JVC 2006 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2006 JVC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54 Victor Company of Japan, Limited

DERIVATIVE FINANCIAL INSTRUMENTS

The Companies use derivative financial instruments in the normal course of their business to manage the exposure

to fluctuations in foreign exchange rates and interest rates. The primary classes of derivatives used by the

Company and its consolidated subsidiaries are forward exchange contracts, currency option contracts and interest

rate swap contracts.

The Company and certain of its overseas subsidiaries have established regulations for financial transactions that

specify the persons with approval authority for derivative transactions. These derivative transactions are executed

and managed by the Company’s accounting department and the member of the Board of Directors in charge of

finance. The results of all such transactions are reported to the Director in charge of finance.

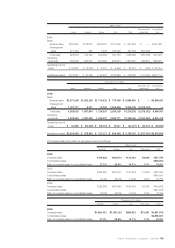

The following summarizes hedging derivative financial instruments used by the Companies and items hedged:

Hedging instruments: Hedged items:

Forward exchange contracts and currency Foreign currency trade receivables and trade

option contracts payables, future transaction denominated

Interest rate swap contracts in a foreign currency

Interest on bonds

The Companies evaluate hedge effectiveness by comparing the cumulative changes in cash flows from or the

changes in fair value of hedged items and the corresponding changes in the hedging derivative instruments.

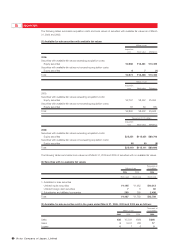

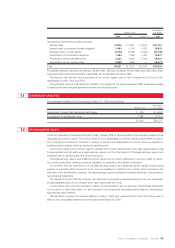

The following tables summarize fair value information as of March 31, 2005 of derivative transactions for which

hedge accounting has not been applied:

Millions of yen

Contract Fair Recognized

March 31, 2005 amount value gain (loss)

Swap contracts:

Receive floating/pay fixed ¥7,159 ¥98 ¥98

The fair value of interest swap contracts is estimated based on the quotes obtained from financial institutions.

As the Companies applied hedge accounting to all derivatives in 2006, market value information for 2006 is not

disclosed.

13