Food Lion 2007 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2007 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

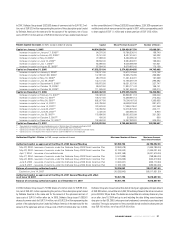

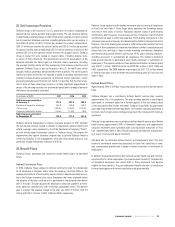

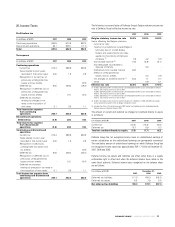

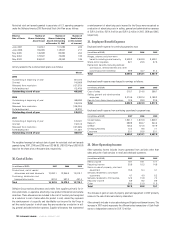

The asset portfolio of Delhaize Belgium’s defined benefit pension plan is funded

through a group insurance program. The plan assets, which benefit from a

guaranteed minimum return, are part of the insurance company’s overall investment.

The insurance company’s asset allocation was as follows:

December 31,

2007 2006 2005

Equities 12% 12% 10%

Debt 70% 69% 64%

Real estate 3% 4% 8%

Other assets 15% 15% 18%

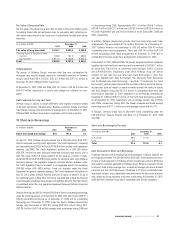

In 2008, Delhaize Belgium expects to contribute EUR 6.9 million to the defined

benefit pension plan.

The expected long-term rate of return for Delhaize Belgium’s defined benefit pen-

sion plan is based on the guaranteed return by the insurance company and the

expected insurance dividend.

The investment policy for the Hannaford defined benefit plan is to maintain a

targeted balance of equity securities, debt securities and cash equivalents in its

portfolio. The portfolio is re-balanced periodically through the year.

The plan’s asset allocation was as follows:

December 31,

2007 2006 2005

Equities 78% 73% 72%

Debt 18% 23% 26%

Cash equivalents 4% 4% 2%

The funding policy for the Hannaford defined benefit plan has been generally to

contribute the minimum required contribution and additional deductible amounts

at the sponsor’s discretion. In 2008, Delhaize Group expects to make pension

contributions, including voluntary amounts, of up to USD 6.0 million (EUR 4.3

million).

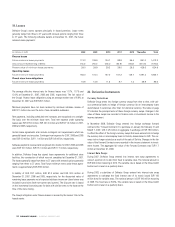

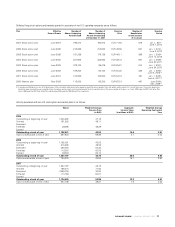

(in millions of EUR)

2007

2006 2005

United Plans Outside Total United Plans Outside Total United Plans Outside Total

States of the United States of the United States of the United

Plans States Plans States Plans States

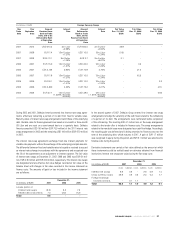

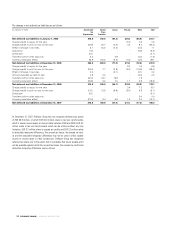

History of experience gains and losses:

Related to plan assets 0.3 (0.1) 0.2 (4.4) 0.3 (4.1) 0.6 0.6 1.2

Percentage of plan assets 0.30% -0.14% 0.13% -5.10% 0.44% -2.73% 0.68% 1.01% 0.85%

Related to plan liabilities 0.7 0.1 0.8 (2.7) 1.0 (1.7) 0.5 11.7 12.2

Percentage of plan liabilities 0.63% 0.09% 0.37% -2.48% 0.84% -0.76% 0.45% 10.22% 5.18%

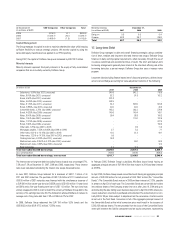

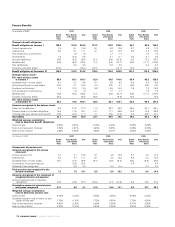

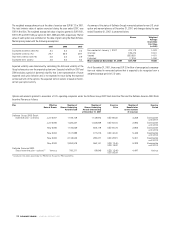

(in millions of EUR)

2007

2006 2005

United Plans Outside Total United Plans Outside Total United Plans Outside Total

States of the United States of the United States of the United

Plans States Plans States Plans States

Balance sheet reconciliation:

Balance sheet liability at January 1 24.1 50.5 74.6 39.5 54.3 93.8 29.5 38.9 68.4

Pension expense recognized in the

income statement in the year 7.3 7.8 15.1 8.5 6.8 15.3 7.5 6.8 14.3

Amounts recognized in the statement of

recognized income and expense in

the year (0.3) (9.4) (9.7) (10.5) (4.1) (14.6) 5.6 15.9 21.5

Employer contributions made in the

year (7.3) (8.6) (15.9) (9.6) (5.7) (15.3) (7.6) (6.5) (14.1)

Benefits paid directly by company

in the year (0.2) (1.4) (1.6) (0.2) (0.8) (1.0) (0.3) (0.8) (1.1)

Currency translation effect (2.5) - (2.5) (3.6) - (3.6) 4.8 - 4.8

Balance sheet liability at December 31 21.1 38.9 60.0 24.1 50.5 74.6 39.5 54.3 93.8

DELHAIZE GROUP / ANNUAL REPORT 2007 91