Food Lion 2007 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2007 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

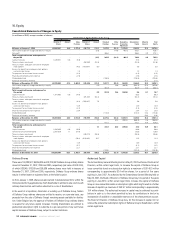

Standards and Interpretations which Became Applicable During 2007

The following standards and interpretations became effective in 2007 and, with

the exception of IFRS 7, had no material impact on the financial statements or

disclosures of the Group.

• IFRS 7 “Financial Instruments: Disclosures”

• IAS 1 “Presentation of Financial Statements” - Amendment - Capital

Disclosures

• IFRIC 7 “Applying the Restatement Approach under IAS 29 Financial

Reporting in Hyperinflatory Economies”

• IFRIC 8 “Scope of IFRS 2”

• IFRIC 9 “Reassessment of Embedded Derivatives”

• IFRIC 10 “Interim Financial Reporting and Impairment”

IFRS 7 “Financial Instruments: Disclosures” is applicable for accounting years

beginning on or after January 1, 2007 and introduces new requirements to

enhance disclosures on financial instruments. IFRS 7 aims at greater transpar-

ency, mainly with regard to the risk that entities run from the use of financial

instruments.

Standards and Interpretations Issued but not yet Effective

The Group did not early apply the following IFRS Standards and Interpretations

which were issued at the date of authorisation of these financial statements

but not yet effective on the balance sheet date. The Group anticipates that the

adoption of these Standards and Interpretations in future periods will have no

material impact on the financial statements of the Group in the period of initial

application:

• IAS 1 “Presentation of Financial Statements” (annual periods beginning on or

after January 1, 2009). This Standard replaces IAS 1 “Presentation of Financial

Statements” (revised in 2003) as amended in 2005

• Amendment to IAS 27 “Consolidated and Separate Financial Statements”

(applicable for annual periods beginning on or after July 1, 2009). This Standard

amends IAS 27 “Consolidated and Separate Financial Statements” (revised

2003)

• Amendment to IFRS 2 “Share-based Payment; Vesting Conditions and

Cancellations” (applicable for annual periods beginning on or after January 1,

2009)

• IFRS 3 “Business Combinations” (applicable to business combinations for which

the acquisition date is on or after the beginning of the first annual report-

ing period beginning on or after July 1, 2009). This Standard replaces IFRS 3

“Business Combinations” as issued in 2004

• IFRS 8 “Operating Segments” (applicable for annual periods beginning on or

after January 1, 2009)

• Amendment to IAS 23 “Borrowing Costs” (applicable for annual periods begin-

ning on or after January 1, 2009)

• Amendments to IAS 32 “Financial Instruments: Presentation” and IAS 1

“Presentation of Financial Statements - Puttable Financial Instruments and

Obligations Arising on Liquidation” (applicable for annual periods beginning on

or after January 1, 2009)

• IFRIC 11 “IFRS 2 : Group and Treasury Share Transactions” (applicable for

annual periods beginning on or after March 1, 2007)

• IFRIC 12 “Service Concession Arrangements” (applicable for annual periods

beginning on or after January 1, 2008)

• IFRIC 13 “Customer Loyalty Programmes” (applicable for annual periods begin-

ning on or after July 1, 2008)

• IFRIC 14 “IAS 19 - The Limit on a Defined Benefit Asset, Minimum Funding

Requirements and their Interaction” (applicable for annual periods beginning on

or after January 1, 2008)

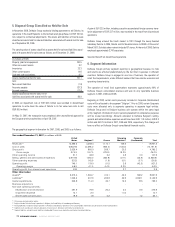

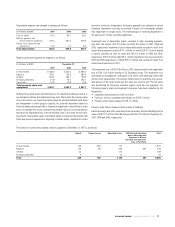

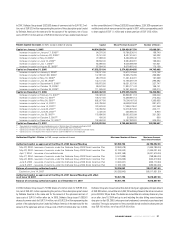

3. Business Acquisitions

In 2005, Delhaize Group acquired 100% of Cash Fresh, a chain of 43 supermarkets

mainly located in northeastern Belgium. Delhaize Group paid an aggregate amount

of EUR 159.1 million in cash for the acquisition of Cash Fresh, net of EUR 1.7 million

in price adjustments received by Delhaize Group in 2006. This amount included

EUR 1.6 million costs directly attributable to the acquisition, and was net of

EUR 6.4 million in cash and cash equivalents acquired. Cash Fresh’s results of opera-

tions are included in Delhaize Group’s consolidated results from May 31, 2005. Cash

Fresh’s net profit was EUR 4.3 million in 2005, since the acquisition date. Goodwill

recognized on the acquisition of Cash Fresh is attributable to anticipated future

economic benefits and synergies.

The assets and liabilities arising from the acquisition of Cash Fresh are as follows:

(in millions of EUR)

Fair Value

Non-current assets 195.7

*

Current assets 22.9

Liabilities (57.8)

Net assets acquired 160.8

(*) Including EUR 143.3 million in goodwill

Cash Fresh’s carrying value of assets and liabilities prior to the acquisition have

not been disclosed because Cash Fresh followed Belgian GAAP and not IFRS, and

therefore, no IFRS information was available.

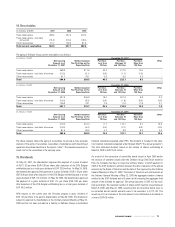

4. Divestitures

On March 15, 2007, Delhaize Group reached a binding agreement to sell Di,

its Belgian beauty and body care business to NPM/CNP and Ackermans & Van

Haaren. This transaction was approved by the European antitrust authorities on

June 1, 2007, and was closed on June 30, 2007. Delhaize Group received an

amount of EUR 33.4 million in cash, subject to contractual adjustments. A pre-

tax gain of EUR 1.5 million has been recorded, including EUR 3.0 million in other

operating income, EUR 2.5 million in other operating expenses and EUR 1.0 million

in income from investments. The Di network consisted of 132 company-operated

and franchised stores, which contributed EUR 95.5 million to Delhaize Group’s 2006

revenues.

DELHAIZE GROUP / ANNUAL REPORT 2007 71