Dollar Tree 2010 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2010 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

NOTE 3—INCOME TAXES

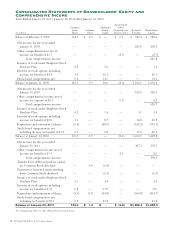

Total income taxes were allocated as follows:

(in millions)

Year Ended

January 29, 2011

Yea r E nd ed

January 30, 2010

Yea r E nd ed

January 31, 2009

Income from continuing operations $ 232.6 $ 187.1 $ 129.6

Accumulated other comprehensive income(loss)

marking derivative fi nancial instruments to fair value 1.3 0.1 (1.7)

Stockholders' equity, tax benefi t on exercises/vesting

of equity-based compensation (7.8) (3.9) (2.3)

$ 226.1 $ 183.3 $ 125.6

The provision for income taxes consists of the following:

(in millions)

Year Ended

January 29, 2011

Yea r E nd ed

January 30, 2010

Yea r E nd ed

January 31, 2009

Federal - current $ 215.7 $ 160.2 $ 91.9

State - current 31.3 27.5 20.7

Total current 247.0 187.7 112.6

Federal - deferred (10.0) (0.4) 15.4

State - deferred (4.4) (0.2) 1.6

Total deferred (14.4) (0.6) 17.0

Provision for income taxes $ 232.6 $ 187.1 $ 129.6

Included in current tax expense for the years ended January 29, 2011, January 30, 2010 and January 31, 2009,

are amounts related to changes in uncertain tax positions associated with temporary differences.

A reconciliation of the statutory federal income tax rate and the effective rate follows:

Year Ended

January 29, 2011

Yea r E nd ed

January 30, 2010

Yea r E nd ed

January 31, 2009

Statutory tax rate 35.0% 35.0% 35.0%

Effect of:

Sta te and local income taxes, net of federal

income tax benefi t 3.4 3.3 3.0

Other, net (1.5) (1.4) (1.9)

Effective tax rate 36.9% 36.9% 36.1%

The rate reduction in “other, net” consists primarily of benefi ts from the resolution of tax uncertainties, interest

on tax reserves, federal jobs credits and tax-exempt interest.

DOLLAR TREE, INC. ♦ 2010 Annual Report 37