Logitech 2004 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2004 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

periods would not be charged to the Company. The Company believes the ultimate resolution of this matter will

not have a material adverse effect on the Company’s financial position, results of operations or cash flows.

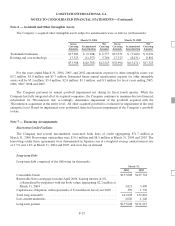

In the normal course of business, the Company pays value-added taxes, or VAT, in China on components

purchased in China, which are refunded after export of goods manufactured in China. The Company files for

refunds, receives approvals from Chinese tax officials and then receives a refund. Beginning in early fiscal year

2002, approval and refund delays started to occur and the Company had accumulated a significant VAT refund

receivable. In March 2003, a portion of the VAT receivable was sold to a bank on a non-recourse basis for a

negotiated discount. The government has since refunded all amounts related to the Company’s calendar 2002

claims, a portion of which was sold to the bank. The Company has received assurances from the Chinese officials

that all approved claims will be paid in full and expects to receive refunds for its calendar 2003 claims by the end

of the second quarter of fiscal year 2005.

The total VAT receivable may increase or decrease in the future depending on the amount of component

purchases in China, the amount of collections from the Chinese government and the amount of VAT that the

Company may be able to sell on a non-recourse basis to a bank in the future. Based on expectations as to the

timing of such payments, the Company has classified a portion of the VAT receivable as a non-current asset. The

Company does not expect the outcome of this matter to have a significant impact on the Company’s financial

position, results of operations or cash flows.

The Company is involved in a number of lawsuits relating to patent infringement and intellectual property

rights. The Company believes the lawsuits are without merit and intends to defend against them vigorously.

However, there can be no assurances that the defense of any of these actions will be successful, or that any

judgment in any of these lawsuits would not have a material adverse impact on the Company’s business,

financial condition and result of operations.

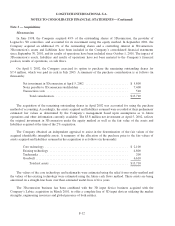

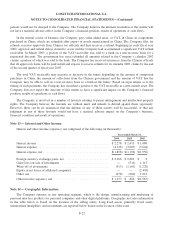

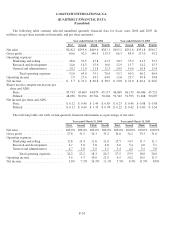

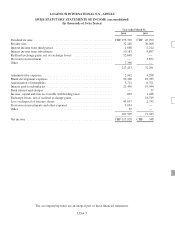

Note 13 — Interest and Other Income:

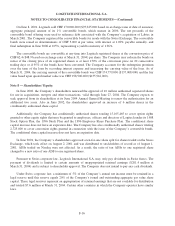

Interest and other income (expense), net comprised of the following (in thousands):

Year ended March 31,

2004 2003 2002

Interest income .............................................. $2,278 $2,411 $1,688

Interest expense ............................................. (4,136) (3,607) (3,644)

Interest expense, net .......................................... $(1,858) $(1,196) $(1,956)

Foreign currency exchange gains, net ............................ $2,966 $2,801 $ 2

Gain (loss) on sale of investments ............................... — (514) 1,115

Write-off of investments ...................................... (515) (1,161) (1,220)

Equity in net losses of affiliated companies ........................ — — (2,476)

Other,net .................................................. (478) (260) 1,012

Other income (expense), net ................................... $1,973 $ 866 $(1,567)

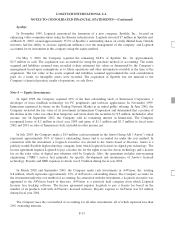

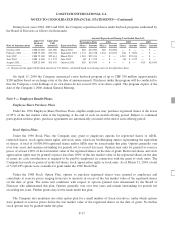

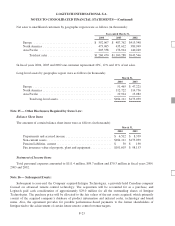

Note 14 — Geographic Information:

The Company operates in one operating segment, which is the design, manufacturing and marketing of

personal interface products for personal computers and other digital platforms. Geographic net sales information

in the table below is based on the location of the selling entity. Long-lived assets, primarily fixed assets,

unamortized intangibles, and investments are reported below based on the location of the asset.

F-22