Loreal 2012 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2012 Loreal annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LUXE

L’ORÉAL

The group’s first instrumental cosmetics brand, CLARISONIC, was

acquired by L’Oréal in December 2011. Initially, the CLARISONIC

brush was designed for use with problem skin, and for preparation

before skincare. Since then, it has created a new ritual not only

for cleansing but also for visibly transforming the skin, which has

given the brand a real boost. In its traditional market, the United

States, sales are growing strongly in selective distribution channels

such as department stores and self-service outlets, and in profes-

sional distribution (dermatologists and spas).

Rapid international success

Elsewhere, L’Oréal subsidiaries have successfully incorporated

the brand in Japan, Singapore, Hong Kong, Australia, Canada,

Mexico and the United Kingdom. In the last quarter of 2012, it

was launched in France, at Sephora, where it has already be-

come the chain’s leading skincare product(2). In its first year as

part of L’Oréal Luxe, CLARISONIC recorded sales growth of +47.3%(1).

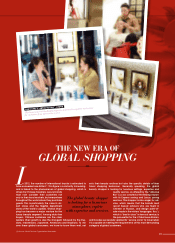

One of the ambitions of L’Oréal Luxe is to make each encounter be-

tween the brand and its customers a unique and memorable experience.

It considers this aspect of luxury as fundamental for ensuring future growth.

Visual communications at the point of sale and on e-commerce websites,

the quality of customer service, and the training and coaching of advisors

are all developed to this end. In 2012, the division created a Retail Depart-

ment to implement these standards, and to ensure brand coherence all

over the world. Several initiatives have been taken, such as the new counters

and the “Absolue Bar”, with its dedicated services at LANCÔME, the new point-

of-sale identities for YVES SAINT LAURENT and BIOTHERM, the HELENA RUBINSTEIN premium

service, the Privé spaces for GIORGIO ARMANI and the latest KIEHL’S stores. The

digital media experience is also an important focus. With +36%(1) growth in

2012, the luxury brands’ e-commerce sites alone offer customers state-of-

the-art features and a unique customer experience.

The KIEHL’S model becomes a reference

At KIEHL’S, the customer experience is one of the brand’s founding values. It

has created a highly original atmosphere and, thanks to its product advisors,

delivers customer service in line with its reputation for excellence. The KIEHL’S

model has become a textbook example at L’Oréal Luxe. Continuing its

remarkable international expansion, KIEHL’S is moving into Brazil and is growing

strongly in Japan, following successes in South Korea and China.

CLARISONIC

BOLD LEAPS FOR A SMALL BRUSH

A UNIQUE CUSTOMER

EXPERIENCE

PATENTED TECHNOLOGY

Thanks to CLARISONIC, L’Oréal Luxe holds

a strategic position in the market for sonic devices

and technology in skincare applications.

(1) Like-for-like. (2) Source: Distributor feedback, products data MTD panel, December 2012.

3838