Lululemon 2011 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2011 Lululemon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

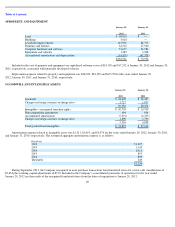

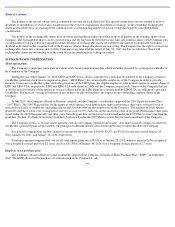

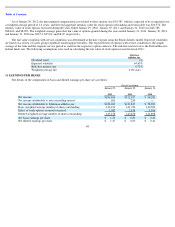

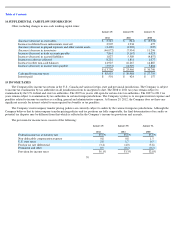

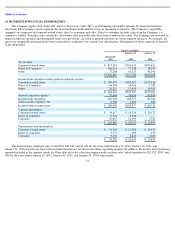

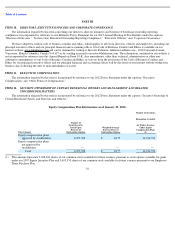

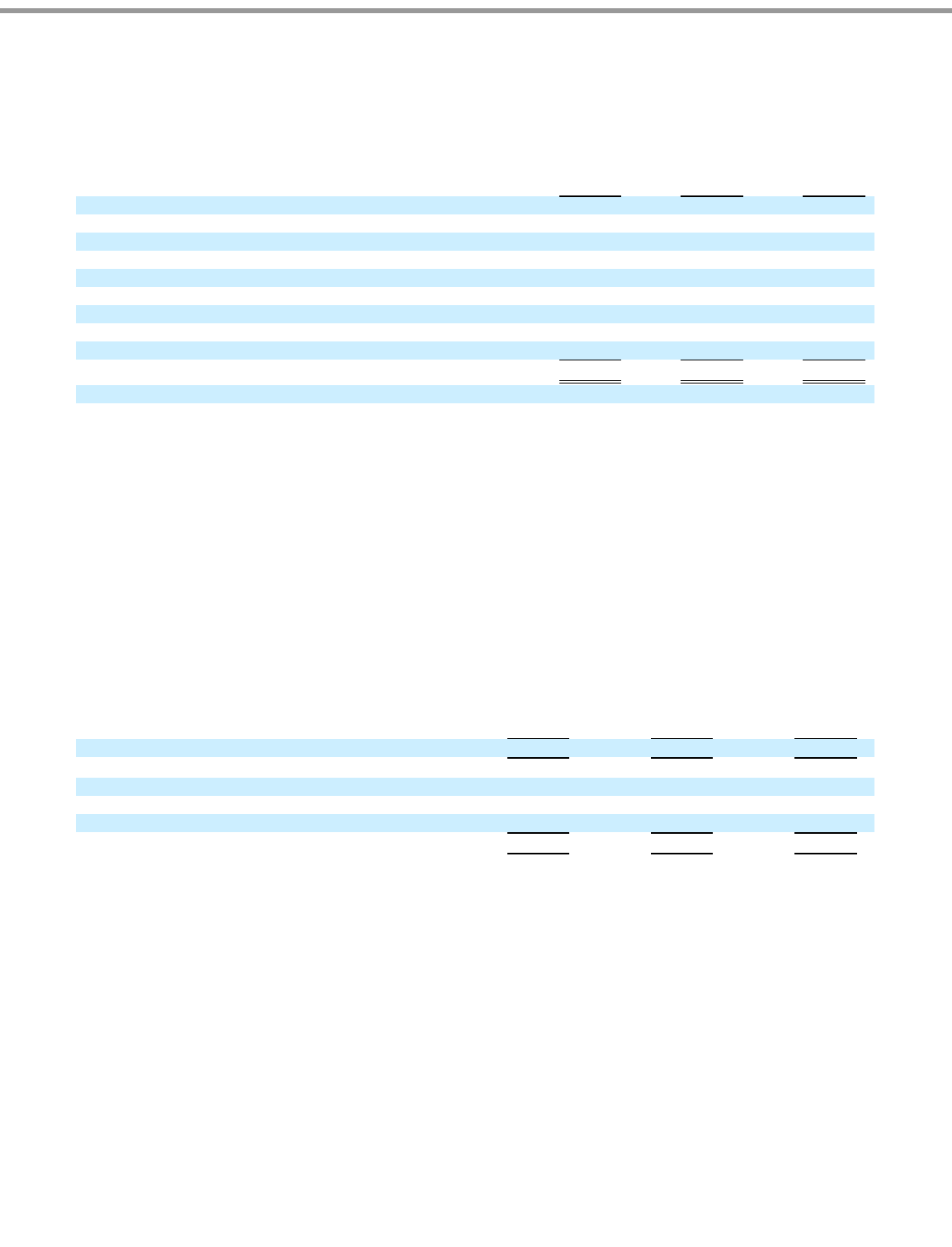

14 SUPPLEMENTAL CASH FLOW INFORMATION

Other, including changes in non-cash working capital items:

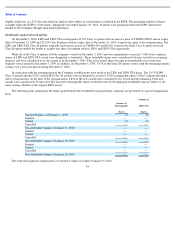

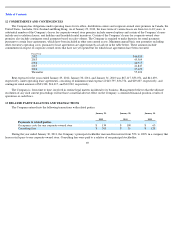

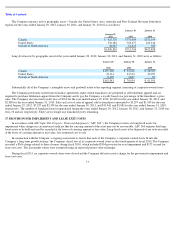

15 INCOME TAXES

The Company files income tax returns in the U.S., Canada and various foreign, state and provincial jurisdictions. The Company is subject

to income tax examination by tax authorities in all jurisdictions from its inception to date. The 2008 to 2011 tax years remain subject to

examination by the U.S. federal and state tax authorities. The 2007 tax year is still open for certain state tax authorities. The 2007 to 2011 tax

years remain subject to examination by tax authorities in certain foreign jurisdictions. The Company

’

s policy is to recognize interest expense and

penalties related to income tax matters as a selling, general and administrative expense. At January 29, 2012, the Company does not have any

significant accruals for interest related to unrecognized tax benefits or tax penalties.

The Company’s intercompany transfer pricing policies are currently subject to audits by the various foreign tax jurisdictions. Although the

Company believes that its intercompany transfer pricing policies and tax positions are fully supportable, the final determination of tax audits or

potential tax disputes may be different from that which is reflected in the Company’s income tax provisions and accruals.

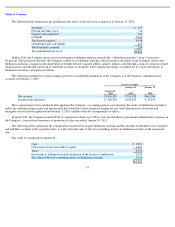

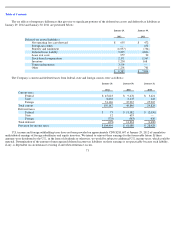

The provision for income taxes consists of the following:

70

January 29,

2012

January 30,

2011

January 31,

2010

(Increase) decrease in receivables

$

3,743

$

(541

)

$

(3,974

)

Increase in deferred lease inducements received

2,905

1,934

675

(Increase) decrease in prepaid expenses and other current assets

(2,400

)

(2,902

)

(225

)

(Increase) decrease in inventories

(46,072

)

(7,954

)

11,296

Increase (decrease) in trade accounts payable

7,861

(5,167

)

6,025

Increase (decrease) in accrued liabilities

1,027

5,589

(4,857

)

Increase in sales tax collected

8,232

1,811

1,077

Increase in other non

-

cash balances

14,925

16,267

14,887

Increase (decrease) in income taxes payable

(3,951

)

14,929

5,886

$

(13,730

)

$

23,966

$

30,790

Cash paid for income taxes

$

85,633

$

30,968

$

27,719

Interest paid

$

501

$

424

$

157

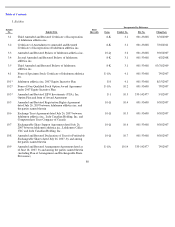

January 29,

2012

January 30,

2011

January 31,

2010

Federal income tax at statutory rate

35.0

%

35.0

%

35.0

%

Non

-

deductible compensation expense

0.8

0.8

1.5

U.S. state taxes

2.8

1.7

0.3

Foreign tax rate differential

(3.4

)

(4.0

)

(3.8

)

Permanent and other

0.9

(0.2

)

(0.2

)

Provision for income taxes

36.1

%

33.3

%

32.8

%