JVC 2006 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2006 JVC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Victor Company of Japan, Limited 51

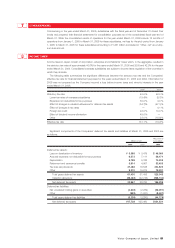

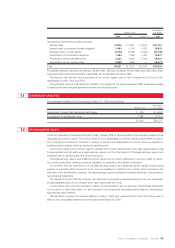

OTHER EXPENSES

Commencing in the year ended March 31, 2006, subsidiaries with the fiscal year-end of December 31 closed their

books and prepared their financial statements for consolidation purposes as of the consolidated fiscal year-end of

March 31. While the consolidated results of operations for the year ended March 31, 2006 include 15 months of

operations from January 1, 2005 to March 31, 2006 for these subsidiaries, net loss for the stub period from January

1, 2005 to March 31, 2005 for these subsidiaries amounting to ¥1,451 million is included in “Other, net” as a lump-

sum loss amount.

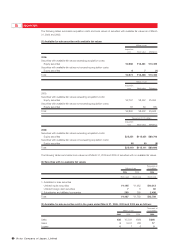

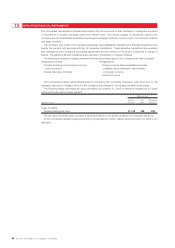

INCOME TAXES

Income taxes in Japan consist of corporation, enterprise and inhabitants’ taxes which, in the aggregate, resulted in

the statutory tax rates of approximately 40.6% for the years ended March 31, 2006 and 2005 and 42.0% for the year

ended March 31, 2004. Consolidated overseas subsidiaries are subject to income taxes regulation of the countries in

which they domicile.

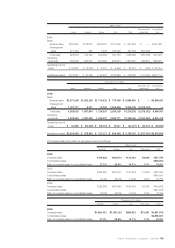

The following table summarizes the significant differences between the statutory tax rate and the Companies’

effective tax rate for financial statement purposes for the years ended March 31, 2005 and 2004. Information for

2006 was not prepared as the Company incurred a loss before income taxes and minority interests in the year

ended March 31, 2006.

2005 2004

Statutory tax rate: 40.6)%42.0)%

Lower tax rates of overseas subsidiaries (19.4)% (8.7)%

Expenses not deductible for tax purposes 50.0)%4.9)%

Effect of changes in valuation allowance for deferred tax assets (34.7)% (47.1)%

Effect of changes in tax rates —)% 4.1)%

Foreign tax credit 22.0)%10.0)%

Effect of dividend income elimination 49.6)%—))%

Other 23.0)%(18.9)%

Effective tax rate 131.1)%(13.7)%

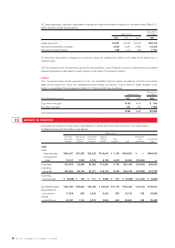

Significant components of the Companies’ deferred tax assets and liabilities at March 31, 2006 and 2005 are

as follows:

Thousands of

Millions of yen U.S. dollars

2006 2005 2006

Deferred tax assets:

Loss on devaluation of inventory ¥05,389 ¥03,479 $046,060

Accrued expenses not deductible for tax purposes 6,572 7,111 56,171

Depreciation 8,799 9,186 75,205

Retirement and severance benefits 3,914 4,907 33,453

Tax loss carryforwards 27,486 16,538 234,923

Other 9,270 10,274 79,231

Total gross deferred tax assets 61,430 51,495 525,043

Valuation allowance (38,463) (22,745) (328,744)

Net deferred tax assets 22,967 28,750 196,299

Deferred tax liabilities:

Net unrealized holding gains on securities (4,246) (2,269) (36,291)

Other (993) (1,021) (8,487)

Total gross deferred tax liabilities (5,239) (3,290) (44,778)

Net deferred tax assets ¥17,728 ¥25,460 $151,521

8

7

Victor Company of Japan, Limited 51