Garmin 2010 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2010 Garmin annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

81

The Company recognized a $29,615 deferred tax asset during 2010 for the future tax benefit of the fair market

value step-up in basis of intangible assets related to the redomestication to Switzerland and local statutory tax

reporting requirements. The deferred tax asset was recognized as an increase to Additional Paid-In Capital in

2010.

At December 25, 2010, the Company had $48,784 million of tax credit carryover which includes $46,234

of Taiwan surtax credit with no expiration. There is a full valuation allowance for the Taiwan surtax credits.

Additionally, the Company had $479 in Taiwan investment credit which will expire in 2012. The valuation

allowance increased by $15,735 during 2010 including $12,109 related to Taiwan surtax credits.

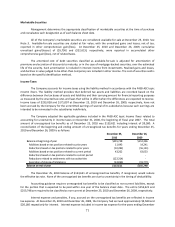

7. Fair Value of Financial Instruments

As required by the Financial Instruments topic of the FASB ASC, the following summarizes required

information about the fair value of certain financial instruments for which it is currently practicable to estimate

such value. None of the financial instruments are held or issued for trading purposes. The carrying amounts and

fair values of the Companys fiaial istuets ae as follos:

Carrying Fair Carrying Fair

Amount Value Amount Value

Cash and cash equivalents $1,260,936 $1,260,936 $1,091,581 $1,091,581

Restricted cash 1,277 1,277 2,047 2,047

Marketable securities 801,819 801,819 766,047 766,047

December 26, 2009

December 25, 2010

Fo etai of the Copas fiaial istuets, iludig aouts eeiale, aouts paale ad othe

accrued liabilities, the carrying amounts approximate fair value due to their short maturities.

8. Segment Information

The Company operates within its targeted markets through four reportable segments, those being related

to products sold into the marine, automotive/mobile, outdoor/fitness, and aviation markets. For external reporting

purposes, we aggregate operating segments which have similar economic characteristics, products, production

processes, types or classes of customers and distribution methods into reportable segments. All of the Copas

reportable segments offe poduts though the Copas etok of idepedet deales ad distiutos as

ell as though OEMs. Hoee, the atue of poduts ad tpes of ustoes fo the fou reportable segments

a sigifiatl. The Copas aie, autootie/oile, and outdoor/fitness segments include portable

global positioning system (GPS) receivers and accessories sold primarily to retail outlets. These products are

podued piail the Copas susidia i Taia. The Copas aiatio poduts ae portable and

panel mount avionics for Visual Flight Rules and Instrument Flight Rules navigation and are sold primarily to

aviation dealers and certain aircraft manufacturers.

The Copas Chief Eeutie Offie has ee idetified as the Chief Opeatig Decision Maker

(CODM). The CODM evaluates performance and allocates resources based on income before income taxes of each

segment. Income before income taxes represents net sales less operating expenses including certain allocated

general and administrative costs, interest income and expense, foreign currency adjustments, and other non-

operating corporate expenses. The accounting policies of the reportable segments are the same as those described

in the summary of significant accounting policies. There are no inter-segment sales or transfers.