Logitech 2004 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2004 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

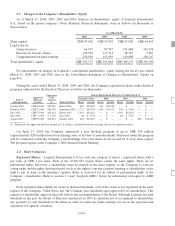

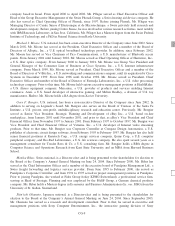

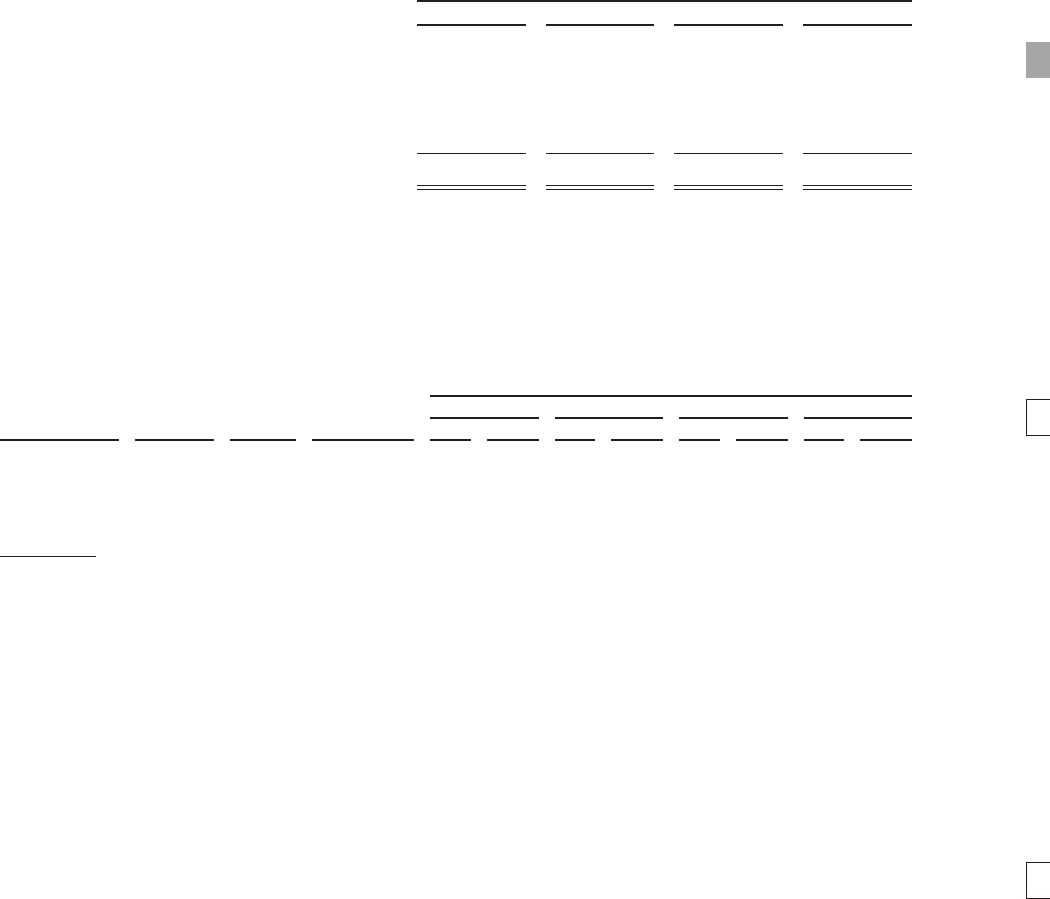

2.3 Changes in the Company’s Shareholders’ Equity

As of March 31, 2004, 2003, 2002 and 2001, balances in shareholders’ equity of Logitech International

S.A., based on the parent company’s Swiss Statutory Financial Statements, were as follows (in thousands of

Swiss francs):

As of March 31,

2004 2003 2002 2001

Share capital ............................. CHF47,902 CHF47,902 CHF47,902 CHF44,419

Legal reserves:

General reserve ....................... 66,319 87,597 151,468 142,474

Reserve for treasury shares ............. 136,590 115,313 28,515 5,967

Unappropriated retained earnings ........ 256,964 141,036 140,688 108,147

Total shareholders’ equity .................. CHF507,775 CHF 391,848 CHF 368,573 CHF 301,700

For information on changes in Logitech’s consolidated shareholders’ equity during the fiscal years ended

March 31, 2004, 2003 and 2002, refer to the Consolidated Statement of Changes in Shareholders’ Equity on

page F-6.

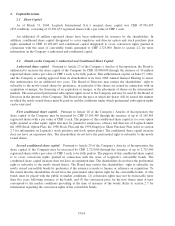

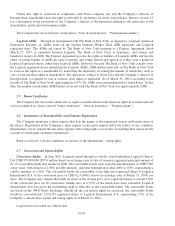

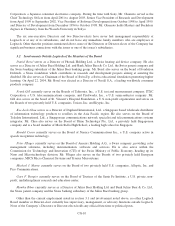

During the years ended March 31, 2004, 2003 and 2002, the Company repurchased shares under buyback

programs authorized by the Board of Directors as follows (in thousands):

Date of

Announcement

Approved

Buyback

Amount

Equivalent

USD

Amount

(1) Expiration Date

Amount Repurchased During Year Ended March 31,

Program to Date 2004 2003 2002

Shares Amount Shares Amount Shares Amount Shares Amount

October 2003 . . . CHF 40,000 $32,090 March 2004 665 $32,090 665 $32,090 — $ — — $ —

February 2003 . . . CHF 75,000 $54,728 September 2003 1,772 $54,728 1,534 $47,072 238 $ 7,656 — $ —

July 2002 ....... CHF75,000 $52,414 March 2003 1,510 $52,414 — $ — 1,510 $52,414 — $ —

June 2002 ...... CHF 6,000 $ 3,752 June2002 88 $ 3,752 — $ — 88 $ 3,752 — $ —

August 2001 .... CHF25,000 $15,043 October 2001 629 $15,043 — $ — — $ — 629 $15,043

(1) Represents the approved buyback amount in U.S. dollars, calculated based on exchange rates on the repurchase dates.

On April 15, 2004, the Company announced a new buyback program of up to CHF 250 million

(approximately $200 million based on exchange rates at the date of announcement). Purchases under the program

will be conducted so that the Company’s total holdings of its own shares do not exceed 10 % of its share capital.

The program expires at the Company’s 2006 Annual General Meeting.

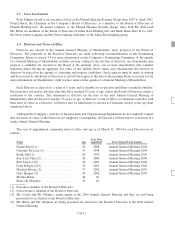

2.4 Share Categories

Registered Shares. Logitech International S.A. has only one category of shares – registered shares with a

par value of CHF 1 per share. Each of the 47,901,655 issued shares carries the same rights. There are no

preferential rights. However, a shareholder must be entered in the share register of the Company to exercise

voting rights and the rights deriving thereof (such as the right to convene a general meeting of shareholders or the

right to put an item on the meeting’s agenda). Refer to section 6 for an outline of participation rights of the

Company’s shareholders. Refer to section 1.1 and “Logitech ADRs” below for information on Logitech’s ADR

program.

Each registered share entitles its owner to declared dividends, even if the owner is not registered in the share

register of the Company. Under Swiss law, the Company pays dividends upon approval by its shareholders. This

request for shareholder approval typically follows the recommendation of the Board. Although Logitech has paid

dividends in the past, the Board of Directors announced in 1997 its intention not to recommend to shareholders

any payment of cash dividends in the future in order to retain any future earnings for use in the operation and

expansion of Logitech’s business.

CG-5