Experian 2009 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2009 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

109Experian Annual Report 2009

Introduction

2 – 7

Business review

8 – 43

Governance

44 – 72

Financial statements

Group nancial statements

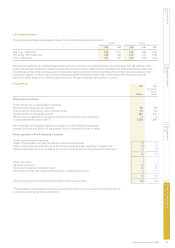

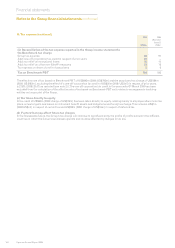

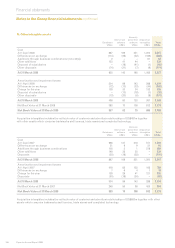

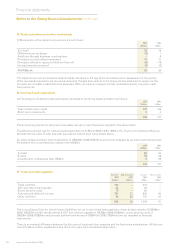

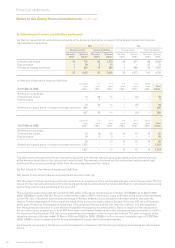

16. Property, plant and equipment

Short

Freehold leasehold Plant and

properties properties equipment To t a l

US$m US$m US$m US$m

Cost

At 1 April 2008 335 122 680 1,137

Differences on exchange (64) - (97) (161)

Additions through business combinations (note 33(a)) - - 1 1

Other additions 1 2 74 77

Disposal of subsidiaries (2) - (96) (98)

Other disposals (1) (1) (36) (38)

Transfers 3 - (3) –

At 31 March 2009 272 123 523 918

Depreciation

At 1 April 2008 68 26 439 533

Differences on exchange (9) - (64) (73)

Charge for the year 8 6 80 94

Disposal of subsidiaries - - (83) (83)

Other disposals - (1) (31) (32)

At 31 March 2009 67 31 341 439

Net Book Value at 31 March 2008 267 96 241 604

Net Book Value at 31 March 2009 205 92 182 479

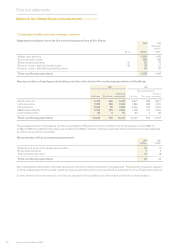

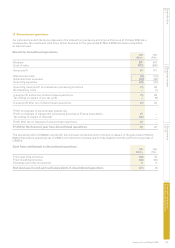

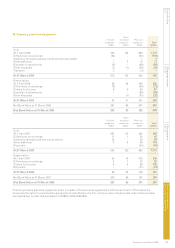

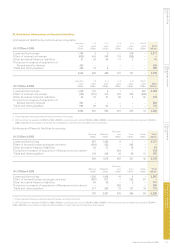

Short

Freehold leasehold Plant and

properties properties equipment To t a l

US$m US$m US$m US$m

Cost

At 1 April 2007 287 115 563 965

Differences on exchange 11 1 30 42

Additions through business combinations 33 - 36 69

Other additions 4 6 95 105

Disposals - - (44) (44)

At 31 March 2008 335 122 680 1,137

Depreciation

At 1 April 2007 55 19 372 446

Differences on exchange 5 1 20 26

Charge for the year 8 6 88 102

Disposals - - (41) (41)

At 31 March 2008 68 26 439 533

Net Book Value at 31 March 2007 232 96 191 519

Net Book Value at 31 March 2008 267 96 241 604

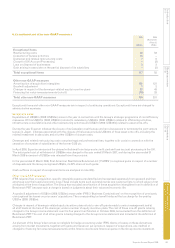

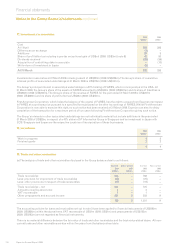

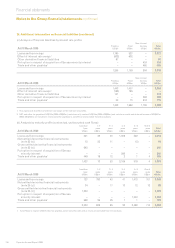

The Group leases plant and equipment under a number of nance lease agreements. At the end of each of the leases the

Group has the option to purchase the equipment at a benecial price. The net book value of assets held under nance leases

and capitalised in plant and equipment is US$9m (2008: US$18m).