Food Lion 2007 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2007 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

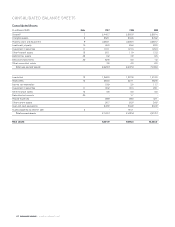

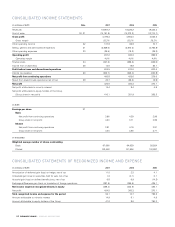

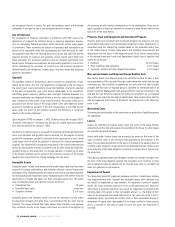

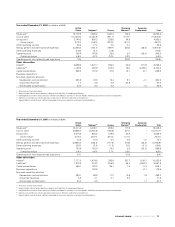

CONSOLIDATED INCOME STATEMENTS

(in millions of EUR) Note 2007 2006 2005

Revenues 18,957.2 19,225.2 18,345.3

Cost of sales 30, 31 (14,161.9) (14,372.2) (13,710.1)

Gross profit 4,795.3 4,853.0 4,635.2

Gross margin 25.3% 25.2% 25.3%

Other operating income 32 107.9 82.8 70.7

Selling, general and administrative expenses 31 (3,929.5) (3,970.3) (3,766.8)

Other operating expenses 33 (36.5) (19.2) (39.2)

Operating profit 937.2 946.3 899.9

Operating margin 4.9% 4.9% 4.9%

Finance costs 34 (347.2) (295.6) (322.6)

Income from investments 35 14.5 19.9 26.1

Profit before taxes and discontinued operations 604.5 670.6 603.4

Income tax expense 26 (203.7) (245.0) (223.8)

Net profit from continuing operations 400.8 425.6 379.6

Result from discontinued operations (net of tax) 28 23.7 (65.3) (9.5)

Net profit 424.5 360.3 370.1

Net profit attributable to minority interest 14.4 8.4 4.9

Net profit attributable to equity holders of the Group

(Group share in net profit) 410.1 351.9 365.2

(in EUR)

Earnings per share 27

Basic

Net profit from continuing operations 3.96 4.39 3.99

Group share in net profit 4.20 3.71 3.89

Diluted

Net profit from continuing operations 3.81 4.19 3.81

Group share in net profit 4.04 3.55 3.71

(in thousands)

Weighted average number of shares outstanding

Basic 97,666 94,939 93,934

Diluted 103,448 101,906 100,897

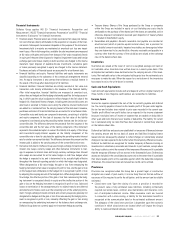

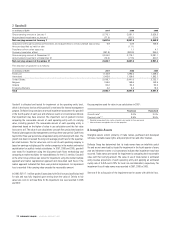

CONSOLIDATED STATEMENTS OF RECOGNIZED INCOME AND EXPENSE

(in millions of EUR) 2007 2006 2005

Amortization of deferred gain (loss) on hedge, net of tax 11.0 3.2 4.1

Unrealized gain (loss) on securities held for sale, net of tax 1.3 (0.1) 0.1

Actuarial gain (loss) on defined benefit plans, net of tax 6.8 9.9 (14.2)

Exchange differences gain (loss) on translation of foreign operations (387.5) (356.6) 435.1

Net income (expense) recognized directly in equity (368.4) (343.6) 425.1

Net profit 424.5 360.3 370.1

Total recognized income and expense for the period 56.1 16.7 795.2

Amount attributable to minority interest 14.9 8.1 4.9

Amount attributable to equity holders of the Group 41.2 8.6 790.3

DELHAIZE GROUP / ANNUAL REPORT 2007

64