Experian 2009 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2009 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

104 Experian Annual Report 2009

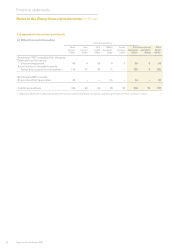

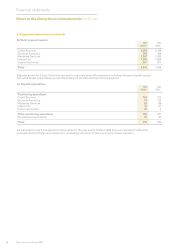

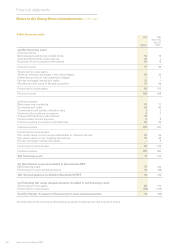

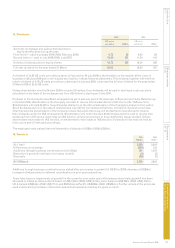

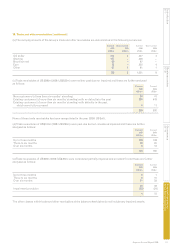

10. Tax expense (continued)

2009 2008

(Restated

Note 2)

US$m US$m

(ii) Reconciliation of the tax expense reported in the Group income statement to

the Benchmark tax charge

Group tax expense 84 91

Add: one-off corporation tax credit in respect of prior years 20 –

Add: tax relief on exceptional items 25 10

Add: tax relief on other non-GAAP measures 53 76

Tax expense on share of prot of associates 2 6

Tax on Benchmark PBT 184 183

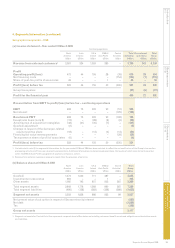

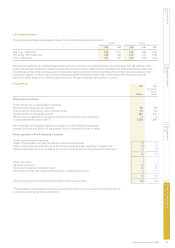

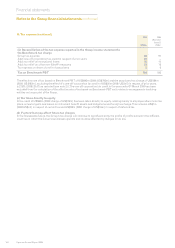

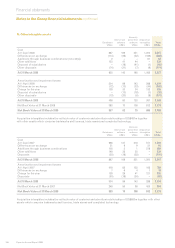

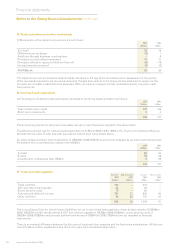

The effective rate of tax based on Benchmark PBT of US$843m (2008: US$783m) and the associated tax charge of US$184m

(2008: US$183m), excluding the effect of a one-off corporation tax credit of US$20m (2008: US$nil) in respect of prior years,

is 21.8% (2008: 23.4% as restated (see note 2)). The one-off corporation tax credit in the year ended 31 March 2009 has been

excluded from the calculation of the effective rate of tax based on Benchmark PBT as it relates to arrangements involving

entities no longer part of the Group.

(c) Tax taken directly to equity

A tax credit of US$60m (2008: charge of US$16m) has been taken directly to equity, relating mainly to employee share incentive

plans, actuarial gains and losses on retirement benet assets and obligations and foreign exchange. This includes US$1m

(2008:US$nil) in respect of current tax and US$59m (2008: charge of US$16m) in respect of deferred tax.

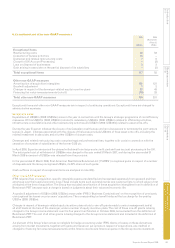

(d) Factors that may affect future tax charges

In the foreseeable future, the Group’s tax charge will continue to be inuenced by the prole of prots earned in the different

countries in which the Group’s businesses operate and could be affected by changes in tax law.

Notes to the Group nancial statements continued

Financial statements