Loreal 2012 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2012 Loreal annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNIVERSAL

BEAUTY

IS

WORLDWIDE

ADVANCES

FOR L’ORÉAL

In a market of contrasting trends but lively growth,

L’Oréal made the most of its rich brand portfolio and

the complementarity of its presence in all channels

and all regions of the world to strengthen its leadership.

L’Oréal once again outperformed the beauty market

and made market share gains: the group demon-

strated its ability both to strengthen its positions in the

New Markets(1), particularly in the Asia and Africa,

Middle East zones and to win new consumers in the

major mature countries, such as North America, France,

Germany and the United Kingdom.

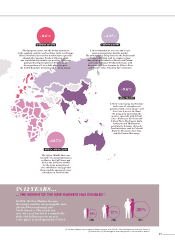

THE NEW MARKETS:

L’ORÉAL’S NUMBER ONE

GEOGRAPHIC ZONE

2012 also marked a milestone in L’Oréal’s internation-

alisation process, as the New Markets became the

group’s number one geographic zone in sales terms.

The group’s top 10 countries already include China

(3rd), Brazil (7th) and Russia (8th). This powerful dynamic is

fully in line with L’Oréal’s goal of winning one billion new

consumers over the next ten years.

NORTH AMERICA

The good results of 2011 were surpassed

in 2012. The Consumer Products Division

has become number one in its field

thanks to strong progress made by

GARNIER, MAYBELLINE NEW YORK

and ESSIE. The end of the year was

marked by the strategic launch of

L’Oréal Paris Advanced Hair Care.

L’Oréal Luxe outperformed its market,

notably thanks to CLARISONIC.

The Active Cosmetics Division

also significantly increased

its presence in drugstores.

+7.2%

(2)

LATIN AMERICA

In 2012, L’Oréal became the market leader

in Mexico and expanded its positions in Chile,

Argentina and Uruguay. L’Oréal stepped up

its roll-out in the countries of Central America

and in Colombia, with the acquisition of the VOGUE

brand, the mass market make-up leader there.

In Brazil, the initiatives of Elvive Arginine Resist,

hair oils, and hair colouration products led to an

improvement in position. The dynamic position of

Active Cosmetics in this zone is also worth noting.

+10.4%

(2)

IN 5 YEARS ...

... 9 NEW SUBSIDIARIES HAVE BEEN CREATED.

In its efforts to conquer a billion new consumers,

L’Oréal is developing new growth relays,

particularly through the opening of subsidiaries

in all parts of the world: in Europe (Bulgaria),

Africa (Kenya, Nigeria and Egypt), the Middle East

(Saudi Arabia), Asia (Kazakhstan, Pakistan

and Vietnam) and Latin America (Panama).

18