Loreal 2014 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2014 Loreal annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

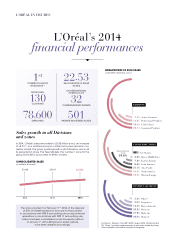

BREAKDOWN OF 2014 SALES

(Cosmetics Divisions, as %)

1st

COSMETICS GROUP

WORLDWIDE

(1)

EMPLOYEES

78,600

32

COMPLEMENTARY BRANDS

AN INTERNATIONAL

PORTFOLIO OF

501

PATENTS REGISTERED IN 2014

BILLION EUROS OF SALES

IN 2014

22.53

Sales growth in all Divisions

and zones

The announcement on February 11th, 2014, of the disposal

of 50% of Galderma leads to account for this business

inaccordance with IFRS 5 accounting rule on discontinued

operations. In accordance with IFRS 11 accounting rule,

Innéov has been consolidated under the equity method

of January 1st, 2014. All figures for earlier periods

have been restated accordingly. (1) Source: “Beauty’s Top 100” WWD, August 2014. (2) Like-for-like.

(3) “Other” includes hygiene products and sales made by Ameri-

can distributors with brands outside of the group.

7.7% Active Cosmetics

14.0% Professional Products

28.6% L’Oréal Luxe

49.7% Consumer Products

DIVISIONS

4.6% Other (3)

9.8% Fragrances

13.2% Hair colourants

20.5% Haircare

21.9% Make-up

30.0% Skincare

BUSINESS SEGMENTS

L’Oréal’s 2014

financial performances

L’ORÉAL IN FIGURES

In 2014, L’Oréal’s sales amounted to 22.53 billion euros, an increase

of +3.7%(2). In a volatile economic context and a less dynamic cos-

metics market, the group posted growth in all its Divisions and in all

its geographic zones. The New Markets, the number 1 zone for the

group since 2012, accounted for 39.6% of sales.

CONSOLIDATED SALES

(in millions of euros)

20142012 2013

22,532

22,12421,638

2.6% Africa, Middle East

7.3% Eastern Europe

8.6% Latin America

21.1% Asia, Pacific

24.9% North America

35.5% Western Europe

New Markets

Total

39.6% New Markets

GEOGRAPHIC ZONES

130

COUNTRIES

MORE THAN