Dollar Tree 2010 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2010 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Surety Bonds

The Company has issued various surety bonds that

primarily serve as collateral for utility payments

at the Company’s stores. The total amount of the

commitment is approximately $2.5 million, which is

committed through various dates through fi scal 2012.

Contingencies

In 2006, a former store manager fi led a collective action

against the Company in Alabama federal court. She

claims that she and other store managers should have

been classifi ed as non-exempt employees under the Fair

Labor Standards Act and received overtime compensa-

tion. The Court preliminarily allowed nationwide

(except California) notice to be sent to all store managers

employed for the three years immediately preceding

the fi ling of the suit. Approximately 265 individuals are

included in the collective action. The Court on its own

motion continued the case from its previously

scheduled

July 2010 trial date. The Company’s motion to decertify

the collective action has been dismissed without

prejudice to refi le at a later date. Additional discovery,

pursuant to the Court’s direction, is presently ongoing.

There is no scheduled trial date. The Company will

continue to vigorously defend itself in this matter.

In 2007, two store managers fi led a class action

against the Company in California federal court,

claiming they and other California store managers

should have been classifi ed as non-exempt employees

under California and federal law. The Court has

allowed notice to be sent to all California store

managers employed since December 12, 2004, and a

class of approximately 184 individuals remains. The

Company fi led a motion to decertify the class which

was both granted and denied in part. The current

class was redefi ned by the Court in its ruling which

resulted in a signifi cant reduction in the number of

class members. The Court on its own continued a

previously scheduled March 2011 trial date. A pretrial

conference has been set for June 2011 at which time

Notes to Consolidated Financial Statements

Related Parties

The Company leases properties for six of its stores

from partnerships owned by related parties. The total

rental payments related to these leases were $0.5

million for each of the years ended January 29, 2011,

January 30, 2010, and January 31, 2009, respectively.

Total future commitments under related party leases

are $2.5 million.

Freight Services

The Company has contracted outbound freight

services from various contract carriers with contracts

expiring through fi scal 2014. The total amount of

these commitments is approximately $288.8 million, of

which approximately $113.0 million is committed in

2011 and in 2012, $46.7 million is committed in 2013

and $16.1 million is committed in 2014.

Technology Assets

The Company has commitments totaling approximately

$5.9 million to purchase primarily store technology

assets for its stores during 2011.

Letters of Credit

The Company is a party to two Letter of Credit

Reimbursement and Security Agreements providing

$121.5 million and $50.0 million, respectively for

letters of credit. Letters of credit under both of

these agreements are generally issued for the routine

purchase of imported merchandise and approximately

$106.9 million was committed to these letters of

credit at January 29, 2011. As discussed in Note 5, the

Company also has $150.0 million of available letters

of credit included in the $550.0 million Unsecured

Credit Agreement (the Agreement) entered into in

2008. As of January 29, 2011, there were no letters of

credit committed under the Agreement.

The Company also has approximately $13.1 million

in stand-by letters of credit that serve as collateral for its

self-insurance programs and expire in fi scal 2011.

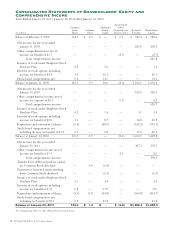

Minimum and Contingent Rentals

Rental expense for store and distribution center operating leases (including payments to related parties) included

in the accompanying consolidated statements of operations are as follows:

(in millions)

Year Ended

January 29, 2011

Yea r E nd ed

January 30, 2010

Yea r E nd ed

January 31, 2009

Minimum rentals $ 381.5 $ 349.9 $ 323.9

Contingent rentals 1.4 1.0 (0.3)

40 DOLLAR TREE, INC. ♦ 2010 Annual Report