Logitech 2004 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2004 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

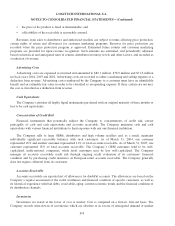

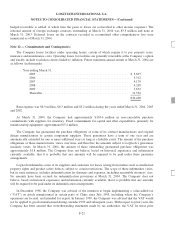

Note 6 — Goodwill and Other Intangible Assets:

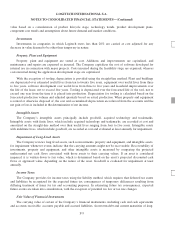

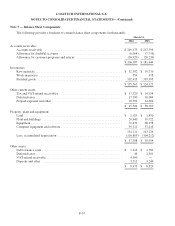

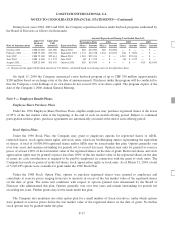

The Company’s acquired other intangible assets subject to amortization were as follows (in thousands):

March 31, 2004 March 31, 2003

Gross

Carrying

Amounts

Accumulated

Amortization

Net

Carrying

Amount

Gross

Carrying

Amounts

Accumulated

Amortization

Net

Carrying

Amount

Trademark/tradename ................. $15,985 $ (9,208) $ 6,777 $15,671 $ (7,040) $ 8,631

Existing and core technology ........... 17,323 (11,557) 5,766 17,323 (8,431) 8,892

$33,308 $(20,765) $12,543 $32,994 $(15,471) $17,523

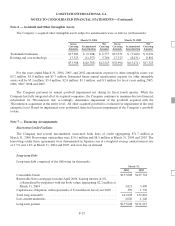

For the years ended March 31, 2004, 2003, and 2002 amortization expense for other intangible assets was

$5.2 million, $5.0 million and $3.7 million. Estimated future annual amortization expense for other intangible

assets will be $5.1 million, $3.4 million, $2.6 million, $1.1 million, and $.3 million for fiscal years ending 2005,

2006, 2007, 2008 and 2009.

The Company performs its annual goodwill impairment test during its fiscal fourth quarter. While the

Company has fully integrated all of its acquired companies, the Company continues to maintain discrete financial

information for 3Dconnexion and, accordingly, determines impairment of the goodwill acquired with the

3Dconnexion acquisition at the entity level. All other acquired goodwill is evaluated for impairment at the total

enterprise level. Based on impairment tests performed, there has been no impairment of the Company’s goodwill

to date.

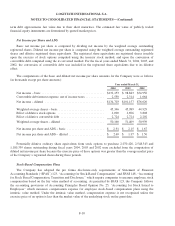

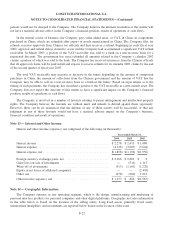

Note 7 — Financing Arrangements:

Short-term Credit Facilities

The Company had several uncommitted, unsecured bank lines of credit aggregating $71.7 million at

March 31, 2004. Borrowings outstanding were $10.1 million and $8.9 million at March 31, 2004 and 2003. The

borrowings under these agreements were denominated in Japanese yen at a weighted average annual interest rate

of 1.3% and 1.4% at March 31, 2004 and 2003, and were due on demand.

Long-term Debt

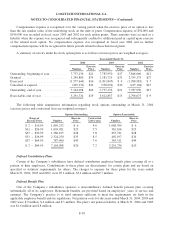

Long-term debt comprised of the following (in thousands):

March 31,

2004 2003

Convertible bonds ................................................. $137,008 $127,722

Renewable Swiss mortgage loan due April 2004, bearing interest at 4%,

collateralized by properties with net book values aggregating $2.2 million at

March 31, 2004 ................................................. 3,621 3,409

Capital lease obligation, with repayments of $.4 million in fiscal year 2005 .... 399 1,730

Total long-term debt ............................................... 141,028 132,861

Less current maturities ............................................. 4,020 1,246

Long-term portion ................................................. $137,008 $131,615

F-15