Experian 2009 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2009 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59Experian Annual Report 2009

Introduction

2 – 7

Governance

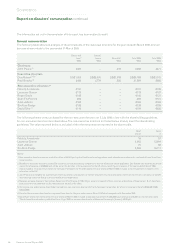

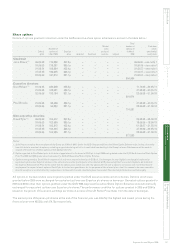

Report on directors’ remuneration Financial statements

73 – 148

Business review

8 – 43

Business review

8 – 43

The remuneration committee:

members, role and frequency of

meetings

Details of the committee members,

the scope of their role and frequency of

meetings can be found in the corporate

governance statement.

Working with advisers

In making its decisions, the committee

consults with the Chairman, the

Chief Executive Ofcer, the Group

HR Director and the Global Head

of Reward who are invited to attend

meetings of the committee as

appropriate. The Chief Financial

Ofcer is also consulted in respect

of performance conditions attaching

to short and long-term incentive

arrangements.

The committee has access to

independent consultants to ensure

that it receives objective advice.

In 2007, Deloitte LLP (‘Deloitte’)

were appointed by the committee as

advisers and they continued to act

during the year under review. Deloitte

also provided unrelated advisory and

tax services to the Group during the

year. Kepler Associates (‘Kepler’) were

also appointed by the committee in

2007 and, during the year under review,

provided advice and valuation data

for Experian’s current and proposed

executive remuneration arrangements

and also provided independent advice

on target calibration for the short and

long-term incentive plans. Linklaters

LLP provided legal advice in respect of

share plan design and interpretation.

Remuneration philosophy

Experian’s remuneration philosophy

is that reward should be used to drive

business performance. In this regard,

the remuneration committee aims to

have in place a remuneration policy for

Experian which is consistent with its

business objectives and is designed to:

pay market-competitive base salary

–

levels;

provide competitive performance-

–

related compensation which

inuences performance and helps

attract and retain executives

by providing the opportunity to

earn commensurate rewards for

outstanding performance, leading

to long-term shareholder value

creation;

apply demanding performance

–

conditions to deliver sustained

protable growth in all our

businesses, thereby aligning

incentives with shareholders’

interests, setting these conditions

with due regard to actual and

expected market conditions;

provide a balanced portfolio of

–

incentives - both cash and share-

based - which align both short-

term (one year) and longer-term

(three year) performance such that

sustainable growth and value are

delivered for our shareholders;

drive accountability and

–

transparency and align remuneration

with the interests of shareholders;

and

deliver competitive benets to

–

underpin the other components of

the remuneration package.

Consistent with the policy, the

committee compares the Experian

remuneration arrangements with

those of other relevant organisations

and companies of similar size and

scope to Experian. The remuneration

arrangements are also reviewed in

light of changing market conditions,

which have become increasingly more

challenging over the year under review.

Performance-related incentives are

targeted at upper quartile levels for

outstanding performance to produce

a highly leveraged package if the

Group’s growth objectives are attained.

Experian is committed to performance-

related pay at all levels within the

organisation.

The committee undertook a review of

remuneration arrangements during the

year. This review concluded that, while

the key elements of our arrangements

are still aligned with the principles of

remuneration policy and long-term

strategy, certain changes should be

made to better align arrangements

with the creation of future shareholder

value. The key elements of

remuneration arrangements going

forward are summarised below.

The remuneration committee is

mindful of the current environment and

especially the need to link pay closely

to performance. In light of current

economic conditions and the desire to

link executive salaries more closely to

policy elsewhere in the organisation,

coupled with the committee’s desire to

ensure a greater emphasis on variable

pay going forward, the committee has

decided to freeze base pay levels for

the coming year for executive directors

and senior management. In the case of

the chief executive ofcer (‘CEO’) this

means his base pay will be frozen for a

second consecutive year.

The revised arrangements take into

account the need to align incentives

with market practice and conditions

and to strike the right balance between

short-term and long-term performance.

The proposed incentive arrangements

will provide a stronger focus on

absolute share price growth (through

the use of options and delivery of

all long-term incentives in shares),

balanced with relative share price

growth (in the Performance Share

Plan (‘PSP’)) and a balance between

internal and external measures

of performance. In addition, by

encouraging executives to invest in and

hold Experian shares through the co-

investment plan (‘CIP’) arrangements,

their interests will be further aligned

with those of our shareholders over the

longer term.

The proposed total compensation

package has a similar expected value

to the arrangements currently in place

and is driven by the need to replace the

reinvestment plan which was a one off

plan and will cease next year.

Further details of how remuneration

arrangements will operate going

forward are set out in the following

pages.

Report on directors’ remuneration