Logitech 2004 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2004 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

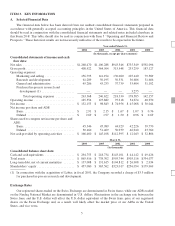

Principal Equity Investments

As of March 31, 2004, Logitech had equity investments in various technology companies totaling $16.2

million. During fiscal years 2004, 2003 and 2002, the Company made investments of $15.2 million, $.4 million

and $1.6 million, and sold or impaired investments amounting to $.5 million, $2.3 million and $4.3 million. The

Company accounts for its investments using the cost method.

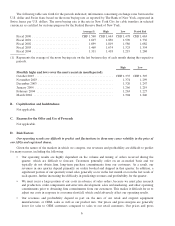

In July 2003, the Company made a $15 million cash investment in the Anoto Group AB (“Anoto”), which

represents approximately 10% of Anoto’s outstanding shares. In connection with this investment, a Logitech

executive was elected to the Anoto board of directors. Anoto is a publicly traded Swedish high technology

company from which Logitech licenses digital pen technology. The license agreement requires Logitech to pay a

license fee for the rights to use the Anoto technology and a license fee on the sales value of digital pen solutions

sold by Logitech. Also, the agreement includes non-recurring engineering (“NRE”) service fees primarily for

specific development and maintenance of Anoto’s licensed technology.

In March 2002 and September 2003, Logitech made cash investments in A4Vision, Inc. (“A4Vision”)

totaling $.8 million, which represents approximately 12% of A4Vision’s outstanding shares. In connection with

this investment, a Logitech executive was appointed to the A4Vision board of directors. A4Vision is a privately

held company from which Logitech licenses face tracking software. The license agreement requires Logitech to

pay a license fee based on the number of its products sold with A4Vision’s licensed software. Subsequent to

year-end, the Company increased its investment in A4Vision providing additional cash funding totaling $.4

million.

B. Business Overview

Company Overview

Logitech is a leader in the design, manufacture and marketing of personal interface products for personal

computers and other digital platforms. The Company’s product family includes webcams, mice, trackballs, and

keyboards for the PC; interactive gaming controllers, multimedia speakers and headsets for the PC and for

gaming consoles; mobile headsets; 3D control devices; and with its recent acquisition of Intrigue Technologies,

advanced remote controls.

Logitech offers rich and varied access to the world of digital information. The Company’s products provide

user-centric solutions intended to be easy to install and easy to use. Many of the products include integrated

software for seamless compatibility and added functionality. Logitech’s personal interface products are often the

most frequent point of physical interaction between people and the digital world. As such, they are a significant

factor in determining the man/machine interface and in increasing its richness. These products allow users to

personalize and enrich their computing environment, and to easily operate in a variety of applications. The

Company is committed to offering products that bring together the tools that business people, home users, and

computer gamers need to make their experience more effective, comfortable, and enjoyable. The Company’s

products are sold through a variety of channels, including consumer electronics retailers; mass merchandisers;

specialty electronics, computer and telecom stores; value added resellers; online merchants and OEMs.

The Company’s retail products increasingly target and appeal directly to consumers and businesses as they

purchase add-on devices for their PC or gaming console. Logitech’s products are purchased as add-ons for

enabling applications that require dedicated devices, including webcams, PC headsets, steering wheels and

joysticks for PC and console games. The products are also purchased to replace the basic peripherals that

originally came with the PC or game console with devices that offer increased comfort, flexibility and

functionality. Logitech’s OEM products are a frequent choice among PC manufacturers, who need high-quality,

affordable, and functional personal interface products in high volumes.

15