Garmin 2010 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2010 Garmin annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

79

In the normal course of business, the Company and its subsidiaries are parties to various legal claims,

actions, and complaints, including matters involving patent infringement and other intellectual property claims and

various other risks. It is not possible to predict with certainty whether or not the Company and its subsidiaries will

ultimately be successful in any of these legal matters, or if not, what the impact might be. However, the

Copas aageet does ot epet that the esults i a of these legal poeedigs ill hae a ateial

adese effet o the Copas esults of opeatios, fiaial positio or cash flows.

5. Employee Benefit Plans

GII sponsors a defined contribution employee retirement plan under which its employees may contribute

up to 50% of their annual compensation subject to Internal Revenue Code maximum limitations and to which GII

otiutes a speified peetage of eah patiipats aual opesatio up to etai liits as defied i the

Plan. Additionally, GEL has a defined contribution plan under which its employees may contribute up to 7.5% of

their annual compensation. Both GII and GEL contribute an amount determined annually at the discretion of the

Board of Directors. During the years ended December 25, 2010, December 26, 2009, and December 27, 2008,

expense related to these plans of $17,952, $16,399, and $14,927 was charged to operations.

Cetai of the Copas foeig susidiaies patiipate i loal defied eefit pesio plas.

Contributions are calculated by formulas that consider final pensionable salaries. Neither obligations nor

contributions for the years ended December 25, 2010, December 26, 2009, and December 27, 2008, were

significant.

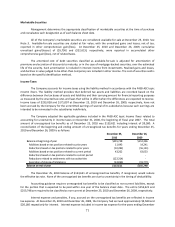

6. Income Taxes

The Copas ioe ta poisio eefit osists of the folloig:

December 25, December 26, December 27,

2010 2009 2008

Federal:

Current ($46,674) $104,186 $90,655

Deferred 284 (12,021) 23,639

(46,390) 92,165 114,294

State:

Current 3,929 5,381 1,318

Deferred (257) (947) 1,090

3,672 4,434 2,408

Foreign:

Current 31,109 18,469 44,279

Deferred 4,278 (10,367) 20,537

35,387 8,102 64,816

Total ($7,331) $104,701 $181,518

Fiscal Year Ended

The income tax provision differs from the amount computed by applying the statutory federal income tax

rate to income before taxes. The sources and tax effects of the differences, including the impact of establishing tax

contingency accruals, are as follows: