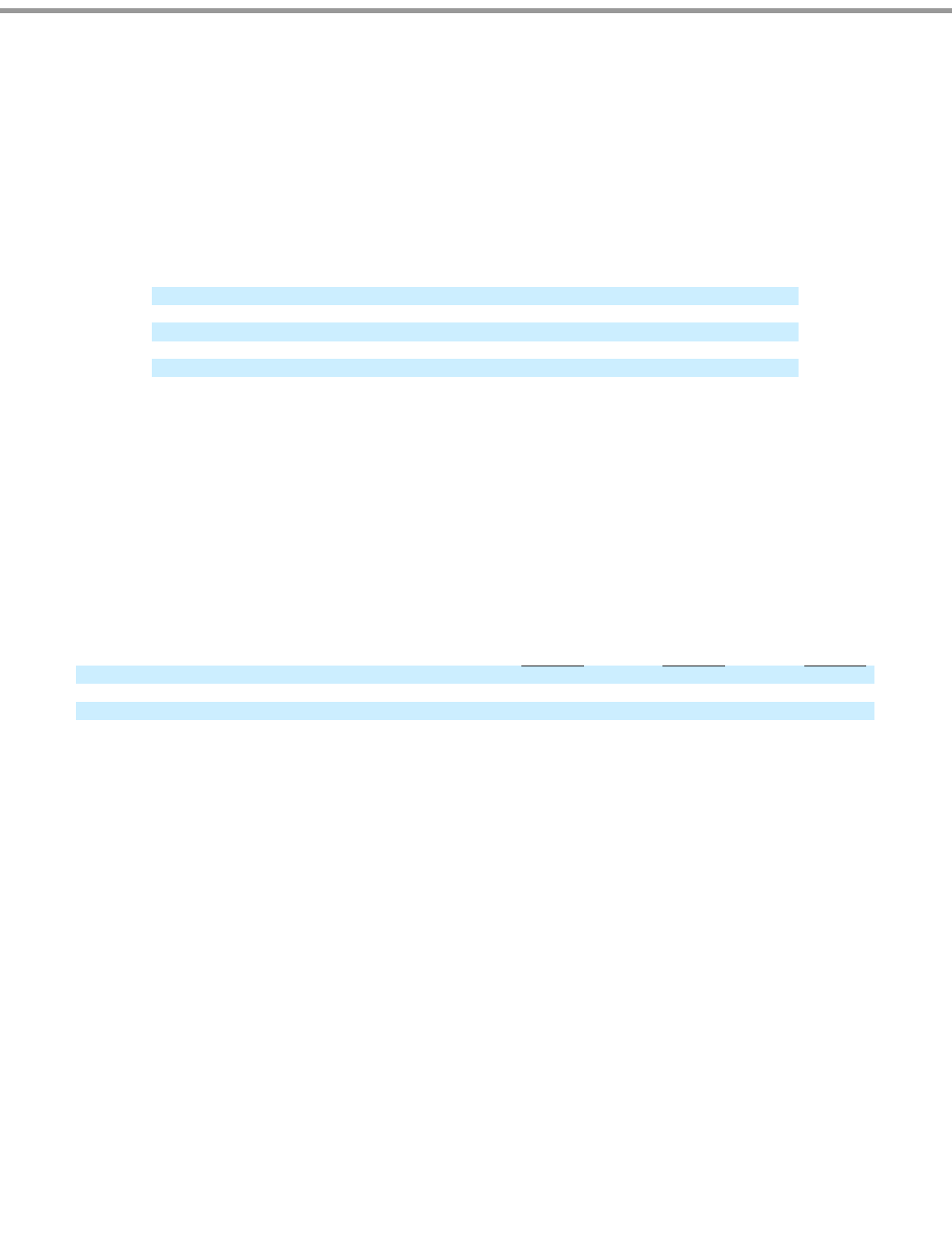

pursuant to certain lease agreements, which have been included in other non-current assets. Minimum annual basic rent payments excluding

other executory operating costs, pursuant to lease agreements are approximately as laid out in the table below. These amounts include

commitment in respect of corporate-owned stores that have not yet opened but for which lease agreements have been executed.

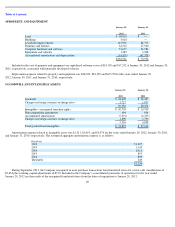

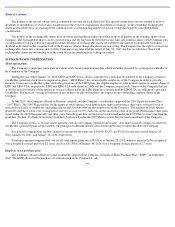

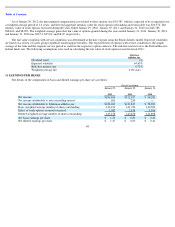

Rent expense for the years ended January 29, 2012, January 30, 2011, and January 31, 2010 was $67,117, $53,071, and $41,639,

respectively, under operating lease agreements, consisting of minimum rental expense of $43,795, $36,754, and $29,607, respectively, and

contingent rental amounts of $23,322, $16,317, and $12,032, respectively.

The Company is, from time to time, involved in routine legal matters incidental to its business. Management believes that the ultimate

resolution of any such current proceedings will not have a material adverse effect on the Company’s continued financial position, results of

operations or cash flows.

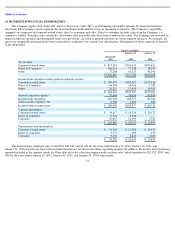

13 RELATED PARTY BALANCES AND TRANSACTIONS

The Company entered into the following transactions with related parties:

During the year ended January 30, 2011, the Company’s principal stockholder increased his interest from 50% to 100% in a company that

leases retail space to one corporate-owned store. Consulting fees were paid to a relative of our principal stockholder.

69

Fiscal Year

2012

$

46,020

2013

45,569

2014

44,915

2015

41,847

2016

37,129

Thereafter

55,303

January 29,

2012

January 30,

2011

January 30,

2011

Payments to related parties

Occupancy costs for one corporate

-

owned store

$

134

$

100

$

63

Consulting fees

$

305

$

31

$

120