Lululemon 2011 Annual Report Download

Download and view the complete annual report

Please find the complete 2011 Lululemon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LULULEMON ATHLETICA INC.

FORM 10-K

(Annual Report)

Filed 03/22/12 for the Period Ending 01/29/12

Telephone 604-732-6124

CIK 0001397187

Symbol LULU

SIC Code

2300 - Apparel & Other Finishd Prods of Fabrics & Similar Matl

Industry Apparel/Accessories

Sector Consumer Cyclical

Fiscal Year 01/30

http://www.edgar-online.com

© Copyright 2012, EDGAR Online, Inc. All Rights Reserved.

Distribution and use of this document restricted under EDGAR Online, Inc. Terms of Use.

Table of contents

-

Page 1

LULULEMON ATHLETICA INC. FORM 10-K (Annual Report) Filed 03/22/12 for the Period Ending 01/29/12 Telephone CIK Symbol SIC Code Industry Sector Fiscal Year 604-732-6124 0001397187 LULU 2300 - Apparel & Other Finishd Prods of Fabrics & Similar Matl Apparel/Accessories Consumer Cyclical 01/30 http... -

Page 2

...Such aggregate market value was computed by reference to the closing price of the common stock as reported on the Nasdaq Global Select Market on July 29, 2011. For purposes of determining this amount only, the registrant has defined affiliates as including the executive officers and directors of the... -

Page 3

... AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA CONTROLS AND PROCEDURES DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE EXECUTIVE COMPENSATION SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS CERTAIN... -

Page 4

... pants, shorts, tops and jackets designed for athletic pursuits such as yoga, running and general fitness. As of January 29, 2012, our branded apparel was principally sold through 174 stores that are located in Canada, the United States, Australia and New Zealand. We believe our vertical retail... -

Page 5

... our product appeal. Distinctive Retail Experience. We locate our stores in street locations, lifestyle centers and malls that position lululemon athletica stores to be an integral part of their communities. We coach our store sales associates, whom we refer to as "educators," to develop a personal... -

Page 6

..., product sourcing, marketing and information technology experience from leading apparel and retail companies such as Abercrombie & Fitch Co., The Gap, Inc., Nike, Inc. and Speedo International Limited. We believe our management team is well positioned to execute the long-term growth strategy for... -

Page 7

... for future growth. • • • • • • • Our Stores As of January 29, 2012, our retail footprint included 47 stores in Canada, 108 stores in the United States, 18 stores in Australia and one in New Zealand. While most of our stores are branded lululemon athletica, five of our corporate... -

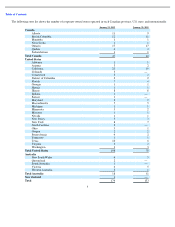

Page 8

... The following store list shows the number of corporate-owned stores operated in each Canadian province, U.S. state, and internationally: January 29, 2012 January 30, 2011 Canada Alberta British Columbia Manitoba Nova Scotia Ontario Québec Saskatchewan Total Canada United States Alabama Arizona... -

Page 9

... our brand. Our direct to consumer channel makes our product accessible in more markets than our corporate-owned store channel alone. We use this channel to build brand awareness, especially in new markets, including those outside of North America. Wholesale Channel We also sell lululemon athletica... -

Page 10

...speed to market necessary to respond quickly to changing trends and increased demand. While we plan to support future growth through manufacturers outside of North America, our intent is also to maintain production in Canada and the United States whenever practicable. We have developed long-standing... -

Page 11

... used in connection with the marketing, distribution and sale of all of our products in Canada, the United States and in the other countries in which our products are currently or intended to be either sold or manufactured. Our major trademarks include lululemon athletica & design, the logo design... -

Page 12

... versions of our Code of Business Conduct and Ethics and charters of the Audit, Compensation, and Nominating and Governance Committees of our Board of Directors. Information on our website does not constitute part of this annual report on Form 10-K or any other report we file or furnish with... -

Page 13

...and successfully develop and introduce new, innovative and updated products, we may not be able to maintain or increase our sales and profitability. Our success depends on our ability to identify and originate product trends as well as to anticipate and react to changing consumer demands in a timely... -

Page 14

... write-downs or write-offs and the sale of excess inventory at discounted prices, which would cause our gross margin to suffer and could impair the strength and exclusivity of our brand. Conversely, if we underestimate customer demand for our products, our manufacturers may not be able to deliver... -

Page 15

... to train our suppliers and manufacturers in our methods, products and quality control standards. Delays related to supplier changes could also arise due to an increase in shipping times if new suppliers are located farther away from our markets or from other participants in our supply chain. Any... -

Page 16

...financial, research and development, store development, marketing, distribution and other resources than we do. In addition, our technical athletic apparel is sold at a price premium to traditional athletic apparel. Our competitors may be able to achieve and maintain brand awareness and market share... -

Page 17

... us from, or the loss of "normal trade relations" status with, China, could significantly increase our cost of products imported into North America, Australia or New Zealand and harm our business. We may not be able to successfully open new store locations in a timely manner, if at all, which could... -

Page 18

... success, which could result in harm to our customer and employee relationships, loss of key information, expertise or know-how and unanticipated recruitment and training costs. We do not maintain a key person life insurance policy on Ms. Day or any of the other members of our senior management team... -

Page 19

... are beyond our control and that could harm our business, financial condition and results of operations. Almost all of our suppliers are located outside the United States. During fiscal 2011, approximately 3% of our products were produced in Canada, approximately 49% in China, approximately 41% in... -

Page 20

..., liquidity and financial condition to suffer. Our limited operating experience and limited brand recognition in new international markets may limit our expansion strategy and cause our business and growth to suffer. Our future growth depends, to an extent, on our international expansion efforts. We... -

Page 21

..., Canada, V6J 1C7. We expect that our current administrative offices are sufficient for our expansion plans for the foreseeable future. In March 2011, we purchased the building that currently houses our administrative offices. We currently operate three distribution centers located in Vancouver... -

Page 22

... Offices 167,000 120,000 78,000 54,000 19,000 April 2020 November 2017 n/a September 2016 September 2013 As of January 29, 2012, we leased approximately 494,000 gross square feet relating to our 174 corporate-owned stores. Our leases generally have initial terms of between five and 10 years... -

Page 23

... funds for use in the operation and expansion of our business. Any future determination as to the payment of cash dividends will be at the discretion of our board of directors and will depend on our financial condition, operating results, current and anticipated cash needs, plans for expansion and... -

Page 24

...are based on historical data. We caution that the stock price performance showing in the graph below is not necessarily indicative of, nor is it intended to forecast, the potential future performance of our common stock. Information used in the graph was obtained from the Nasdaq Stock Market website... -

Page 25

...Stock Exchange or the Nasdaq Global Select Market (or such other stock exchange as we may designate from time to time). Unless our Board of Directors terminates the ESPP earlier, the ESPP will continue until all shares authorized for purchase under the ESPP have been purchased. The maximum number of... -

Page 26

... 30, January 29, 2012 Fiscal Year Ended January 31, February 1, February 3, 2008 2011 2010 2009 (In thousands, except per share data) Consolidated statement of operations data: Net revenue Cost of goods sold Gross profit Operating expenses: Selling, general and administrative expenses Provision... -

Page 27

... Contents As of January 31, 2010 (In thousands) January 29, 2012 January 30, 2011 February 1, 2009 February 3, 2008 Consolidated balance sheet data: Cash and cash equivalents Total assets Total stockholders' equity Non-controlling interest $ 409,437 734,634 606,181 4,805 24 $ 316,286 499,302... -

Page 28

... revenue growth, which leveraged our fixed operating costs and in turn led to increased operating margins. We increased our store base through execution of our real estate strategy, when and where we saw opportunities for success. For example, we opened 41 new corporate-owned stores in North America... -

Page 29

... Operating Segment Overview lululemon is a designer and retailer of technical athletic apparel operating primarily in North America and Australia. Our yoga-inspired apparel is primarily marketed under the lululemon athletica and ivivva athletica brand names. We offer a comprehensive line of apparel... -

Page 30

...net revenue in future fiscal years. Warehouse sales are typically held one or more times a year to sell slow moving inventory or inventory from prior seasons to retail customers at discounted prices. Our showrooms are typically small locations that we open from time to time when we enter new markets... -

Page 31

... store sales has limited utility for assessing the success of our growth strategy insofar as comparable store sales do not reflect the performance of stores open less than 12 months. Cost of goods sold includes the cost of purchased merchandise, which includes acquisition and production costs... -

Page 32

...future we may start to sell our products directly to some customers located outside of Canada, the United States, Australia and New Zealand, in which case we would become subject to taxation based on the foreign statutory rates in the countries where these sales take place and our effective tax rate... -

Page 33

..., both in dollars and as a percentage of net revenue: Fiscal Year Ended January 30, January 29, 2012 2011 (In thousands) January 31, 2010 Consolidated statements of operations: Net revenue Cost of goods sold Gross profit Operating expenses: Selling, general and administrative expenses Provision for... -

Page 34

... through new showroom locations, new wholesale partners and net revenue growth at existing locations attributable to a strong product offering and brand interest. We continue to employ our other segment strategy to increase interest in our product in markets we may have corporate-owned stores. Gross... -

Page 35

... natural growth in labor hours associated with new and existing corporate-owned stores, outlets and other, as well as an increase in wages as we invest in our employees; an increase in head office employee costs, including stock-based compensation expense and management incentive-based compensation... -

Page 36

... professional fees paid as our e-commerce operations were brought in-house near the beginning of fiscal 2011. We discontinued our phone sales channel during fiscal 2011, and therefore our direct to consumer segment will only include e-commerce sales in future fiscal years. Other. Net income from our... -

Page 37

... net revenue increase was driven by increased sales at locations in our comparable stores base, sales from new stores and showrooms opened, sales from franchised stores that were reacquired during fiscal 2010 and the growth of our e-commerce website sales included in our direct to consumer segment... -

Page 38

... sales and outlets. Net revenue from our franchise channel decreased due to our reacquisition of one franchised store in Canada and nine franchised stores in Australia. Our other segment continues to grow year over year through new showroom locations, new wholesale partners and net revenue growth... -

Page 39

... hours associated with new corporate-owned stores, showrooms, outlets and other, and growth at existing locations; an increase in variable administrative costs of $18.4 million related to our direct to consumer segment, primarily associated with revenue growth in our e-commerce website sales channel... -

Page 40

... by a natural increase in selling, general and administrative expenses related to employee costs as well as operating expenses associated with new stores and net revenue growth at existing stores. Direct to consumer. Net income from our direct to consumer segment increased $8.6 million, or 160... -

Page 41

... to continue to increase in future years as we grow our overall business and require increased efforts at our head office to support our corporate-owned stores, franchises and other segments. Our $1.8 million provision for impairment and lease exit costs was a result of management's review of our... -

Page 42

... of cash and cash equivalents, cash flows from operations and borrowings available under our revolving credit facility. Our primary cash needs are capital expenditures for opening new stores and remodeling existing stores, making information technology system enhancements and funding working capital... -

Page 43

.... This increase in cash used in investing activities represents an increase in the number of new stores opened in fiscal 2011 compared to fiscal 2010, as well as our reacquisition of our remaining four franchised stores. Capital expenditures for our corporate-owned stores segment were $34.1 million... -

Page 44

... as of January 29, 2012, and the timing and effect that such commitments are expected to have on our liquidity and cash flows in future periods: Total 2012 Payments Due by Fiscal Year 2013 2014 2015 (In thousands) 2016 Thereafter Operating Leases (minimum rent) Off-Balance Sheet Arrangements... -

Page 45

... accounting policies affect our more significant estimates and judgments used in the preparation of our consolidated financial statements: Revenue Recognition. Net revenue is comprised of corporate-owned store net revenue, direct to consumer sales through www.lululemon.com , and other net revenue... -

Page 46

.... The liability is estimated based on a number of assumptions requiring management's judgment, including store closing costs, cost inflation rates and discount rates, and is accreted to its projected future value over time. The capitalized asset is depreciated using the convention for depreciation... -

Page 47

... with the offsetting credit to additional paid-in capital. Our calculation of stock-based compensation requires us to make a number of complex and subjective estimates and assumptions, including future forfeitures, stock price volatility, expected life of the options and related tax effects. The... -

Page 48

...position due to adverse changes in financial market prices and rates. Our market risk exposure is primarily a result of fluctuations in interest rates and foreign currency exchange rates. We do not hold or issue financial instruments for trading purposes. Foreign Currency Exchange Risk. We currently... -

Page 49

... impact on our financial position or results of operations to date, a high rate of inflation in the future may have an adverse effect on our ability to maintain current levels of gross margin and selling, general and administrative expenses as a percentage of net revenue if the selling prices of our... -

Page 50

... lululemon athletica inc. and Subsidiaries INDEX TO CONSOLIDATED FINANCIAL STATEMENTS Consolidated Financial Statements: Report of Independent Registered Public Accounting Firm Consolidated Balance Sheets as at January 29, 2012 and January 30, 2011 Consolidated Statements of Operations for the years... -

Page 51

..., on the financial statement schedule, and on the Company's internal control over financial reporting based on our integrated audits. We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and... -

Page 52

... Accounts payable Accrued liabilities Accrued compensation and related expenses Income taxes payable Unredeemed gift card liability Other non-current liabilities Stockholders' equity Undesignated preferred stock, $0.01 par value, 5,000 shares authorized, none issued and outstanding Exchangeable... -

Page 53

... of Contents lululemon athletica inc. and Subsidiaries CONSOLIDATED STATEMENTS OF OPERATIONS Fiscal Year Ended January 30, January 29, 2012 2011 (Amounts in thousands, except per share amounts) January 31, 2010 Net revenue Cost of goods sold Gross profit Operating expenses: Selling, general and... -

Page 54

...to non-controlling interests Balance at January 30, 2011 Net income attributable to lululemon athletica inc. Foreign currency translation adjustment Comprehensive income Stock-based compensation Excess tax benefit from stock-based compensation Common stock issued upon exchange of exchangeable shares... -

Page 55

.... and Subsidiaries CONSOLIDATED STATEMENTS OF CASH FLOWS Fiscal Year Ended January 30, January 29, 2012 2011 (Amounts in thousands) January 31, 2010 Cash flows from operating activities Net income attributable to lululemon athletica inc Net income attributable to non-controlling interest Net income... -

Page 56

...manufacture and distribution of healthy lifestyle inspired athletic apparel, which is sold through a chain of corporate-owned and operated retail stores, direct to consumer through e-commerce, and a network of wholesale accounts. The Company's primary markets are Canada, the United States, Australia... -

Page 57

... and makes provisions as necessary to appropriately value obsolete or damaged goods. The amount of the provision is equal to the difference between the cost of the inventory and its estimated net realizable value based upon assumptions about future demand, selling prices and market conditions... -

Page 58

.... The liability is estimated based on a number of assumptions requiring management's judgment, including store closing costs, cost inflation rates and discount rates, and is accreted to its projected future value over time. The capitalized asset is depreciated using the convention for depreciation... -

Page 59

..., direct to consumer through www.lululemon.com , sales through a network of wholesale accounts, and sales from company-operated showrooms. Sales to customers through corporate-owned retail stores are recognized at the point of sale, net of an estimated allowance for sales returns. Sales of apparel... -

Page 60

... in the consolidated statements of operations under selling, general and administrative expenses. The fair value of these financial instruments approximates their carrying value, unless otherwise noted. Foreign exchange risk A significant portion of the Company's sales are denominated in Canadian... -

Page 61

... the years ended January 29, 2012, January 30, 2011, and January 31, 2010, respectively. Concentration of credit risk The Company is not exposed to significant credit risk on its cash and cash equivalents and trade accounts receivable. Cash and cash equivalents are held with high quality financial... -

Page 62

... fair value and for disclosing information about fair value measurements common to US GAAP and International Financial Reporting Standards. This guidance is effective for interim and annual periods beginning on or after December 15, 2011. The Company will adopt the amendment in the first quarter of... -

Page 63

... is as follows: Fiscal Year 2012 2013 2014 2015 2016 Thereafter $1,327 1,145 1,011 895 809 349 $5,536 During September 2011, the Company reacquired in asset purchase transactions four franchised stores for a total cash consideration of $5,654 plus working capital adjustments of $170. Included in... -

Page 64

... control over lululemon australia, which became a subsidiary of the Company on this date. lululemon australia is engaged in the distribution of healthy lifestyle inspired athletic apparel, which is sold through a chain of corporate-owned retail locations and through a network of wholesale accounts... -

Page 65

...value of the non-controlling interest in lululemon australia. In July 2010, the Company reacquired in an asset purchase transaction a franchised store in Saskatoon, Saskatchewan for total cash consideration of $6,610. Included in the Company's consolidated statements of operations for the year ended... -

Page 66

...$ 13,129 6,516 $ 19,645 8 LONG-TERM DEBT AND CREDIT FACILITIES In April 2007, the Company executed a credit facility with a lending institution that provided for a CDN$20,000 uncommitted demand revolving credit facilities to fund the working capital requirements of the Company. Borrowings under the... -

Page 67

... cost for all stock option plans was $18,619 as at January 29, 2012, which is expected to be recognized over a weighted-average period of 2.2 years, and was $15,399 as at January 30, 2011 over a weighted-average period of 2.7 years. Employee stock purchase plan The Company's Board of Directors... -

Page 68

... employees at a 25% discount from fair market value subject to certain limits as defined in the ESPP. The maximum number of shares available under the ESPP is 6,000 shares. During the year ended January 29, 2012, 18 shares were purchased under the ESPP, which were funded by the Company through open... -

Page 69

... yield Expected volatility Risk-free interest rate Weighted-average expected life of option (years) 0% 45% 5% 5.0 years The expected volatility was based on available information on volatility from a peer group of publicly traded U.S. and Canadian retail apparel companies. The expected life of the... -

Page 70

...fair value of performance share units is based on the closing price of the Company's common stock on the award date. Expense for performance share units is recognized when it is probable the performance goal will be achieved. The following table summarizes information about stock options outstanding... -

Page 71

... The following assumptions were used in calculating the fair value of stock options issued in fiscal 2011: lululemon athletica inc. Dividend yield Expected volatility Risk-free interest rate Weighted-average life 11 EARNINGS PER SHARE The details of the computation of basic and diluted earnings per... -

Page 72

... legal matters incidental to its business. Management believes that the ultimate resolution of any such current proceedings will not have a material adverse effect on the Company's continued financial position, results of operations or cash flows. 13 RELATED PARTY BALANCES AND TRANSACTIONS The... -

Page 73

... CASH FLOW INFORMATION Other, including changes in non-cash working capital items: January 29, 2012 January 30, 2011 January 31, 2010 (Increase) decrease in receivables Increase in deferred lease inducements received (Increase) decrease in prepaid expenses and other current assets (Increase... -

Page 74

... tax assets and deferred tax liabilities at January 29, 2012 and January 30, 2011 are presented below: January 29, 2012 January 30, 2011 Deferred tax assets/(liabilities) Net operating loss carryforward Foreign tax credits Property and equipment Deferred lease liability Lease exit costs Stock-based... -

Page 75

...based on the financial information it uses in managing its business. The Company's reportable segments are comprised of corporate-owned stores, direct to consumer and other. Direct to consumer includes sales from the Company's ecommerce website. Franchise sales, wholesale, showrooms sales and outlet... -

Page 76

... relate to the reporting segment consisting of corporate-owned stores. The Company previously entered into franchise agreements under which franchisees are permitted to sell lululemon apparel and are required to purchase lululemon apparel from the Company and to pay the Company a royalty based... -

Page 77

... for any future quarter or for a full year. Fourth Quarter Fiscal 2011 Third Second Quarter Quarter First Fourth Quarter Quarter (In thousands) (unaudited) Fiscal 2010 Third Second Quarter Quarter First Quarter Consolidated statements of income: Net revenue Cost of goods sold Gross profit Operating... -

Page 78

... such information is accumulated and communicated to our management, including our chief executive officer and chief financial officer, as appropriate to allow timely decisions regarding required disclosure. Inherent Limitations Over Internal Controls Our internal control over financial reporting is... -

Page 79

...obtained by writing to Investor Relations, lululemon athletica inc., 1818 Cornwall Avenue, Vancouver, British Columbia, Canada V6J 1C7 or by sending an email to [email protected]. The information contained on our website is not incorporated by reference into this Annual Report on Form 10-K. Any... -

Page 80

... RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE The information required by this item is incorporated by reference to our 2012 Proxy Statement under the captions "Certain Relationships and Related Transactions" and "Corporate Governance." ITEM 14. PRINCIPAL ACCOUNTING FEES AND... -

Page 81

Table of Contents PART IV ITEM 15. EXHIBITS AND FINANCIAL STATEMENT SCHEDULES (a) Documents filed as part of this report: 1. Financial Statements. The financial statements as set forth under Item 8 of this Annual Report on Form 10-K are incorporated herein. 78 -

Page 82

... of Contents 2. Financial Statement Schedules. Schedule II Valuation and Qualifying Accounts Balance at Charged to Beginning of Year Write-offs Balance at End of Year Description Costs and Net of Expenses Recoveries (In thousands) Shrink Provision on Finished Goods For the year ended January 31... -

Page 83

... Registration Rights Agreement dated July 26, 2007 between lululemon athletica inc. and the parties named therein Exchange Trust Agreement dated July 26, 2007 between lululemon athletica inc., Lulu Canadian Holding, Inc. and Computershare Trust Company of Canada Exchangeable Share Support Agreement... -

Page 84

.... and its directors and certain officers Purchase and Sale Agreement between 2725312 Canada Inc and lululemon athletica inc., dated December 22, 2010 Outside Director Compensation Plan lululemon athletica inc. Employee Share Purchase Plan Executive Employment Agreement with Christine M. Day, dated... -

Page 85

... The following financial statements from the Company's 10-K for the fiscal year ended January 29, 2012, formatted in XBRL: (i) Consolidated Balance Sheets, (ii) Consolidated Statements of Operations, (iii) Consolidated Statements of Stockholders' Equity, (iv) Consolidated Statements of Cash Flows... -

Page 86

... Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. LULULEMON ATHLETICA INC. By: /s/ C HRISTINE M. D AY Christine M. Day Chief Executive Officer (Principal Executive Officer) KNOW ALL PERSONS... -

Page 87

... Registration Rights Agreement dated July 26, 2007 between lululemon athletica inc. and the parties named therein Exchange Trust Agreement dated July 26, 2007 between lululemon athletica inc., Lulu Canadian Holding, Inc. and Computershare Trust Company of Canada Exchangeable Share Support Agreement... -

Page 88

.... and its directors and certain officers Purchase and Sale Agreement between 2725312 Canada Inc and lululemon athletica inc., dated December 22, 2010 Outside Director Compensation Plan lululemon athletica inc. Employee Share Purchase Plan Executive Employment Agreement with Christine M. Day, dated... -

Page 89

... The following financial statements from the Company's 10-K for the fiscal year ended January 29, 2012, formatted in XBRL: (i) Consolidated Balance Sheets, (ii) Consolidated Statements of Operations, (iii) Consolidated Statements of Stockholders' Equity, (iv) Consolidated Statements of Cash Flows... -

Page 90

... Holding Inc. lululemon athletica canada inc. 0902600 B.C. Ltd. ivivva athletica canada inc. VICTORIA lululemon athletica australia holdings Pty Ltd. lululemon autralia Pty Ltd. NEW ZEALAND lululemon athletica new zealand limited HONG KONG Lululemon Hong Kong Limited UNITED KINGDOM Lululemon UK ltd... -

Page 91

...OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM We hereby consent to the incorporation by reference in the Registration Statements on Form ...lululemon athletica inc. of our report relating to the consolidated financial statements and on the effectiveness of internal control over financial reporting... -

Page 92

... and report financial information; and (b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. By: /s/ C HRISTINE M. D AY Christine M. Day Chief Executive Officer and Director... -

Page 93

... and the audit committee of the registrant's board of directors (or persons performing the equivalent functions): (a) All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the... -

Page 94

...15(d) of the Securities Exchange Act of 1934; and (2) The information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Company. /s/ C HRISTINE M. D AY Christine M. Day Chief Executive Officer and Director (Principal Executive...