Food Lion 2007 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2007 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

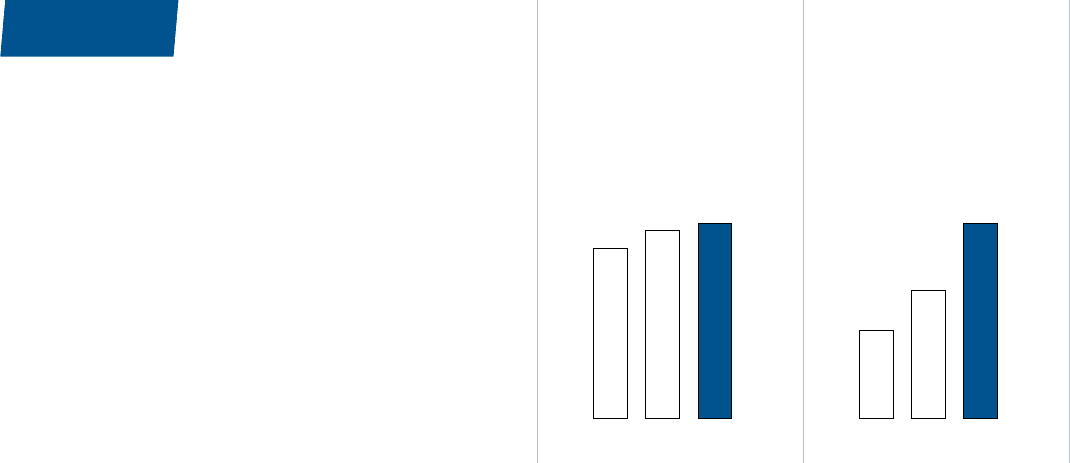

636 700 729

2005 2006 2007

Capital

Expenditures

(IN MILLIONS OF EUR)

149 215 328

2005 2006 2007

Free Cash Flow

(IN MILLIONS OF EUR)

supermarkets underwent a remodeling and 20 Cash Fresh stores were converted

into Delhaize banners. Capital spending in information technologies, logistics

and distribution, and miscellaneous categories amounted to EUR 240.0 million

(32.9% of total capital expenditures), compared to EUR 238.0 million in

2006.

Net cash used in fi nancing activities decreased from EUR 636.8 million

to EUR 333.7 million mainly due to a signifi cant decrease in the redemption

of long-term loans. In February and April of 2006, Delhaize Group redeemed

EUR 627.5 million of long–term debt. In 2007, the Group’s net repayment

of long-term debt was EUR 181.5 million, mostly the redemption of

USD 145.0 million (EUR 105.8 million) Delhaize America notes.

In 2007, Delhaize Group generated free cash fl ow of EUR 326.7 million,

compared to EUR 215.1 million in 2006. This increase was the result of

higher cash provided by operating activities and the cash proceeds from the

divestitures of Delvita and Di.

BALANCE SHEET

At the end of 2007, Delhaize Group‘s total assets amounted to EUR 8.8 billion,

5.1% lower than at the end of 2006. This decrease was due to the 10.5%

weakening of the U.S. dollar compared to the euro between the two closing

dates.

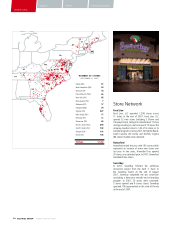

At the end of 2007, Delhaize Group’s sales network consisted of 2,545 stores,

160 less than one year earlier because of the divestiture of Di and Delvita. Of

these 2,545 stores, 325 were owned by the company, 720 were held under

fi nance leases and 1,139 under operating leases. The remaining 361 stores

were affi liated stores owned by their operators or directly leased by their

operators from a third party. Delhaize Group owned 12 of its 13 warehousing

and distribution facilities in the U.S., six of the seven distribution centers of

Delhaize Belgium, two of its four distribution centers in Greece and two of its

four distribution centers in the Emerging Markets

At the end of 2007, total equity, including minority interests, increased to

EUR 3.7 billion. The increase in equity as a result of the recognized income

and expense of the year, the exercise of warrants and stock options and the

conversion of convertible bonds, was partially offset by the purchase of treasury

shares and dividends declared.

The number of Delhaize Group shares, including treasury shares, increased in

2007 by 3.8 million shares to 100.3 million due to the exercise of warrants and

the conversion of convertible bonds. In connection with stock option exercises,

the Group repurchased 536,275 of its shares and used 515,925 treasury

shares in 2007. At the end of 2007, Delhaize Group owned 938,949 treasury

shares, at a value of EUR 62.3 per share, compared to an average purchase

price of EUR 61.6 per share.

In May of 2007, Delhaize Group implemented debt cross-guarantees with

its U.S. subsidiary Delhaize America and received an investment grade rating

of Baa3 (with stable outlook) from Moody’s, while S&P gave a BB+ rating with

a positive outlook. Delhaize Group thus became the rated entity instead of

Delhaize America.

In June of 2007, Delhaize America purchased USD 1,050 million of its 2011

debt and USD 50 million of its debentures due in 2031 through a public

tender. The transaction was fi nanced with the issuance by Delhaize Group of

EUR 500 million 7 year senior notes at 5.625% and USD 450 million 10 year

senior notes at 6.50%. The euro bond was entirely swapped to USD in order

to match the currency of the debt to the currency of the underlying assets and

earnings.

The refi nancing transformed Delhaize’s debt profi le to a more balanced set of

maturities. At year-end 2007, 80% of profi t from operations of Delhaize Group

was generated in USD and 80% of its fi nancial obligations were in USD. The

transaction allowed Delhaize Group to reduce its average cost of long-term

debt from 7.2% in 2006 to 6.7% for 2007, with a fi rst full-year impact in

2008.

At the end of 2007, Delhaize Group had fi nancial debt of EUR 2.7 billion, a

12.7% decrease compared to the end of 2006 primarily due to the weakening

of the U.S. dollar, the conversion of EUR 129.3 million convertible bonds and

the generation of free cash fl ow. Of the total fi nancial debt at year-end, 25.3%

was at variable interest rates and 74.7% at fi xed interest rates; 80.3% was

denominated in U.S. dollar and 19.7% in euro. Approximately 98% of fi nancial

debt excluding fi nance leases is long-term. The average maturity of the debt,

excluding fi nance leases, increased due to the refi nancing transaction to

10.7 years compared to 9.2 years in 2006.

On December 31, 2007, Delhaize Group had fi nance lease obligations

outstanding of EUR 634.9 million compared with EUR 636.5 million at the end

of 2006. The average interest rate on fi nancial lease obligations was 11.7%

in 2007.

At the end of 2007, Delhaize Group’s net debt amounted to EUR 2.2 billion,

a decrease of EUR 390.5 million or -14.8% mainly due to the weakening of

the U.S. dollar between the two balance sheet dates (currency translation effect

DELHAIZE GROUP / ANNUAL REPORT 2007

34