Garmin 2010 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2010 Garmin annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

dividend was increased to $1.50 per share. Stock repurchases are made at the discretion of management under

repurchase programs approved by the Board of Directors as business and market conditions warrant. In 2010,

2009 and 2008, the Company repurchased 7.4 million shares, 0.7 million shares and 17.1 million shares,

respectively.

We currently use cash flow from operations to fund our capital expenditures, to support our working

capital requirements, to pay dividends and to repurchase shares. We expect that future cash requirements will

principally be for capital expenditures, working capital, repurchase of shares, payment of dividends declared, and

the funding of strategic acquisitions.

We believe that our existing cash balances and cash flow from operations will be sufficient to meet our

projected capital expenditures, working capital and other cash requirements at least through the end of fiscal

2011.

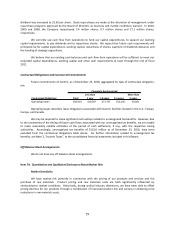

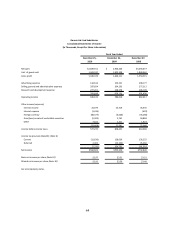

Contractual Obligations and Commercial Commitments

Future commitments of Garmin, as of December 25, 2010, aggregated by type of contractual obligation,

are:

Payments due by period

Less than More than

Contractual Obligations Total 1 year 1-3 years 3-5 years 5 years

Operating Leases $44,920 $10,397 $17,737 $12,205 $4,581

Operating leases describes lease obligations associated with Garmin facilities located in the U.S., Taiwan,

Europe, and Canada.

We may be required to make significant cash outlays related to unrecognized tax benefits. However, due

to the uncertainty of the timing of future cash flows associated with our unrecognized tax benefits, we are unable

to make reasonably reliable estimates of the period of cash settlement, if any, with the respective taxing

authorities. Accordingly, unrecognized tax benefits of $153.6 million as of December 25, 2010, have been

excluded from the contractual obligations table above. For further information related to unrecognized tax

benefits, see Note 2, Ioe Taes, to the osolidated fiaial stateets iluded i this Repot.

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

Market Sensitivity

We have market risk primarily in connection with the pricing of our products and services and the

purchase of raw materials. Product pricing and raw materials costs are both significantly influenced by

semiconductor market conditions. Historically, during cyclical industry downturns, we have been able to offset

pricing declines for our products through a combination of improved product mix and success in obtaining price

reductions in raw materials costs.