Experian 2009 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2009 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

130 Experian Annual Report 2009

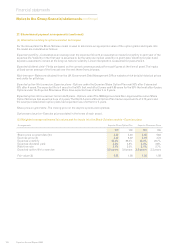

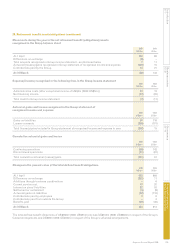

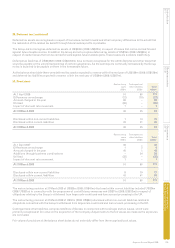

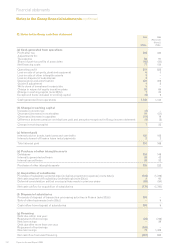

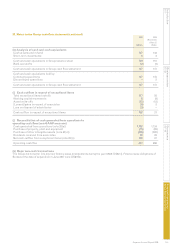

31. Reconciliation of movements in total equity

Attributable Equity

Number of Share Share Retained Other to equity minority To t a l

shares capital premium earnings reserves holders interests equity

Year ended 31 March 2009 m US$m US$m US$m US$m US$m US$m US$m

At 1 April 2008 1,023.4 102 1,442 16,065 (15,653) 1,956 161 2,117

Prot for the nancial year – – – 486 – 486 20 506

Net expense recognised directly

in equity for the year – – – (153) (384) (537) (44) (581)

Employee share incentive plans:

– value of employee services – – – 53 – 53 – 53

– proceeds from shares issued 1.9 – 7 – – 7 – 7

Exercise of share options – – – (11) 20 9 – 9

Minority interest arising on

business combinations – – – – – – 2 2

Disposal of minority interest – – – – – – (1) (1)

Equity dividends paid during the year

(note 13) – – – (189) – (189) – (189)

Dividends paid to minority shareholders – – – – – – (24) (24)

At 31 March 2009 1,025.3 102 1,449 16,251 (16,017) 1,785 114 1,899

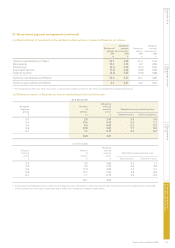

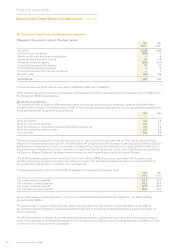

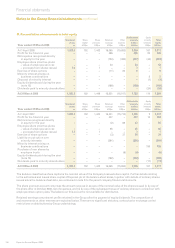

Attributable Equity

Number of Share Share Retained Other to equity minority To t a l

shares capital premium earnings reserves holders interests equity

Year ended 31 March 2008 m US$m US$m US$m US$m US$m US$m US$m

At 1 April 2007 1,022.3 102 1,435 16,341 (15,773) 2,105 2 2,107

Prot for the nancial year – – – 437 – 437 15 452

Net income recognised directly

in equity for the year – – – (2) 89 87 – 87

Employee share incentive plans:

– value of employee services – – – 65 – 65 – 65

– proceeds from shares issued 1.1 – 7 – – 7 – 7

Exercise of share options – – – (3) 37 34 – 34

Liability on put option over

minority interests – – – (591) – (591) – (591)

Minority interest arising on

business combinations – – – – – – 155 155

Purchase of own shares by

employee trusts – – – – (6) (6) – (6)

Equity dividends paid during the year

(note 13) – – – (182) – (182) – (182)

Dividends paid to minority shareholders – – – – – – (11) (11)

At 31 March 2008 1,023.4 102 1,442 16,065 (15,653) 1,956 161 2,117

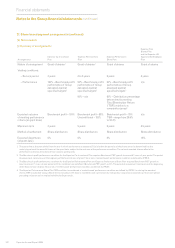

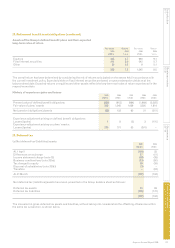

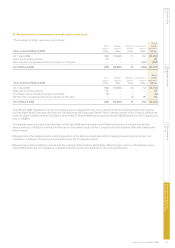

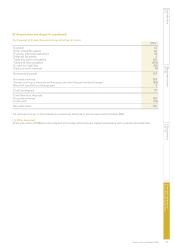

The balance classied as share capital is the nominal value of the Company’s issued share capital. Further details relating

to the authorised and issued share capital of Experian plc at the balance sheet dates, together with details of ordinary shares

issued since the balance sheet date, are contained in note K to the parent company nancial statements.

The share premium account comprises the amount received in excess of the nominal value of the shares issued (i) by way of

the share offer in October 2006, net of expenses, and (ii) by way of the subsequent issue of ordinary shares in connection with

employee share option plans. The balance on this account is not available for distribution.

Retained earnings comprise net prots retained in the Group after the payment of equity dividends. The composition of

and movements on other reserves are explained below. There are no signicant statutory, contractual or exchange control

restrictions on distributions by Group undertakings.

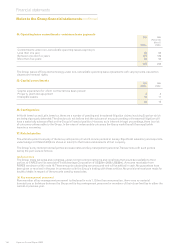

Notes to the Group nancial statements continued

Financial statements