Experian 2009 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2009 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

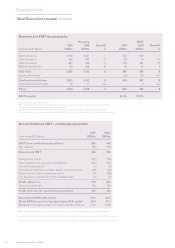

14 Experian Annual Report 2009

Total Organic

2009 2008 growth1 growth1

Year ended 31 March US$m US$m % %

Revenue

– Credit Services2 740 771 (4) (5)

– Decision Analytics2 119 118 1 1

– Marketing Services2 358 360 (1) (2)

– Interactive2 866 812 7 7

Total North America 2,083 2,061 1 1

EBIT

– Direct business 568 554 3

– FARES 48 54 (11)

Total North America 616 608 1

EBIT margin3 27.3% 26.9%

1 Growth at constant exchange rates

2 2008 restated for the reclassication of certain businesses between segments, see note 2 to the Group nancial statements

on page 78

3 EBIT margin is for continuing business only, excluding FARES

North America

Business review

Credit Services

Total revenue at Credit Services

declined by 4%, with organic revenue

down 5%. Prospecting activity by

nancial services clients remained

weak throughout the year, due to the

depressed market environment for

lending. Mortgage origination revenue

also declined, although there were

occasional surges in volumes linked

to consumer renancing activity.

These factors were partially offset by

growth in account management and

collections, with good traction from

new countercyclical products such

as bankruptcy scores and business

delinquency notication services.

In addition, there was a resilient

performance from the automotive

vertical, which beneted from market-

share gains in the sale of vehicle history

reports.

Experian North America delivered modest organic revenue growth

during a time of exceptionally challenging market conditions. There

was good progress on margins, up 40 basis points, reecting

excellent delivery on cost efciency initiatives.

• Organicrevenuegrowth

of 1%

• Increaseddemandfor

account management and

collections helps offset

depressed lending market

• Recessionaryconditions

impact traditional

marketing spend, but new

media businesses deliver

good growth

• Strongperformanceat

Consumer Direct with

revenue up over 20%

• EBITmarginimprovement

reects progress on cost

efciency initiatives

2009 Revenue by activity1

Decision Analytics

Credit Services

Marketing Services

Interactive

1 Excludes discontinuing activities

27.3%

26.9%

25.8%

EBIT (US$m) and margin

EBIT excludes discontinuing activities

EBIT margin is for continuing direct business only and

excludes FARES

23.3%

21.3%

09 616

08 608

07 573

06 473

05 356

EBIT