Experian 2009 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2009 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

89Experian Annual Report 2009

Introduction

2 – 7

Business review

8 – 43

Governance

44 – 72

Financial statements

Group nancial statements

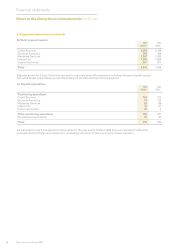

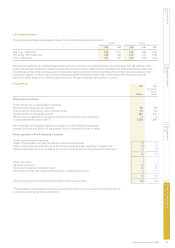

2. Basis of preparation and signicant accounting policies (continued)

Once adopted by the EU, the following accounting standards, amendments and interpretations issued by the IASB and the

International Financial Reporting Interpretations Committee will be effective for the Group’s accounting periods beginning on

or after 1 April 2009:

Amendments to the following standards as a result of the May 2008 annual improvements process:

-

IFRS 5 ‘Non–current assets held for sale and discontinued operations’ *

IAS 16 ‘Property, plant and equipment’ *

IAS 19 ‘Employee benets’ *

IAS 20 ‘Accounting for government grants and disclosure of government assistance’ *

IAS 29 ‘Financial reporting in hyperinationary economies’ *

IAS 31 ‘Financial reporting of interests in joint ventures’ *

IAS 36 ‘Impairment of assets’ *

IAS 38 ‘Intangible assets’ *

IAS 40 ‘Investment property’ *

IAS 41 ‘Agriculture’ *

IFRS 1 ‘Amendment – First time adoption of IFRS’

-

IFRS 2 ‘Amendment – Share-Based Payments’ -

IFRS 3 (Revised) ‘Business Combinations’ * -

IFRS 8 ‘Operating segments’ -

IAS 1 ‘Amendment – Presentation of Financial Statements’ -

IAS 23 ‘Amendment – Borrowing Costs’ -

IAS 27 (Revised) ‘Consolidated and Separate Financial Statements’ -

IAS 28 ‘Amendment – Investment in Associates’ * -

IAS 32 ‘Amendment – Financial Instruments: Presentation’ -

IAS 39 ‘Amendment – Financial Instruments: Recognition and Measurement’ * -

IAS 39 (Revised) – ‘Financial Instruments: Recognition and Measurement’ * -

IFRIC 13 ‘Customer Loyalty Programmes’ * -

IFRIC 15 ‘Agreements for the Construction of Real Estate’ * -

IFRIC 16 ‘Hedges of a Net Investment in a Foreign Operation’ * -

IFRIC 18 ‘Transfer of Assets from Customers’ * -

* These standards are still subject to adoption by the EU.

Of these there is only one which is expected to have a material effect on the results and net assets of the Group although a

number of the developments will lead to additional or revised disclosures. As previously indicated, IFRS 3 (Revised) requires

amendments to accounting for business combinations and the treatment of associated transaction costs and accordingly will

impact the accounting treatment of future acquisitions in the nancial statements.

The most signicant of those that will lead to additional or revised disclosures is IFRS 8. The Group has reviewed the

requirements of this IFRS during the year and is adopting it with effect from 1 April 2009. Whilst compliance with IFRS 8 will

require some revisions to the nature of segmental information disclosed, the structure of the Group’s segmental information

will be largely unchanged from that currently provided.

Use of non-GAAP measures

The Group has identied certain measures that it believes will assist understanding of the performance of the business. The

measures are not dened under IFRS and they may not be directly comparable with other companies’ adjusted measures.

The non-GAAP measures are not intended to be a substitute for, or superior to, any IFRS measures of performance but

management has included them as they consider them to be important comparables and key measures used within the

business for assessing performance.