Logitech 2004 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2004 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Foreign Currency Exchange Rates

The Company is exposed to foreign currency exchange rate risk as it transacts business in multiple foreign

currencies, including exposure related to anticipated sales, anticipated purchases and assets and liabilities

denominated in currencies other than the U.S. dollar. Logitech transacts business in approximately 30 currencies

worldwide, of which the most significant to operations are the Euro, Taiwanese dollar, Swiss franc, Japanese yen

and Chinese renminbi yuan. With the exception of its operating subsidiaries in China, which use the U.S. dollar

as their functional currency, Logitech’s international operations generally use the local currency of the country as

their functional currency. Accordingly, unrealized foreign currency gains or losses resulting from the translation

of net assets denominated in foreign currencies to the U.S. dollar are accumulated in the cumulative translation

adjustment component of other comprehensive loss in shareholders’ equity.

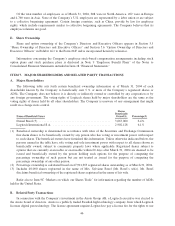

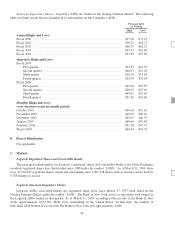

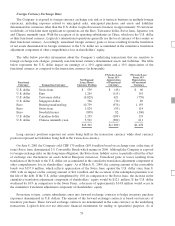

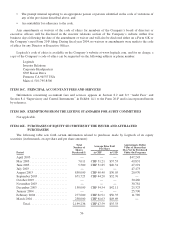

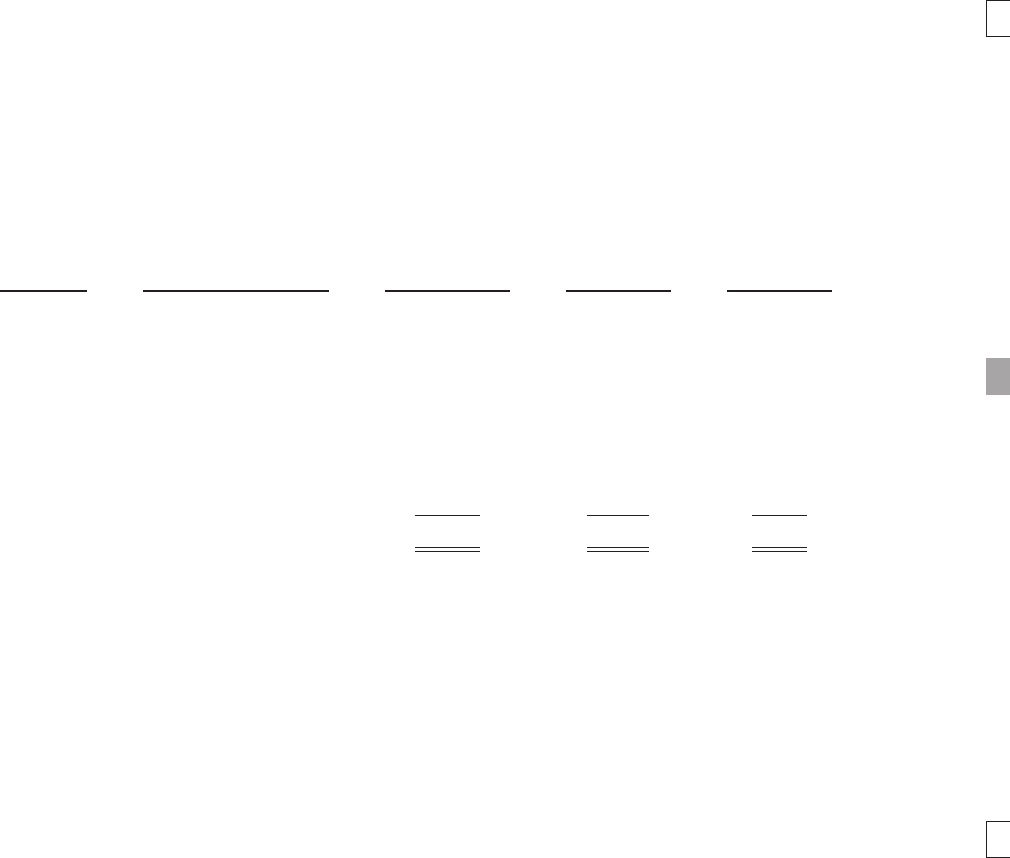

The table below provides information about the Company’s underlying transactions that are sensitive to

foreign exchange rate changes, primarily non-functional currency-denominated assets and liabilities. The table

below represents the U.S. dollar impact on earnings of a 10% appreciation and a 10% depreciation of the

functional currency as compared to the transaction currency (in thousands):

Functional

Currency Transaction Currency

Net Exposed

Long (Short)

Currency Position

FX Gain (Loss)

From 10%

Appreciation

of Functional

Currency

FX Gain (Loss)

From 10%

Depreciation

of Functional

Currency

U.S. dollar Swiss franc $ 539 $ (49) $ 60

U.S. dollar Euro 1,265 (115) 141

U.S. dollar Taiwanese dollar (6,829) 621 (759)

U.S. dollar Singapore dollar 766 (70) 85

Euro British pound sterling 10,739 (976) 1,193

Euro Swiss franc 1,024 (93) 114

Euro Swedish kroner (899) 82 (100)

U.S. dollar Canadian dollar 1,195 (109) 133

U.S. dollar Chinese renminbi yuan 5,501 (500) 611

$13,301 $(1,209) $1,478

Long currency positions represent net assets being held in the transaction currency while short currency

positions represent net liabilities being held in the transaction currency.

On June 8, 2001 the Company sold CHF 170 million ($95.6 million based on exchange rates at the time of

issue) Swiss franc denominated 1% Convertible Bonds which mature in 2006. Although the Company is exposed

to foreign exchange risks on this long-term obligation, the Swiss franc liability serves to partially offset the effect

of exchange rate fluctuations on assets held in European currencies. Unrealized gains or losses resulting from

translation of the bonds to the U.S. dollar are accumulated in the cumulative translation adjustment component of

other comprehensive loss in shareholders’ equity. As of March 31, 2004, the carrying amount of the convertible

bonds was $137.0 million, which reflects appreciation of the Swiss franc against the U.S. dollar since June 8,

2001 with an impact on the carrying amount of $41.4 million and the accretion of the redemption premium over

the life of the debt. If the U.S. dollar strengthened by 10% in comparison to the Swiss franc, the increase in the

cumulative translation adjustment component of shareholders’ equity would be $12.1 million. If the U.S. dollar

weakened by 10% in comparison to the Swiss Franc, a decrease of approximately $14.8 million would occur in

the cumulative translation adjustment component of shareholders’ equity.

From time to time, certain subsidiaries enter into forward exchange contracts to hedge inventory purchase

exposures denominated in U.S. dollars. The amount of the forward exchange contracts is based on forecasts of

inventory purchases. These forward exchange contracts are denominated in the same currency as the underlying

transactions. Logitech does not use derivative financial instruments for trading or speculative purposes. As of

53