Garmin 2010 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2010 Garmin annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.68

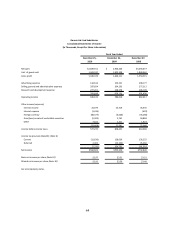

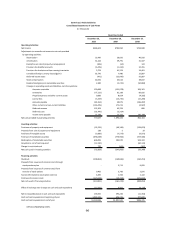

GARMIN LTD. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(In Thousands, Except Share and Per Share Information)

December 25, 2010 and December 26, 2009

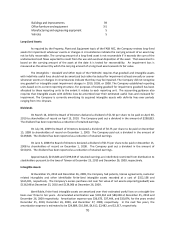

1. Description of the Business

Gai Ltd. ad susidiaies togethe, the Copa aufatue, aket, ad distiute Gloal

Positioning System-enabled products and other related products. Garmin Corporation (GC), wholly-owned by

Gai Ltd., is piail esposile fo the aufatuig ad distiutio of the Copas poduts to Gai

International, Inc. (GII), a wholly-owned subsidiary of GC, and Garmin (Europe) Limited (GEL), a wholly-owned

subsidiary of Garmin Ltd., and, to a lesser extent, new product development and sales and marketing of the

Copas poduts i Asia ad the Fa East. GII is piail esposile fo sales ad aketig of the Copas

products in many international markets and in the United States as well as research and new product

deelopet. GII also aufatues etai poduts fo the Copas aiatio seget. GEL is esposile fo

sales ad aketig of the Copas poduts, piipall ithi the Euopea aket.

2. Summary of Significant Accounting Policies

Basis of Presentation and Principles of Consolidation

The accompanying consolidated financial statements have been prepared in accordance with accounting

principles generally accepted in the United States. The accompanying consolidated financial statements reflect the

accounts of Garmin Ltd. and its wholly owned subsidiaries. All significant inter-company balances and transactions

have been eliminated.

Fiscal Year

The Company has adopted a 52–53-week period ending on the last Saturday of the calendar year. Due to

the fact that there are not exactly 52 weeks in a calendar year and there is slightly more than one additional day

per year (not including the effects of leap year) in each calendar year as compared to a 52-week fiscal year, the

Company will have a fiscal year comprising 53 weeks in certain fiscal years, as determined by when the last

Saturday of the calendar year occurs.

In those resulting fiscal years that have 53 weeks, the Company will record an extra week of sales, costs,

and related financial activity. Therefore, the financial results of those fiscal years, and the associated 14-week

fourth quarter, will not be entirely comparable to the prior and subsequent 52-week fiscal years and the

associated quarters having only 13 weeks. Fiscal 2010, 2009, and 2008 included 52 weeks.

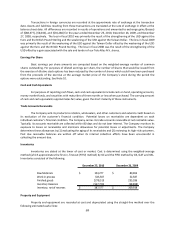

Foreign Currency Translation

Many Garmin Ltd. subsidiaries utilize currencies other than the United States Dollar (USD) as their

functional currency. As required by the Foreign Currency Matters topic of the Financial Accounting Standards

Board (FASB) Accounting Standards Codification (ASC), the financial statements of these subsidiaries for all periods

presented have been translated into USD, the functional currency of Garmin Ltd., and the reporting currency

herein, for purposes of consolidation at rates prevailing during the year for sales, costs, and expenses and at end-

of-year rates for all assets and liabilities. The effect of this translation is recorded in a separate component of

stokholdes euit. Cuulatie taslatio adjustets of $61,740 and $9,231 as of December 25, 2010 and

December 26, 2009, respectively, have been included in accumulated other comprehensive gain/(loss) in the

accompanying consolidated balance sheets.