Experian 2009 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2009 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

123Experian Annual Report 2009

Introduction

2 – 7

Business review

8 – 43

Governance

44 – 72

Financial statements

Group nancial statements

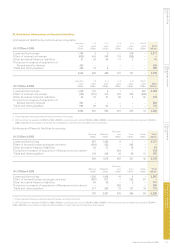

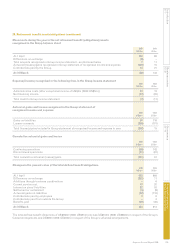

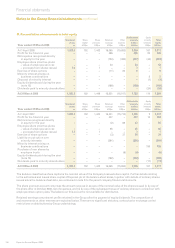

27. Share-based payment arrangements (continued)

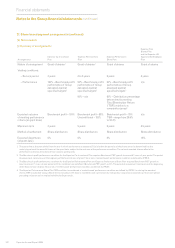

(ii) Information relating to share grant valuation techniques

The majority of the grants under the Experian share award plans were made on the rst day of trading for Experian plc shares

in October 2006 and trading was particularly volatile on that day. The weighted average share price for that day’s trading was

used to determine the value of demerger share awards. For the former GUS plans the value of awards is determined as the

market closing price on the date awarded grants are issued to participants. For the Experian Reinvestment Plan and the

former GUS Co-Investment Plan, this occurs after the rst year of performance is assessed. Where appropriate market-based

performance conditions are included in the fair value measurement on grant date and are not revised for actual performance.

Participants in the share award plans have an entitlement to dividend distributions on awarded shares from the issue date

until the date of vesting. The market price on the day of valuation is considered inclusive of such future dividend distributions

and no modications are made for dividend distributions or other factors.

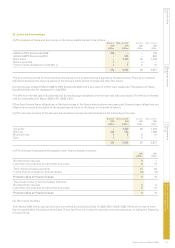

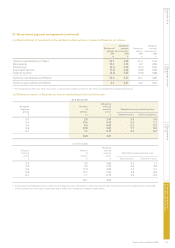

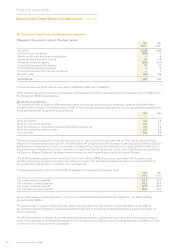

(iii) Reconciliation of Experian plc share awards outstanding

Number Number

of awards of awards

2009 2008

m m

Awards outstanding at 1 April 23.7 24.6

New grants 0.7 2.1

Forfeitures (1.8) (2.5)

Expired awards (0.6) –

Vesting (1.2) (0.5)

Awards outstanding at 31 March 20.8 23.7

Share awards granted in the year had a weighted average fair value of £3.69 (2008: £5.67).

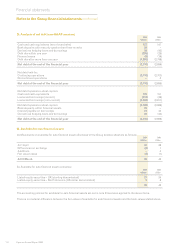

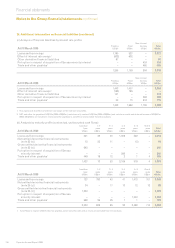

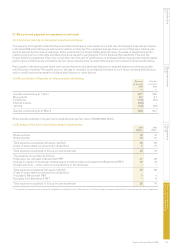

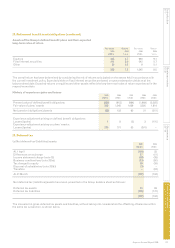

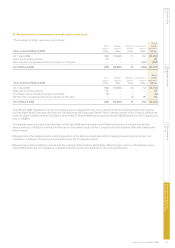

(c) Summary of the total cost of share-based compensation

2009 2008

US$m US$m

Share options 10 15

Share awards 43 51

Total expense recognised (all equity settled) 53 66

Costs of associated social security obligations1 2 10

Total expense recognised in Group income statement 55 76

The expense is reported as follows:

Employee cost included in Benchmark PBT 21 22

Charge in respect of demerger-related equity incentive plans (excluded from Benchmark PBT) 32 43

Exceptional item – other costs incurred relating to the demerger – 1

Total expense recognised (all equity settled) 53 66

Costs of associated social security obligations:

Included in Benchmark PBT 2 4

Excluded from Benchmark PBT – 6

Total expense recognised in Group income statement 55 76

1. The costs of associated social security obligations include the costs of derivatives, in the form of equity swaps, entered into in connection with such obligations.