Food Lion 2007 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2007 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

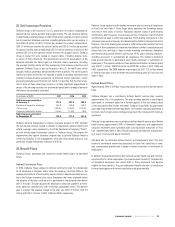

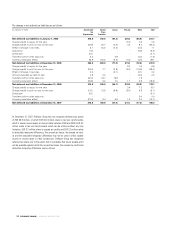

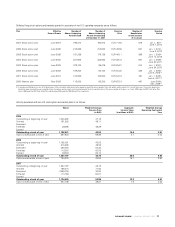

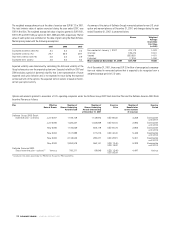

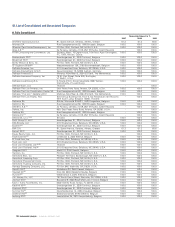

Options and warrants granted to associates of U.S. operating companies under the Delhaize Group 2002 Stock Incentive Plan and the Delhaize America 2000 Stock

Incentive Plan are as follows:

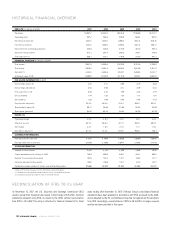

Plan Effective Number of Number of Exercise Number of Exercise

Date of Grants Shares Underlying Shares Underlying Price Beneficiaries Period

Award Issued Awards Outstanding (at the moment

at December 31, 2007 of issuance)

Delhaize Group 2002 Stock

Incentive plan - warrants June 2007 1,165,108 1,138,873 USD 96.30 3,238 Exercisable

until 2017

June 2006 1,324,347 1,032,668 USD 63.04 2,983 Exercisable

until 2016

May 2005 1,100,639 562,118 USD 60.76 2,862 Exercisable

until 2015

May 2004 1,517,988 377,216 USD 46.40 5,449 Exercisable

until 2014

May 2003 2,132,043 280,377 USD 28.91 5,301 Exercisable

until 2013

May 2002 3,853,578 550,141 USD 13.40 - 5,328 Exercisable

USD 76.87 until 2012

Delhaize America 2000

Stock Incentive plan - options

(1)

Various 700,311 58,649 USD 13.40 - 4,497 Various

USD 93.04

(1)

Including the stock options granted under the 1996 Food Lion Plan and the 1998 Hannaford Plan.

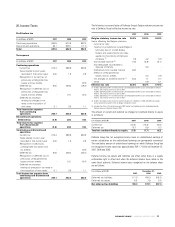

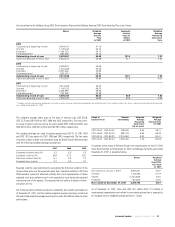

The weighted average share price at the date of exercise was EUR 67.12 in 2007.

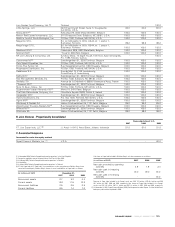

The total intrinsic value of options exercised during the year ended 2007, was

EUR 14.6 million. The weighted average fair value of options granted is EUR 16.61,

EUR 13.97 and EUR 16.52 per option for 2007, 2006 and 2005, respectively. The fair

value of each option was estimated on the date of grant using the Black-Scholes-

Merton pricing model with the following assumptions:

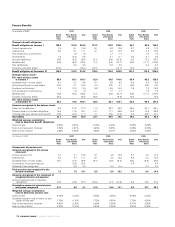

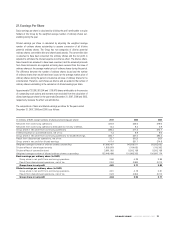

2007 2006 2005

Expected dividend yield (%) 2.4 2.4 2.3

Expected volatility (%) 25.7 26.5 39.7

Risk-free interest rate (%) 4.5 3.6 2.9

Expected term (years) 4.6 5.0 5.3

Expected volatility was determined by calculating the historical volatility of the

Group’s share price over the expected option term. Expected volatility in 2007 and

2006 excludes a period of abnormal volatility that is not representative of future

expected stock price behavior and is not expected to recur during the expected

contractual term of the options. The expected term of options is based on histori-

cal ten-year option activity.

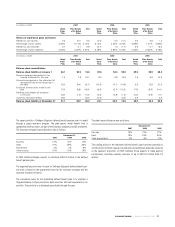

A summary of the status of Delhaize Group’s nonvested options for non U.S. stock

option and warrant plans as of December 31, 2007, and changes during the year

ended December 31, 2007, is presented below:

Shares Weighted

Average

Grant-Date

Fair Value

(in EUR)

Non-vested at January 1, 2007 474,113 14.83

Granted 185,474 16.61

Vested (220,621) 14.81

Forfeited (7,216) 14.96

Non-vested at December 31, 2007 431,750 15.60

As of December 31, 2007, there was EUR 3.9 million of unrecognized compensa-

tion cost related to nonvested options that is expected to be recognized over a

weighted average period of 2.3 years.

DELHAIZE GROUP / ANNUAL REPORT 2007

98