Dollar Tree 2010 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2010 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

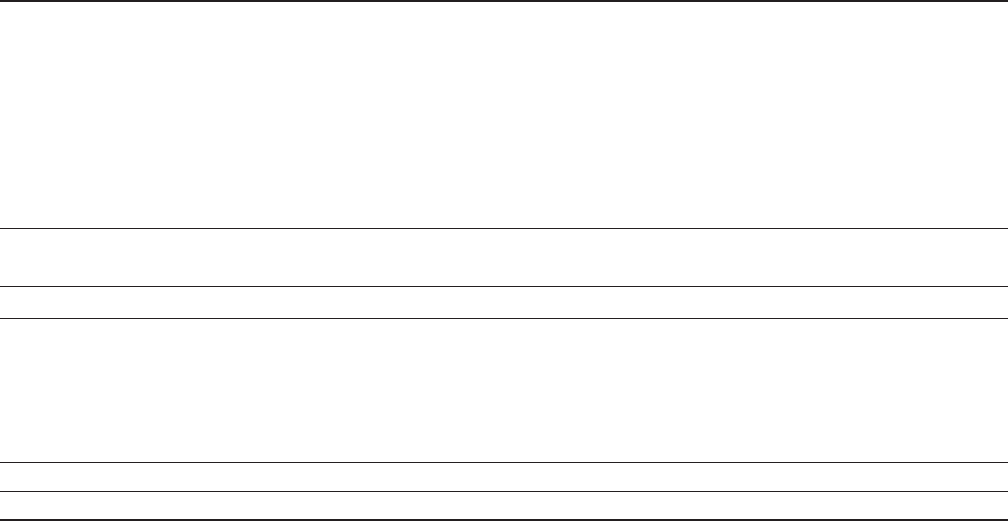

Deferred income taxes refl ect the net tax effects of temporary differences between the carrying amounts of

assets and liabilities for fi nancial reporting purposes and the amounts used for income tax purposes. Deferred tax

assets and liabilities are classifi ed on the accompanying consolidated balance sheets based on the classifi cation of the

underlying asset or liability. Signifi cant components of the Company’s net deferred tax assets (liabilities) follow:

(in millions) January 29, 2011 January 30, 2010

Deferred tax assets:

Deferred rent $ 31.4 $ 23.0

Accrued expenses

25.4 24.8

Property and equipment —

4.3

Sta te tax net operating losses and credit carryforwards,

net of federal benefi t

6.4

6.7

Accrued compensation expense

22.5

22.2

Other

1.9

2.0

Total deferred tax assets

87.6

83.0

Valuation allowance

(4.8)

(6.1)

Deferred tax assets, net

82.8

76.9

Deferred tax liabilities:

Property and equipment

(4.6) —

Goodwill

(15.8)

(15.1)

Prepaid expenses

(3.8)

(7.0)

Inventory

(4.3)

(13.6)

Total deferred tax liabilities

(28.5)

(35.7)

Net deferred tax asset $ 54.3 $ 41.2

38 DOLLAR TREE, INC. ♦ 2010 Annual Report