Food Lion 2007 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2007 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

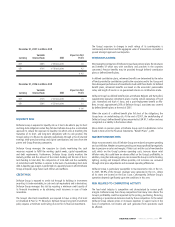

Remuneration of the Board

The Company’s directors are remunerated for their services with a fi xed

compensation, decided by the Board of Directors and not to exceed the

maximum amounts set by the Company’s shareholders. The maximum amount

approved by the shareholders is EUR 80,000 per year per director, increased

with an additional amount of up to EUR 10,000 per year for the Chairman of

any standing committee of the Board and increased with an amount of up to

EUR 5,000 per year for services as a member of any standing committee of the

Board. For the Chairman of the Board, the maximum amount is EUR 160,000

per year (including any amount due as Chairman or member of any standing

committee).

Non-executive directors of the Company do not receive any remuneration,

benefi ts, equity-linked consideration or other incentives from the Company

other than their remuneration for their service as director of the Company.

The amount of the remuneration granted for fi scal year 2007 individually to

directors of the Company is described in Note 38 to the Financial Statements,

“Related Party Transactions”, page 102. Delhaize Group has not extended

credit, arranged for the extension of credit or renewed an extension of credit in

the form of a personal loan to or for any member of the Board.

Committees of the Board of Directors

The Board of Directors has two standing committees: the Audit Committee and

the Remuneration and Nomination Committee. The table on page 49 provides

an overview of the membership of the standing committees of the Board of

Directors.

Audit Committee

The Audit Committee was appointed by the Board to assist the Board in

monitoring the integrity of the fi nancial statements of the Company, the

Company’s compliance with legal and regulatory requirements, the Statutory

Auditor’s qualifi cation and independence, the performance of the Company’s

internal audit function and Statutory Auditor, and the Company’s internal

controls and risk management. The Audit Committee’s specifi c responsibilities

are set forth in the Terms of Reference of the Audit Committee, which are

attached as Exhibit B to the Company’s Corporate Governance Charter.

The Audit Committee is composed solely of independent directors. The

composition of the Audit Committee can be found in the table on page 49. The

Board of Directors has also determined that Mr. Robert J. Murray, Count de Pret

Roose de Calesberg, and Ms. Claire Babrowski are “audit committee fi nancial

experts” as defi ned under applicable U.S. law.

In 2007, the Audit Committee met fi ve times. All members of the Audit

Committee attended all of those meetings.

The activities of the Audit Committee in 2007 included, among others:

• Review of fi nancial statements and related revenues and earnings press

releases

• Review of the effect of regulatory and accounting initiatives and any off-

balance sheet structures on the fi nancial statements

• Review of changes, as applicable, in accounting principles and valuation

rules

• Review of U.S. Securities and Exchange Commission comments to the 2006

annual report on Form 20-F and the Company’s responses

• Review of the Internal Audit Plan

• Review of Management’s Representation Letter

• Review of the Audit Committee Charter Required Actions Checklist

• Review of reports concerning the policy on complaints (SOX 301 Reports

Policy/Sentinel Hotline)

• Review of SOX 404 compliance plan for 2007

• Review of General Counsel reports

• Review and evaluation of the lead partner of the independent auditor

• Holding separate closed sessions with the independent auditor and with the

Company’s Chief Audit Offi cer

• Review and approval of the Policy for Audit Committee Approval of

Independent Auditor Services

• Review of required communications from the independent auditor

• Review and approve the Statutory Auditor’s global audit plan for 2007

Remuneration and Nomination Committee

The principal responsibilities of the Remuneration and Nomination Committee

are to: (i) identify individuals qualifi ed to become Board members, consistent

with criteria approved by the Board; (ii) recommend to the Board the director

nominees for each Ordinary General Meeting; (iii) recommend to the Board

director nominees to fi ll vacancies, (iv) recommend to the Board qualifi ed and

experienced directors for service on the committees of the Board; (v) recommend

to the Board the compensation of the members of executive management, (vi)

recommend to the Board any incentive compensation plans and equity-based

plans, and awards thereunder, and profi t-sharing plans for the Company’s

associates; (vii) evaluate the performance of the Chief Executive Offi cer; and

(viii) advise the Board on other compensation issues. The Remuneration and

Nomination Committee’s specifi c responsibilities are set forth in the Terms

of Reference of the Remuneration and Nomination Committee, which are

attached as Exhibit C to the Company’s Corporate Governance Charter.

The Remuneration and Nomination Committee is composed solely of non-

executive directors, and all of them are independent directors under the Belgian

Company Code, the Belgian Code on Corporate Governance and the rules of

the NYSE. The composition of the Remuneration and Nomination Committee

can be found in the table on page 49.

In 2007, the Remuneration and Nomination Committee met fi ve times. All

members of the Remuneration and Nomination Committee attended all of

those meetings.

The activities of the Remuneration and Nomination Committee in 2007

included, among others:

• Approval of benchmark parameters and related data for 2007 compensation

review

• Review of and recommendation for senior management compensation

individually and review variable remuneration for other levels of management

in the aggregate

Corporate

Governance

DELHAIZE GROUP / ANNUAL REPORT 2007

50