Garmin 2010 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2010 Garmin annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

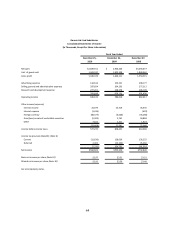

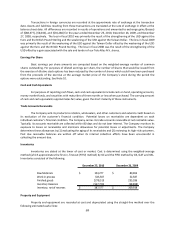

65

Garmin Ltd. And Subsidiaries

Consolidated Statements of Stockholders' Equity

(In Thousands, Except Share and Per Share Information)

Accumulated

Additional Other

Common Stock Paid-In Treasury Retained Comprehensive

Shares Dollars Capital Stock Earnings Gain/(Loss) Total

Balance at December 29, 2007 216,980 $1,086 $132,264 $0 $2,171,134 $46,130 $2,350,614

Net income – – – – 732,848 –732,848

Translation adjustment – – (3,053) –(1,595) (14,991) (19,639)

Adjustment related to unrealized

gains (losses) on available-for-sale

securities, net of income tax effects

of $150 – – – – – (68,790) (68,790)

Comprehensive income 644,419

Dividends paid – – – – (150,251) –(150,251)

Tax benefit from exercise of employee

stock options – – 2,143 – – – 2,143

Issuance of common stock from

exercise of stock options 158 2 2,873 – – – 2,875

Stock compensation – – 38,872 – – – 38,872

Purchase and retirement of

common stock (17,138) (86) (182,128) –(489,633) –(671,847)

Issuance of common stock through

stock purchase plan 363 –9,029 – – – 9,029

Balance at December 27, 2008 200,363 $1,002 $0 $0 $2,262,503 ($37,651) $2,225,854

Net income – – – – 703,950 –703,950

Translation adjustment – – – – – 24,537 24,537

Adjustment related to unrealized

gains (losses) on available-for-sale

securities, net of income tax effects

of $676 – – – – – (268) (268)

Comprehensive income 728,219

Dividends paid – – – – (149,846) –(149,846)

Tax benefit from exercise of employee

stock options – – 1,366 – – – 1,366

Issuance of common stock from

exercise of stock options 409 3 3,781 – – – 3,784

Stock compensation – – 43,616 – – – 43,616

Purchase and retirement of

common stock (708) (4) (20,254) – – – (20,258)

Issuance of common stock through

stock purchase plan 210 –3,712 – – – 3,712

Balance at December 26, 2009 200,274 $1,001 $32,221 $0 $2,816,607 ($13,382) $2,836,447

Net income – – – – 584,603 –584,603

Translation adjustment – – – – – 52,509 52,509

Adjustment related to unrealized gains

(losses) on available-for-sale securities

net of income tax effects of $348 – – – – – 16,877 16,877

Comprehensive income 653,989

Dividends paid – – – – (298,853) –(298,853)

Tax benefit from exercise of employee

stock options – – 4,495 – – – 4,495

Issuance of common stock from

exercise of stock options 928 2 (867) 10,330 – – 9,465

Stock compensation – – 40,332 – – – 40,332

Purchase and retirement of

common stock (prior to June 27, 2010) (6,844) (16) (67,528) –(41,296) –(108,840)

Purchase of treasury stock – – – (117,088) – – (117,088)

Impact of redomestication on par value

of common shares –1,796,448 – – (1,796,448) ––

Deferred tax impact of redomestication – – 29,615 – – – 29,615

Balance at December 25, 2010 194,358 $1,797,435 $38,268 ($106,758) $1,264,613 $56,004 $3,049,562

See accompanying notes.