Logitech 2004 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2004 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

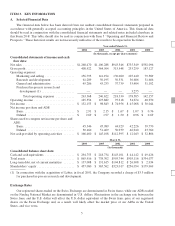

(1) Audit fees represent those fees incurred for the indicated fiscal year, regardless of when they were paid.

Audit fees include group and statutory audit fees as well as the reviews of Logitech’s quarterly reports on

Form 6-K.

(2) Audit-related fees represent services provided in implementing the various provisions of the Sarbanes-Oxley

Act and consultation on various accounting issues and potential acquisitions.

(3) Tax fees represent those fees incurred for tax compliance, assistance with tax audits, tax advice and tax

planning.

(4) All other fees represent services provided to Logitech for expatriate and other consulting services.

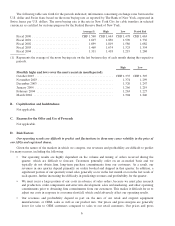

8.4 Supervisory and Control Instruments

The Company’s Audit Committee pre-approves all audit and non-audit services provided by its independent

auditors. This pre-approval must occur before the auditor is engaged. Audit services can be approved no more

than 6 months in advance of the services being performed. Services that last longer than a year must be re-

approved by the Audit Committee.

Logitech’s Audit Committee can delegate the pre-approval ability to a single independent member of the

Audit Committee. The delegate must communicate all services approved at the next scheduled Audit Committee

meeting. The Audit Committee or its delegate can pre-approve types of services to be performed by the auditors

with a set dollar limit per the type of service. The Chief Financial Officer is responsible for ensuring that the

work performed is within the scope and dollar limit as approved by the Audit Committee. Management must

report to the Audit Committee the status of each project or service provided by the auditors.

9. Information Policy

The Company reports its financial results quarterly with an earnings press release. In addition, the Company

informs its shareholders by means of an annual report, and informs the public by the means of press releases

upon occurrence of significant events within Logitech.

The Company has reporting requirements under Swiss law and the regulations of the SWX Swiss Exchange,

and to the United States Securities and Exchange Commission (“SEC”). The reports submitted to the SEC may

be downloaded from http://www.sec.gov.

Copies of the quarterly and annual SEC filings as well as press releases are available for download from the

Logitech Web site at www.logitech.com. For no charge, a copy of the Company’s filings can be requested via the

following address or phone number:

Logitech

Investor Relations

Corporate Headquarters

6505 Kaiser Drive

Fremont, CA 94555 USA

Main +1-510-795-8500

CG-23