Logitech 2004 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2004 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Any of these and other factors could prevent us from realizing the anticipated benefits of the acquisition and

could adversely affect our business and operating results. Further, the acquisition will result in the recording of

other intangible assets for Intrigues’ brand name, technology and database of product information and infrared

codes, which would result in amortization expense. Also, the acquisition would result in the recording of

goodwill, which could result in potential impairment charges, which could adversely affect our operating results.

Acquisitions are inherently risky, and no assurance can be given that our acquisition of Intrigue will be

successful and will not adversely affect business, operating results or financial condition.

ITEM 4. INFORMATION ON THE COMPANY

A. History and Development of the Company

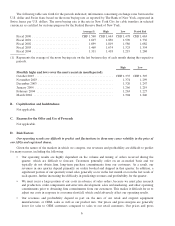

Logitech International S.A. was incorporated under the laws of Switzerland in 1981, and in 1988, the

Company listed its shares in an initial public offering in Switzerland. In March 1997, the Company sold

4,000,000 registered shares from treasury in a U.S. initial public offering in the form of 4,000,000 American

Depositary Shares (ADSs), which were listed on the Nasdaq National Market. Logitech maintains its corporate

headquarters through its U.S. subsidiary located at 6505 Kaiser Drive, Fremont, California. The Company’s

telephone number there is (510) 795-8500. The Company also maintains regional headquarters through local

subsidiaries in Romanel, Switzerland, Hsinchu, Taiwan, and Hong Kong, China. In addition, Logitech has

manufacturing operations in China, with distribution facilities in the United States, Europe and Asia, and sales

offices in major cities in the United States, Europe and Asia.

Important Events

In September 1998, the Company acquired the QuickCam

®

PC video camera business of Connectix

Corporation for $26.2 million, including closing and other transaction costs. The acquisition was consistent with

the Company’s strategy to pursue new areas of growth and enter the PC video camera market. The Connectix

business has been integrated into the Company’s video division. The acquisition allowed the Company to take

advantage of the new technologies in digital imaging and the growth of the market for PC video cameras. With the

success of its line of PC video cameras, the Company has emerged as a market leader in this product category.

In March 2001, Logitech acquired Labtec Inc., a publicly traded provider of PC speakers, headsets and

microphones based in Vancouver, Washington, for $73 million in cash and stock, and $3.3 million in transaction

costs. The acquisition strengthened Logitech’s market presence in the audio interface space and furthered its

strategy to move the Company beyond the PC platform and into markets such as mobile telephony. The

Company successfully integrated the Labtec business into its ongoing processes and has expanded the Labtec

brand to encompass additional product categories such as mice and web cameras.

Subsequent to year-end, the Company acquired Intrigue Technologies, Inc., a privately held Canadian

company focused on advanced remote control technology. Logitech paid cash consideration of approximately

$29 million for all the outstanding shares of Intrigue Technologies. The purchase price will be allocated to the

fair values of the net assets acquired, which primarily consist of the acquired company’s database of product

information and infrared codes, technology and brand name. Also, the agreement provides for possible

performance-based payments to the former shareholders of Intrigue tied to the achievement of certain future

remote control revenue targets. The acquisition is part of the Company’s growth strategy to position Logitech at

the convergence of consumer electronics and personal computing in the living room. With its knowledge and

experience in control devices for the PC and game consoles, combined with Intrigue’s expertise and know-how

in advanced remote control technology, the Company believes it is well positioned to further its presence in the

digital living room.

Principal Capital Expenditures

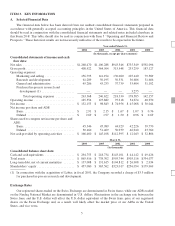

Logitech’s capital expenditures for property, plant and equipment for fiscal years 2004, 2003 and 2002 were

$24.7 million, $28.7 million and $21.9 million. Principal areas of investment during those years related to normal

expenditures for tooling costs, machinery and equipment and computer equipment and software.

14