Dollar Tree 2010 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2010 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion And Analysis

Of Financial Condition And Results Of Operations

from this liquidation of $40.5 million were put into

cash equivalent money market accounts. In 2009,

we also purchased $27.8 million of short-term invest-

ments. Capital expenditures increased $33.5 million

in 2009 primarily due to the purchase of our new

distribution center in San Bernardino, CA.

In 2010, net cash used in fi nancing activities

increased $243.0 million as a result of increased share

repurchases in 2010 and repayments of $13.8 million

for debt acquired from Dollar Giant.

In 2009, net cash used in fi nancing activities

increased $184.0 million as the result of share repur-

chases in 2009. There were no share repurchases in 2008.

At January 29, 2011, our long-term borrowings

were $266.5 million and our capital lease commit-

ments were $1.4 million. We also have $121.5 million

and $50.0 million Letter of Credit Reimbursement

and Security Agreements, under which approximately

$106.9 million were committed to letters of credit

issued for routine purchases of imported merchandise

at January 29, 2011.

On February 20, 2008, we entered into a fi ve-year

$550.0 million unsecured Credit Agreement (the

Agreement). The Agreement provides for a $300.0

million revolving line of credit, including up to $150.0

million in available letters of credit, and a $250.0

million term loan. The interest rate on the Agreement

Net cash provided by operating activities decreased

$62.3 million in 2010 compared to 2009 due to

an increase in cash used to purchase merchandise

inventories partially offset by increased earnings before

income taxes, depreciation and amortization in the

current year.

Net cash provided by operating activities increased

$177.9 million in 2009 compared to 2008 due to

increased earnings before income taxes, depreciation

and amortization in 2009. Also providing more cash

at January 30, 2010 was better inventory management

resulting in lower inventory balances per store and

higher accounts payable balances due to the timing of

payments and increased incentive compensation accruals.

Net cash used in investing activities increased

$161.6 million in the current year primarily due to

short-term investment activity and the Dollar Giant

acquisition. In 2010 we purchased $157.8 million of

short-term investments compared to $27.8 million

in 2009. This was partially offset by an increase in

proceeds from the sales of short-term investments of

$10.8 million in the current year.

Net cash used in investing activities increased

$110.5 million in 2009 primarily due to short-term

investment activity and increased capital expenditures

in 2009. In 2008 we liquidated our short-term invest-

ments due to market conditions. The net proceeds

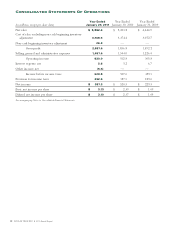

Liquidity and Capital Resources

Our business requires capital to build and open new stores, expand our distribution network and operate existing

stores. Our working capital requirements for existing stores are seasonal and usually reach their peak in September

and October. Historically, we have satisfi ed our seasonal working capital requirements for existing stores and have

funded our store opening and distribution network expansion programs from internally generated funds and

borrowings under our credit facilities.

The following table compares cash-fl ow related information for the years ended January 29, 2011, January 30, 2010

and January 31, 2009:

(in millions)

Year Ended

January 29, 2011

Yea r E nd ed

January 30, 2010

Yea r E nd ed

January 31, 2009

Net cash provided by (used in):

Operating activities $ 518.7 $ 581.0 $ 403.1

Investing activities (374.1) (212.5) (102.0)

Financing activities (404.3) (161.3) 22.7

DOLLAR TREE, INC. ♦ 2010 Annual Report 19