Dollar Tree 2010 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2010 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

NOTE 5—LONG-TERM DEBT

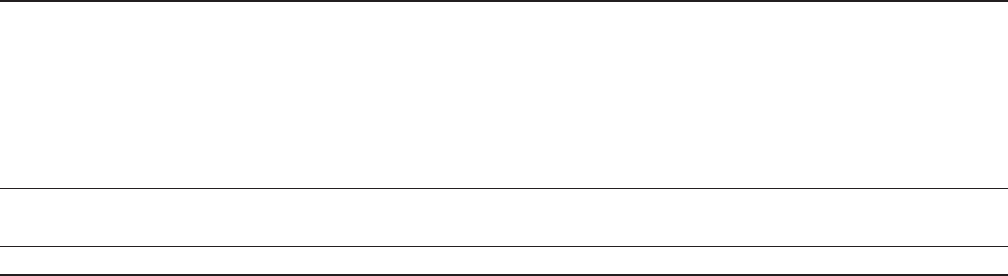

Long-term debt at January 29, 2011 and January 30, 2010 consists of the following:

(in millions) January 29, 2011 January 30, 2010

$550.0 million Unsecured Credit Agreement, interest

payable monthly at LIBOR, plus 0.50%, which was

0.76% at January 29, 2011, principal payable upon

expiration of the facility in February 2013 $ 250.0 $ 250.0

Demand Revenue Bonds, interest payable monthly at

a variable rate which was 0.30% at January 29, 2011,

principal payable on demand, maturing June 2018 16.5 17.5

Total long-term debt $ 266.5 $ 267.5

Less current portion 16.5 17.5

Long-term debt, excluding current portion $ 250.0 $ 250.0

Maturities of long-term debt are as follows: 2011 – $16.5 million and 2013 – $250.0 million.

Unsecured Credit Agreement

In 2008, the Company entered into the Agreement

which provides for a $300.0 million revolving line

of credit, including up to $150.0 million in available

letters of credit, and a $250.0 million term loan. The

interest rate on the facility is based, at the Company’s

option, on a LIBOR rate, plus a margin, or an alternate

base rate, plus a margin. The revolving line of credit

also bears a facilities fee, calculated as a percentage,

as defi ned, of the amount available under the line of

credit, payable quarterly. The term loan is due and

a new trial date will be established. It is anticipated

the case will go to trial in calendar year 2011. The

Company is vigorously defending itself in this matter.

In 2008, the Company was sued under the Equal

Pay Act in Alabama federal court by two female store

managers alleging that they and other female store

managers were paid less than male store managers.

Among other things, they seek monetary damages and

back pay. The Court ordered that notice be sent to

potential plaintiffs and there are now approximately 363

opt-in plaintiffs. The Company expects that the Court

will rule upon a motion by the Company to decertify

the collective action later in 2011. In October 2009,

34 plaintiffs, most of whom are opt-in plaintiffs in the

Alabama action, fi led a new class action Complaint

in a federal court in Virginia, alleging gender pay

and promotion discrimination under Title VII. On

March 11, 2010, the case was dismissed with prejudice.

Plaintiffs then fi led a motion requesting the Court to

alter, amend and vacate its dismissal Order which the

trial Court denied. Plaintiffs have fi led an appeal to the

U.S. Court of Appeals for the Fourth Circuit. It is

anticipated the Court will hand down a decision in 2011.

In 2010, two former assistant store managers fi led

a collective action against the Company in a Florida

federal court. Their amended claim is that they were

required to work off the clock without compensa-

tion in violation of the Fair Labor Standards Act.

An additional 22 party plaintiffs have joined the suit.

The Company’s motion to transfer venue to the U.S.

District Court for the Eastern District of Virginia was

recently overruled without prejudice pending future

case developments. There is no trial date. The Company

will continue to vigorously defend itself in this matter.

The Company does not believe that any of these

matters will, individually or in the aggregate, have

a material adverse effect on its business or fi nancial

condition. The Company cannot give assurance,

however, that one or more of these lawsuits will not

have a material adverse effect on its results of opera-

tions for the period in which they are resolved.

payable in full at the fi ve year maturity date of the

Agreement. The Agreement also bears an administra-

tive fee payable annually. The Agreement, among other

things, requires the maintenance of certain specifi ed

fi nancial ratios, restricts the payment of certain distri-

butions and prohibits the incurrence of certain new

indebtedness. As of January 29, 2011, the Company

had the $250.0 million term loan outstanding under

the Agreement and no amounts outstanding under the

$300.0 million revolving line of credit.

DOLLAR TREE, INC. ♦ 2010 Annual Report 41