Lululemon 2011 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2011 Lululemon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

eligible employees at a 25% discount from fair market value subject to certain limits as defined in the ESPP. The maximum number of shares

available under the ESPP is 6,000 shares. During the year ended January 29, 2012, 18 shares were purchased under the ESPP, which were

funded by the Company through open market purchases.

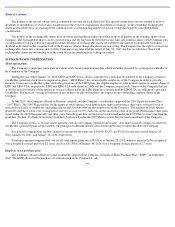

Stockholder sponsored stock options

On December 1, 2005, LIPO and LIPO USA each granted 10,592 Class A options with an exercise price of CDN$0.000005 and an expiry

date of December 31, 2009 and 22,124 Class B options with an expiry date of December 31, 2010, respectively, prior to the reorganization. The

LIPO and LIPO USA Class B options originally had exercise prices of CDN$0.495 and $0.005, respectively. Each Class A option and each

Class B option entitled the holder to acquire one share of common stock of LIPO and LIPO USA respectively.

While all of the Class A options of both companies vested on December 5, 2005 and were immediately exercised, 7,098 of the common

shares of LIPO and LIPO USA issued were designated as forfeitable. These forfeitable shares were considered to be non-vested for accounting

purposes and were considered not to be earned as of December 5, 2005. These non-vested shares became non-forfeitable over a four-year

requisite service period to December 5, 2009. In addition, on December 5, 2005, 4,478 of the Series B options vested, with the remaining options

vesting over a five-year period ending December 5, 2010.

In connection with the reorganization of the Company, modifications were made to the LIPO and LIPO USA plans. The 10,570 LIPO

Class A awards and the 8,222 vested LIPO Class B awards were exchanged for a total of 3,920 exchangeable shares of the Company through a

series of transactions. At the time of the reorganization, 2,836 of the new awards were considered to be vested and the remaining 1,082 new

awards were considered to be unvested. The unvested exchangeable shares are held in trust by the principal stockholder and are subject to the

same vesting schedule as the original LIPO award.

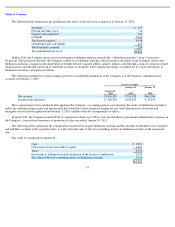

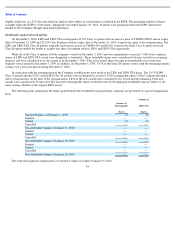

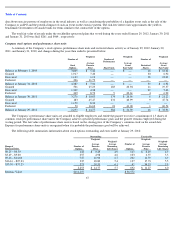

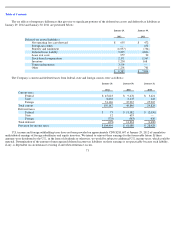

The following table summarizes the shares granted under the stockholder sponsored plan. Amounts are presented on a post reorganization

basis.

The total unrecognized compensation cost related to shares was $nil at January 29, 2012.

65

Number of

Exchangeable

Shares

Number of

LIPO USA

Shares

Unvested balance at February 1, 2009

76

16

Granted

—

—

Vested

76

16

Cancelled

—

—

Non

-

forfeitable balance at January 31, 2010

—

—

Granted

—

—

Vested

—

—

Cancelled

—

—

Non

-

forfeitable balance at January 30, 2011

—

—

Granted

—

—

Vested

—

—

Cancelled

—

—

Non

-

forfeitable balance at January 29, 2012

—

—