Logitech 2004 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2004 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.8 million cordless products and 4 million webcams in fiscal 2002 alone. At the same time, the Company’s OEM

business was able to realize new opportunities for bundling higher value-added products, including cordless,

audio and optical devices, to compensate for the slumping PC market. The Company added new platforms to its

product portfolio while continuing to enrich the PC experience. After the successful launch of its force feedback

steering wheel for PlayStation®2 in fiscal 2001, the Company launched another highly popular PlayStation2

racing wheel to help strengthen its position in the console peripheral market. Also, the Company successfully

integrated the Labtec business (acquired in March 2001) into its existing operations and expanded the Labtec

brand to encompass additional product categories such as mice and webcams.

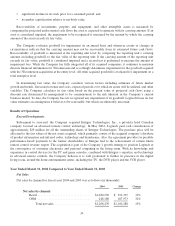

Moving into fiscal year 2003, the Company continued to deliver record results, reporting its fifth

consecutive year of record revenues and profitability despite a challenging technology market and a weak PC

industry. The Company reached an important milestone in fiscal 2003, reporting revenues of over $1 billion

during the fiscal year. Revenues during fiscal year 2003 grew 17% over the prior year, with net income

increasing 32% to $99 million. Logitech’s retail business increased 15% for the year, while OEM business grew

23%, as the Company continued to increase the number of products offered to traditional PC customers, as well

as to broaden its presence in the console peripheral market. The growth in revenue was partially attributable to

the strengthening Euro, as a significant portion of Logitech’s sales are denominated in currencies other than the

U.S. dollar. This benefit does not take into account the impact that currency fluctuations have on the Company’s

pricing strategy resulting in it lowering or raising selling prices in a currency in order to avoid disparity with U.S.

dollar prices and to respond to currency-driven competitive pricing actions. Also, the Company continued to

benefit from its acquisition of Labtec with solid growth in its core audio business and new market opportunities

with its line of mobile phone headsets. The Company remained focused on providing high quality products to its

customers and continued investment in research and development, while committed to maintaining its low-cost

structure. Also in fiscal 2003, the Company worked to manage supply chain and logistics issues resulting from

the consolidation of its North American distribution centers to a third party provider in Tennessee, further

complicated by a threatened dock strike on the west coast of North America; and invested in improving internal

processes to support its global operations.

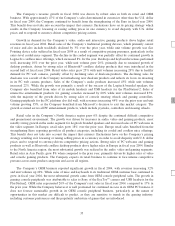

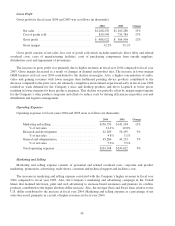

Fiscal year 2004 continued to be challenging for the industry and the Company. In the first quarter, the

Company experienced a decline in its profitability despite growth in revenues, primarily driven by competitive

pressures in select products that drove Logitech to lower product prices. The Company addressed these issues in

the beginning of the second quarter and focused on lower cost new products, cost reductions of existing products

and effective distribution and logistic management; and embarked on a marketing and advertising campaign to

increase brand awareness and promote the cordless connectivity of its products. As a result, Logitech continued

to report growth in revenues and profitability in fiscal year 2004, with revenues growing 15% to $1.3 billion and

net income of $132.2 million, a 34% increase over the prior year. The Company’s OEM business grew 32% over

the prior year, primarily driven by strong sales of its gaming console peripherals. Historically, the Company’s

OEM business was comprised of sales of pointing devices to PC manufacturers. While sales to its traditional

OEM customer base continued to grow in fiscal year 2004, the most substantial growth came from OEM console

peripheral sales. The Company’s retail business grew 12% over the prior year driven by strong sales growth of its

video, audio and gaming products. Despite flat growth in fiscal 2004 of its retail mice sales, Logitech’s business

grew in other retail market categories. The Company continued to be the market leader in the webcam category

and gained substantial market share in the PC audio segment. Also, the Company continued to benefit from the

strong Euro, as a significant portion of Logitech’s sales are denominated in currencies other than the U.S. dollar.

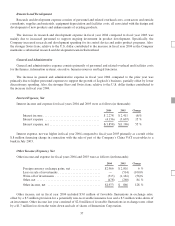

This benefit does not take into account the impact that currency fluctuations have on the Company’s pricing

strategy resulting in it lowering or raising selling prices in a currency in order to avoid disparity with U.S. dollar

prices and to respond to currency-driven competitive pricing actions. The Company’s commitment to

investments in research and engineering resulted in growth opportunities both in the expansion of its product

portfolio and sales growth of its existing product offerings. Finally, while confronted with shortages of certain

components during fiscal year 2004 that resulted in the carrying of buffer stock, the Company was able to

effectively manage working capital and generated record cash from operations of $166.5 million.

30