Food Lion 2007 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2007 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

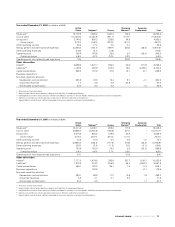

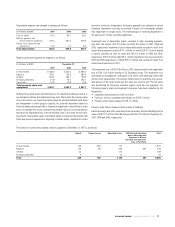

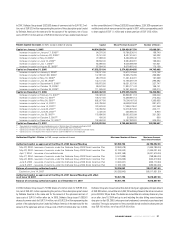

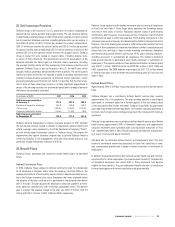

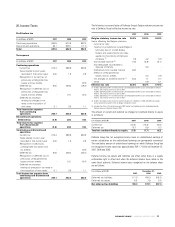

At December 31 USD Companies Other Companies Total

(in millions of EUR)

2005 (675.0) 10.1 (664.9)

2006 (1,045.7) 20.0 (1,025.7)

2007 (1,408.4) (7.5) (1,415.9)

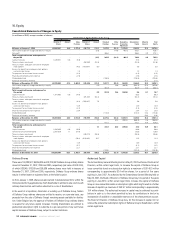

Capital Management

The Group manages its capital in order to maximize shareholder value while keeping

sufficient flexibility to execute strategic projects. We monitor capital by using the

same debt/equity classifications as applied in our IFRS reporting.

During 2007, the capital of Delhaize Group was increased by EUR 182.2 million.

Minority Interests

Minority interests represent third-party interests in the equity of fully consolidated

companies that are not wholly owned by Delhaize Group.

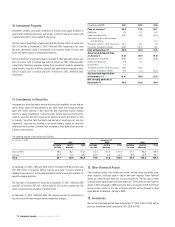

Minority Interests December 31,

(in millions of EUR) 2007 2006 2005

Belgium 0.5 0.5 0.4

Greece 48.2 35.7 29.8

Total 48.7 36.2 30.2

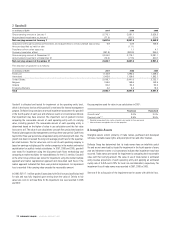

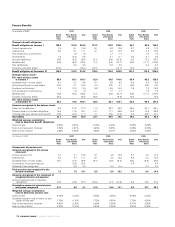

17. Long-term Debt

Delhaize Group manages its debt and overall financing strategies using a combina-

tion of short, medium and long-term debt and interest rate swaps. Delhaize Group

finances its daily working capital requirements, when necessary, through the use of

its various committed and uncommitted lines of credit. The short and medium-term

borrowing arrangements generally bear interest at the inter-bank offering rate at the

borrowing date plus a pre-set margin. Delhaize Group also uses a treasury notes

program.

Long-term debt (excluding finance leases) net of discounts/premiums, deferred trans-

action cost and hedge accounting fair value adjustment consists of the following:

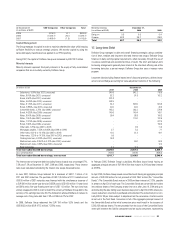

(in millions of EUR) December 31,

2007 2006 2005

Debentures, 9.00% (due 2031), unsecured 540.8 642.2 716.6

Notes, 8.05% (due 2027), unsecured 82.3 91.8 102.2

Bonds, 6.50% (due 2017), unsecured 301.8 - -

Notes, 5.625% (due 2014), unsecured 503.5 - -

Notes, 8.125% (due 2011), unsecured 34.2 829.0 924.8

Bonds, 3.895%, (due 2010), unsecured 40.0 40.0 40.0

Convertible bonds, 2.75% (due 2009), unsecured 165.2 283.2 276.6

Bonds, 4.625% (due 2009), unsecured 149.6 149.4 149.1

Notes, 8.00% (due 2008), unsecured 99.4 98.8 100.3

Notes, 7.55% (due 2007), unsecured - 110.0 122.6

Notes, 7.375% (due 2006), unsecured - - 477.5

Bonds, 5.50% (due 2006), unsecured - - 150.0

Other debt, 7.25% (due 2007 to 2018) - 9.9 11.5

Mortgages payable, 7.55% to 8.65% (due 2008 to 2016) 3.7 5.3 7.1

Other notes, 6.31% to 14.15% (due 2007 to 2016) 19.2 31.4 49.1

Other notes, 7.25% to 14.15%, (due 2007 to 2013), unsecured 0.9 - -

Floating term loan, 5.318% (due 2012), unsecured 76.8 - -

Medium-term notes 3.354% to 4.70% (due 2007), unsecured - 50.0 50.0

Medium-term notes, 6.80% (due 2006), unsecured - - 12.4

Bank borrowings 3.2 10.4 14.9

Total non-subordinated borrowings 2,020.6 2,351.4 3,204.7

Less current portion (108.9) (181.6) (658.3)

Total non-subordinated borrowings, non-current 1,911.7 2,169.8 2,546.4

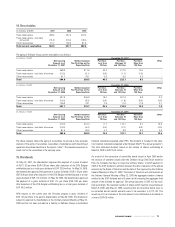

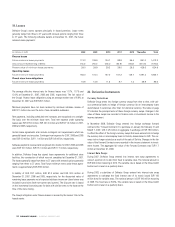

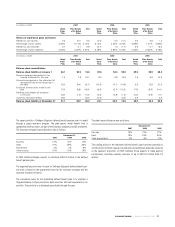

The interest rate on long-term debt (excluding finance leases) was on average 6.7%,

7.3% and 7.2% at December 31, 2007, 2006 and 2005, respectively. These interest

rates were calculated considering the interest rate swaps discussed below.

In June 2007, Delhaize Group tendered for a maximum of USD 1.1 billion of its

2011 and 2031 maturities. The purchase of USD 1,05 billion of 2011 maturities and

USD 50 million of 2031 maturities was financed with the simultaneous issuance of

a EUR 500 million seven-year bond at 5.625% and a USD 450 million 10-year bond

at 6.50% and a five-year floating term loan of USD 113 million. The euro bond was

entirely swapped to USD in order to match the currency of Delhaize Group debt to the

currency of its earnings (see note 20). The transaction allowed Delhaize to reduce its

average cost of long term debt from 7.3% in 2006 to 6.7% for 2007.

In 2006, Delhaize Group redeemed the EUR 150 million 5.5% bonds and the

USD 563.5 million (EUR 477.5 million) 7.375% notes.

In February 2005, Delhaize Group’s subsidiary Alfa-Beta issued bonds having an

aggregate principal amount of EUR 40 million that mature in 2010 and bear interest

at 3.895%.

In April 2004, Delhaize Group issued convertible bonds having an aggregate principal

amount of EUR 300 million for net proceeds of EUR 295.2 million (the “Convertible

Bonds”). The Convertible Bonds mature in 2009 and bear interest at 2.75%, payable

in arrears on April 30 of each year. The Convertible Bonds are convertible by holders

into ordinary shares of the Company at any time on or after June 10, 2004 and up to

and including the date falling seven business days prior to April 30, 2009, unless pre-

viously redeemed, converted or purchased and cancelled. The conversion price is ini-

tially EUR 57.00 per share subject to adjustment on the occurrence of certain events

as set out in the Trust Deed. Conversion in full of the aggregate principal amount of

the Convertible Bonds at the initial conversion price would result in the issuance of

5,263,158 ordinary shares. The net proceeds from the issue of the Convertible Bonds

were split between the liability component and an equity component, representing

DELHAIZE GROUP / ANNUAL REPORT 2007 83